Answered step by step

Verified Expert Solution

Question

1 Approved Answer

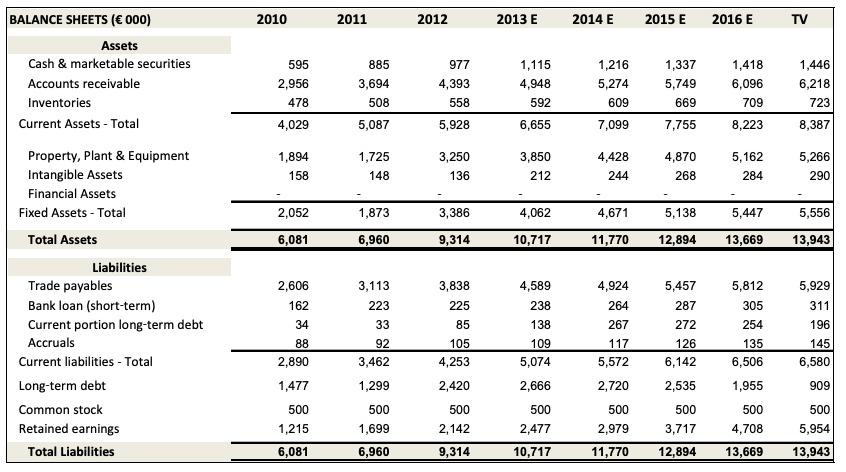

Calculate the FCF (Free Cash Flow) to the firm for the forecasting periods and the terminal value. Show how to exactly calculate the Net Working

Calculate the FCF (Free Cash Flow) to the firm for the forecasting periods and the terminal value.

Show how to exactly calculate the Net Working Capital

Show ALL Steps!!! No Excel

BALANCE SHEETS ( 000) Assets Cash & marketable securities Accounts receivable Inventories Current Assets - Total Property, Plant & Equipment Intangible Assets Financial Assets Fixed Assets - Total Total Assets Liabilities Trade payables Bank loan (short-term) Current portion long-term debt Accruals Current liabilities - Total Long-term debt Common stock Retained earnings Total Liabilities 2010 595 2,956 478 4,029 1,894 158 2,052 6,081 2,606 162 34 88 2,890 1,477 500 1,215 6,081 2011 885 3,694 508 5,087 1,725 148 1,873 6,960 3,113 223 33 92 3,462 1,299 500 1,699 6,960 2012 977 4,393 558 5,928 3,250 136 3,386 9,314 3,838 225 85 105 4,253 2,420 500 2,142 9,314 2013 E 1,115 4,948 592 6,655 3,850 212 4,062 10,717 4,589 238 138 109 5,074 2,666 500 2,477 10,717 2014 E 1,216 5,274 609 7,099 4,428 244 4,671 11,770 2015 E 1,337 5,749 669 7,755 4,870 268 5,138 12,894 2016 E 1,418 6,096 709 8,223 5,162 284 5,447 13,669 4,924 5,457 264 287 267 272 117 126 5,572 6,142 2,720 2,535 500 500 500 2,979 3,717 4,708 11,770 12,894 13,669 5,812 305 254 135 6,506 1,955 TV 1,446 6,218 723 8,387 5,266 290 5,556 13,943 5,929 311 196 145 6,580 909 500 5,954 13,943

Step by Step Solution

★★★★★

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Free Cash Flow FCF for the forecasting periods and the terminal value we need to fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started