Answered step by step

Verified Expert Solution

Question

1 Approved Answer

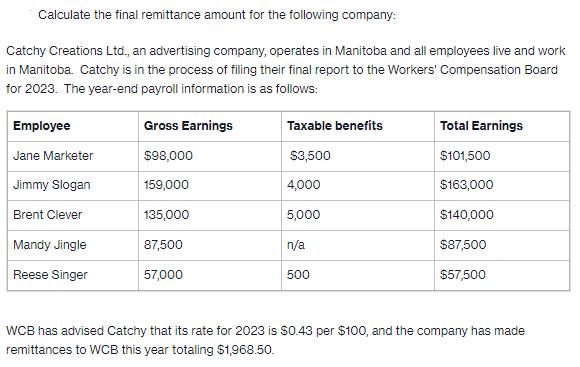

Calculate the final remittance amount for the following company: Catchy Creations Ltd., an advertising company, operates in Manitoba and all employees live and work

Calculate the final remittance amount for the following company: Catchy Creations Ltd., an advertising company, operates in Manitoba and all employees live and work in Manitoba. Catchy is in the process of filing their final report to the Workers' Compensation Board for 2023. The year-end payroll information is as follows: Employee Jane Marketer Jimmy Slogan Brent Clever Mandy Jingle Reese Singer Gross Earnings $98,000 159,000 135,000 87,500 57,000 Taxable benefits $3,500 4,000 5,000 n/a 500 Total Earnings $101,500 $163,000 $140,000 $87,500 $57,500 WCB has advised Catchy that its rate for 2023 is $0.43 per $100, and the company has made remittances to WCB this year totaling $1,968.50.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

First lets calculate the assessable payroll for each employee Employee Jane Marketer Gross Earnings ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started