Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the financial ratios and operating statistics and comment on the ratios andoperatingindicatorsthathaveincreasedordecreasedby10%ormore since 2019. Calculate and evaluate the compound growth rates for revenue, expense

- Calculate the financial ratios and operating statistics and comment on the ratios and operating indicators that have increased or decreased by 10% or more since 2019.

- Calculate and evaluate the compound growth rates for revenue, expense type, and department expenses from 2019 through 2022.

- Compare Barton's 2022 financial ratios and operating indicators with the benchmarks provided in the template provided in part 1 and discuss any ratio or indicator where hospital performance deviates by +/-10% or more from the benchmarks. Create graphs to highlight important factors, trends, and large changes.

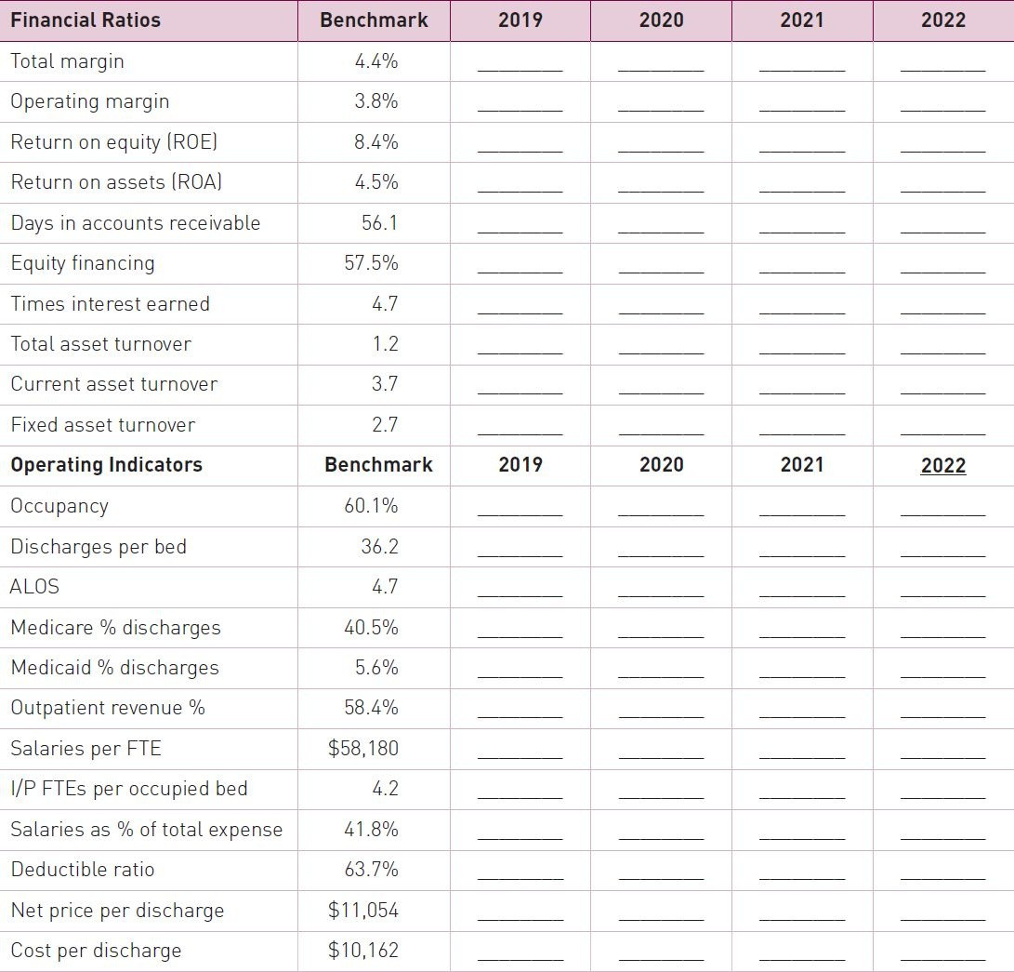

Financial Ratios Benchmark 2019 2020 2021 2022 Total margin 4.4% Operating margin 3.8% Return on equity (ROE) 8.4% Return on assets (ROA) 4.5% Days in accounts receivable 56.1 Equity financing 57.5% Times interest earned 4.7 Total asset turnover 1.2 Current asset turnover 3.7 Fixed asset turnover 2.7 Operating Indicators Benchmark 2019 2020 2021 2022 Occupancy 60.1% Discharges per bed 36.2 ALOS 4.7 Medicare % discharges 40.5% Medicaid % discharges 5.6% Outpatient revenue % 58.4% Salaries per FTE $58,180 I/P FTEs per occupied bed 4.2 Salaries as % of total expense 41.8% Deductible ratio 63.7% Net price per discharge $11,054 Cost per discharge $10,162

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started