Question

calculate the financial ratios needed to determine your chosen business's current financial health. Once you've calculated these ratios, you will use the results to analyze

calculate the financial ratios needed to determine your chosen business's current financial health. Once you've calculated these ratios, you will use the results to analyze the business's current financial position. This will help you make decisions about how to improve or maintain their financial health. Pay close attention to working capital management. If liquidity is an issue, think about how the company will meet its short-term obligations.

Directions

For the company you chose in the Module Two journal assignment, open the following documents:

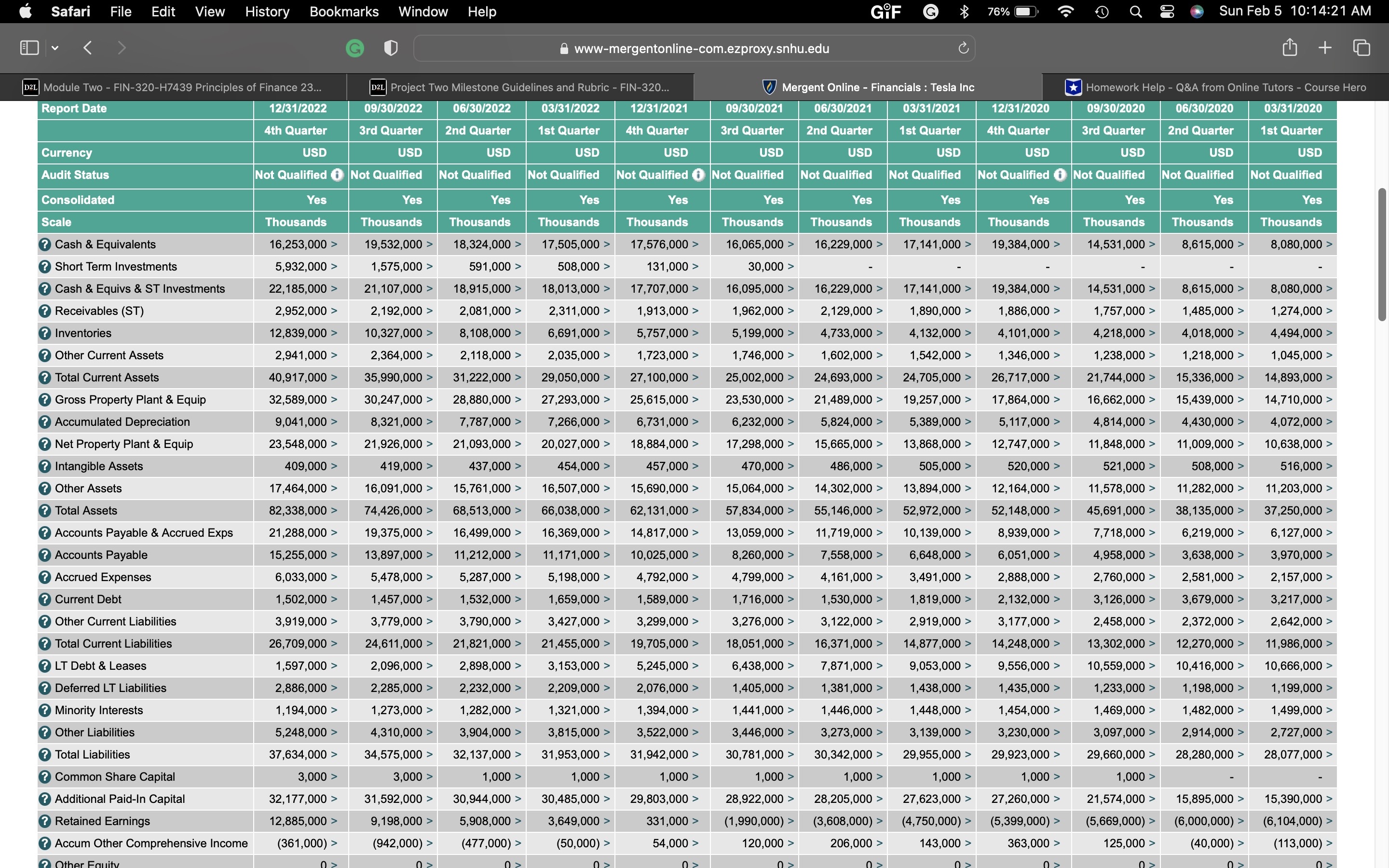

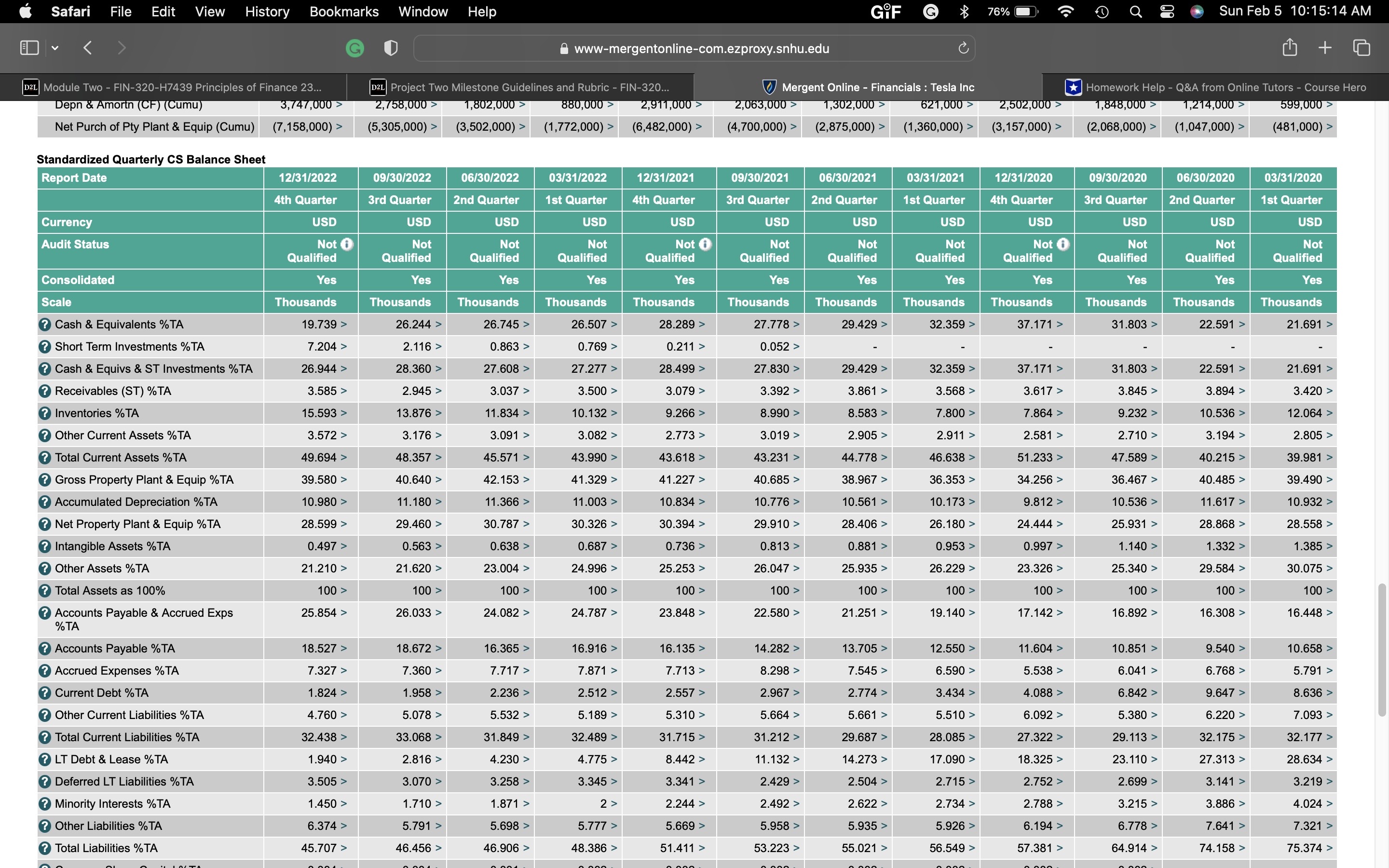

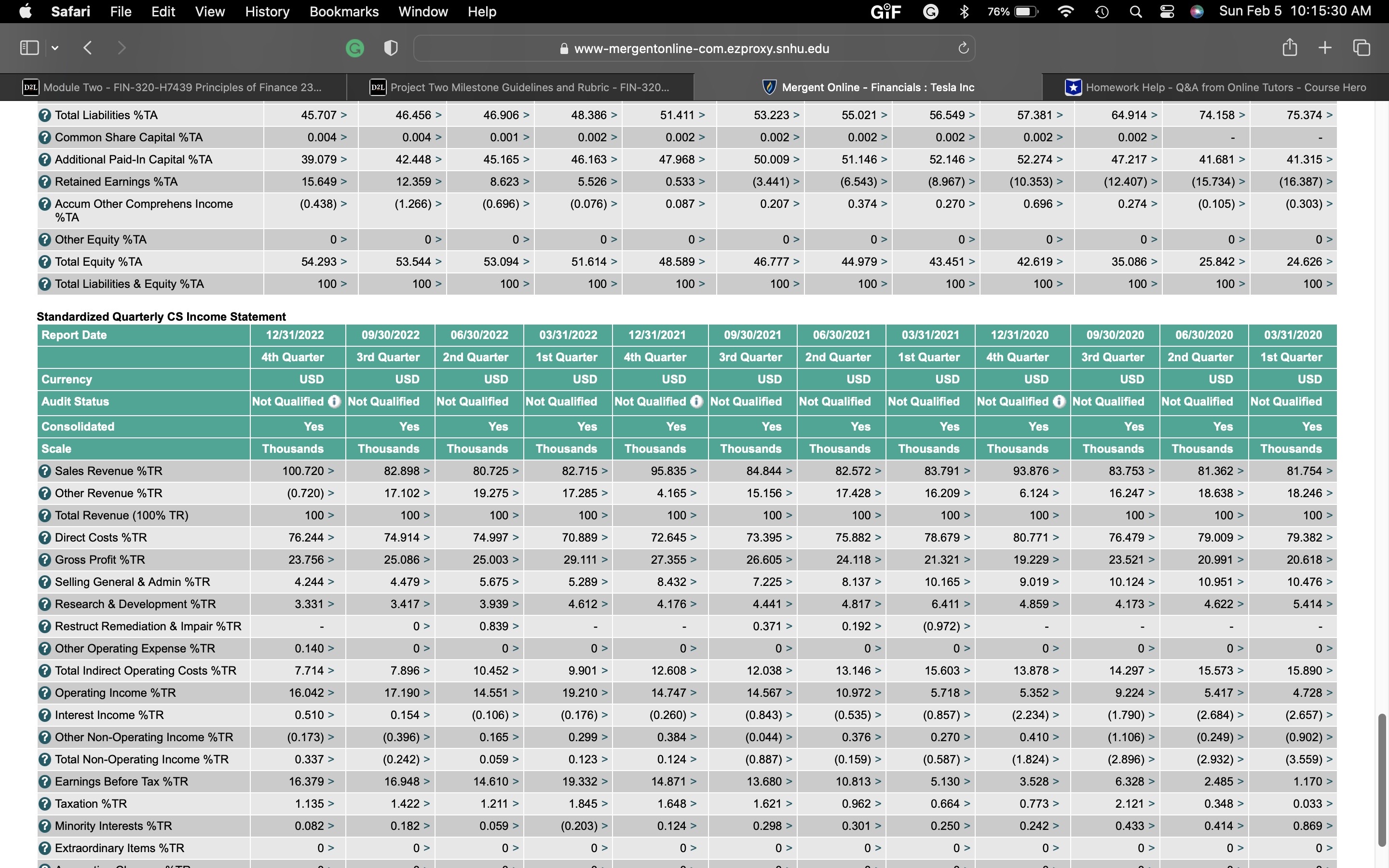

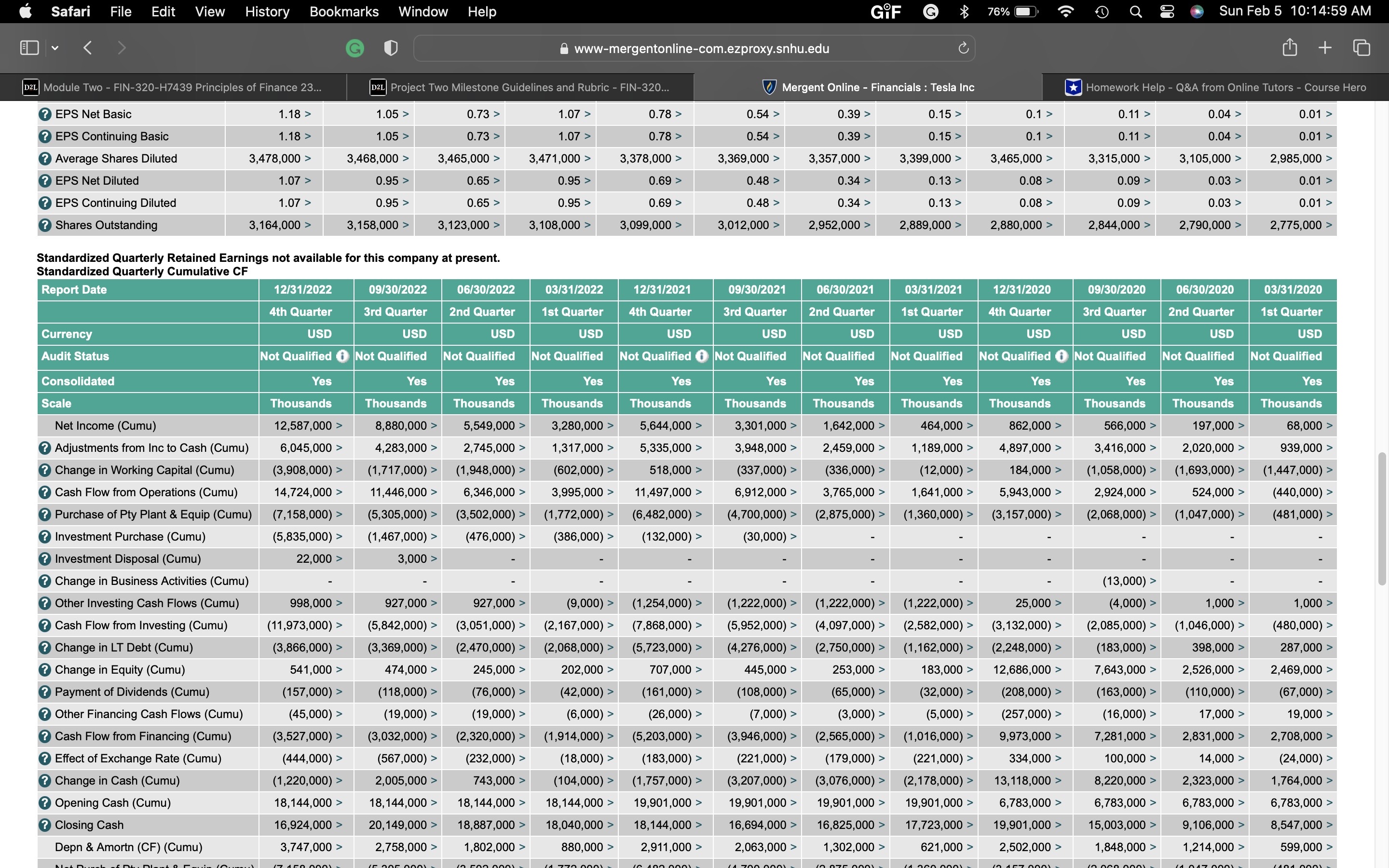

- The balance sheet, income statement, and cash flow statement from the most recent fiscal quarter (from Mergent Online)

- The Ratios Most Recent Fiscal Qtr worksheet in the Project Two Financial Formulasworkbook.

- For example, if the most recent fiscal quarter available is the third quarter in 2022, you'll compare those results to the same financial calculations from the third quarter in 2021.

- The Ratios Same Fiscal Qtr 1 Year Ago worksheet

- Fiscal Quarter Comparison. Summarize the differences between the following:

- The results from your financial calculations of the most recent fiscal quarter

- The results of the same financial calculations of the same fiscal quarter from one year ago

- For example, if the most recent fiscal quarter available is the third quarter in 2022, you'll compare those results to the same financial calculations from the third quarter in 2021.

- Comparison Analysis. Explain what your calculations and comparison show about the business's current financial health. Give examples to support your explanation for the following questions:

- Do the results show the business is financially healthy or unhealthy? Which results indicate this?

- What might be the causes of the business's financial success or failure?

- Is more information needed to determine the business's financial health? If so, which pieces of information might still be needed?

- Short-Term Financing. Explain how potential short-term financing sources could help the business raise funds needed to improve its financial health. Base your response on the business's current financial information.

Safari File Edit View History Bookmarks Window Help GiF 76% Sun Feb 5 10:14:21 AM D2L Module Two - FIN-320-H7439 Principles of Finance 23... Report Date 12/31/2022 06/30/2022 03/31/2022 www-mergentonline-com.ezproxy.snhu.edu D2L Project Two Milestone Guidelines and Rubric - FIN-320... 09/30/2022 Mergent Online - Financials: Tesla Inc 4th Quarter Currency Audit Status Consolidated Scale ? Cash & Equivalents USD 3rd Quarter USD 2nd Quarter USD 1st Quarter USD 12/31/2021 4th Quarter USD 09/30/2021 06/30/2021 03/31/2021 12/31/2020 Homework Help - Q&A from Online Tutors - Course Hero 09/30/2020 06/30/2020 03/31/2020 3rd Quarter USD 2nd Quarter USD 1st Quarter USD 4th Quarter USD 3rd Quarter USD Not Qualified Not Qualified Not Qualified Not Qualified Not Qualified Not Qualified Not Qualified Not Qualified Not Qualified Not Qualified 2nd Quarter USD Not Qualified 1st Quarter USD Not Qualified Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Thousands 16,253,000 > Short Term Investments 5,932,000 > ? Cash & Equivs & ST Investments 22,185,000 > ? Receivables (ST) ? Inventories ? Other Current Assets 2,952,000 > 12,839,000 > 2,941,000 > ? Total Current Assets 40,917,000 > ? Gross Property Plant & Equip 32,589,000 > ? Accumulated Depreciation 9,041,000 > ? Net Property Plant & Equip 23,548,000 > ? Intangible Assets ? Other Assets ? Total Assets 409,000 > 17,464,000 > 82,338,000 > ? Accounts Payable & Accrued Exps 21,288,000 > Thousands 19,532,000 > 1,575,000 > 21,107,000 > 2,192,000 > 10,327,000 > 2,364,000 > 35,990,000 > 30,247,000 > 8,321,000 > 21,926,000 > 419,000 > 16,091,000 > 74,426,000 > 19,375,000 > Thousands 18,324,000 > 591,000 > 18,915,000 > 2,081,000 > 8,108,000 > Thousands 17,505,000 > 508,000 > 18,013,000 > 2,311,000 > 6,691,000 > Thousands 17,576,000 > 131,000 > 17,707,000 > 1,913,000 > 5,757,000 > ? Accounts Payable 15,255,000 > 13,897,000 > ? Accrued Expenses 6,033,000 > 5,478,000 > 2,118,000 > 31,222,000 > 28,880,000 > 7,787,000 > 21,093,000 > 437,000 > 15,761,000 > 68,513,000 > 16,499,000 > 11,212,000 > 5,287,000 > 2,035,000 > 29,050,000 > 27,293,000 > 7,266,000 > 20,027,000 > 454,000 > 16,507,000 > 66,038,000 > 1,723,000 > 27,100,000 > 25,615,000 > 6,731,000 > 18,884,000 > 457,000 > 15,690,000 > 62,131,000 > Thousands 16,065,000 > 30,000 > 16,095,000 > 1,962,000 > 5,199,000 > 1,746,000 > 25,002,000 > 23,530,000 > 6,232,000 > 17,298,000 > 470,000 > 15,064,000 > 57,834,000 > Thousands 16,229,000 > Thousands 17,141,000 > Thousands 19,384,000 > Thousands 14,531,000 > Thousands 8,615,000 > Thousands 8,080,000 > 16,229,000 > 2,129,000 > 4,733,000 > 17,141,000 > 1,890,000 > 1,602,000 > 16,369,000 > 14,817,000 > 13,059,000 > 24,693,000 > 21,489,000 > 5,824,000 > 15,665,000 > 486,000 > 14,302,000 > 55,146,000 > 11,719,000 > 4,132,000 > 1,542,000 > 24,705,000 > 19,384,000 > 1,886,000 > 4,101,000 > 14,531,000 > 1,757,000 > 8,615,000 > 8,080,000 1,485,000 > 1,274,000 > 4,218,000 > 4,018,000 > 4,494,000 > 19,257,000 > 5,389,000 > 13,868,000 > 505,000 > 13,894,000 > 52,972,000 > 10,139,000 > 1,346,000 > 26,717,000 > 17,864,000 > 5,117,000 > 12,747,000 > 520,000 > 12,164,000 > 52,148,000 > 8,939,000 > 1,238,000 > 21,744,000 > 16,662,000 > 4,814,000 > 11,848,000 > 521,000 > 11,578,000 > 45,691,000 > 7,718,000 > 1,218,000 > 1,045,000 > 15,336,000 > 14,893,000 > 15,439,000 > 4,430,000 > 11,009,000 > 508,000 > 11,282,000 > 38,135,000 > 14,710,000 > 4,072,000 > 10,638,000 > 516,000 > 11,203,000 > 37,250,000 > 6,219,000 > 6,127,000 > 11,171,000 > 10,025,000 > 8,260,000 > 7,558,000 > 6,648,000 > 6,051,000 > 4,958,000 > 3,638,000 > 3,970,000 > 5,198,000 > 4,792,000 > 4,799,000 > 4,161,000 > 3,491,000 > 2,888,000 > 2,760,000 > 2,581,000 > 2,157,000 > ? Current Debt 1,502,000 > 1,457,000 > 1,532,000 > 1,659,000 > 1,589,000 > 1,716,000 > 1,530,000 > 1,819,000 > 2,132,000 > 3,126,000 > 3,679,000 > 3,217,000 > Other Current Liabilities 3,919,000 > 3,779,000 > ? Total Current Liabilities 26,709,000 > 24,611,000 > 3,790,000 > 21,821,000 > 3,427,000 > 21,455,000 > 3,299,000 > ? LT Debt & Leases 1,597,000 > 2,096,000 > 2,898,000 > 3,153,000 > 19,705,000 > 5,245,000 > 3,276,000 > 18,051,000 > 3,122,000 > 2,919,000 > 3,177,000 > 16,371,000 > 6,438,000 > 7,871,000 > 14,877,000 > 9,053,000 > 14,248,000 > 9,556,000 > ? Deferred LT Liabilities 2,886,000 > 2,285,000 > 2,232,000 > 2,209,000 > 2,076,000 > 1,405,000 > 1,381,000 > 1,438,000 > ? Minority Interests 1,194,000 > 1,273,000 > 1,282,000 > 1,321,000 > 1,394,000 > 1,441,000 > 1,446,000 > 1,448,000 > 1,435,000 > 1,454,000 > 2,458,000 > 13,302,000 > 10,559,000 > 1,233,000 > 2,372,000 > 2,642,000 > 12,270,000 > 11,986,000 > 10,416,000 > 10,666,000 > 1,469,000 > ? Other Liabilities 5,248,000 > ? Total Liabilities ? Common Share Capital Additional Paid-In Capital 37,634,000 > 3,000 > 32,177,000 > ? Retained Earnings 12,885,000 > 4,310,000 > 34,575,000 > 3,000 > 31,592,000 > 9,198,000 > ? Accum Other Comprehensive Income (361,000) > (942,000) > 3,904,000 > 32,137,000 > 1,000 > 30,944,000 > 5,908,000 > (477,000) > 3,815,000 > 3,522,000 > 3,446,000 > 31,953,000 > 1,000 > 30,485,000 > 3,649,000 > (50,000) > 31,942,000 > 1,000 > 29,803,000 > 331,000 > 54,000 > 30,781,000 > 1,000 > 28,922,000 > (1,990,000) > 120,000 > 3,273,000 > 30,342,000 > 1,000 > 28,205,000 > (3,608,000) > 206,000 > 3,139,000 > 29,955,000 > 1,000 > 27,623,000 > (4,750,000) > 143,000 > 3,230,000 > 29,923,000 > 1,000 > 27,260,000 > (5,399,000) > 363,000 > 3,097,000 > 29,660,000 > 1,198,000 > 1,482,000 > 2,914,000 > 28,280,000 > 1,199,000 > 1,499,000 > 2,727,000 > 28,077,000 > ? Other Equity 0 > 0 > 0 > 0> 0 > 1,000 > 21,574,000 > (5,669,000) 125,000 > 0 > 15,895,000 > (6,000,000) > (40,000) > 15,390,000 > (6,104,000) (113,000) > 0 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started