Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the following: 1. NPV assuming a 7% interest rate 2. NPV assuming a 3% interest rate 3. ROI 4. Pay Back Period, do not

Calculate the following:

1. NPV assuming a 7% interest rate

2. NPV assuming a 3% interest rate

3. ROI 4. Pay Back Period, do not consider time value of money.

5. IRR

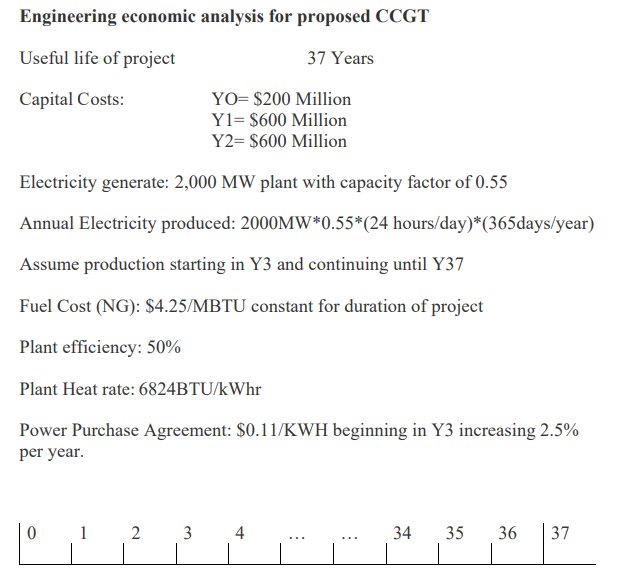

Engineering economic analysis for proposed CCGT Useful life of project Capital Costs: 37 Years YO- $200 Million Y1- S600 Million Y2- $600 Million Electricity generate: 2,000 MW plant with capacity factor of 0.55 Annual Electricity produced: 2000MW*.55 (24 hours/day) (365days/year) Assume production starting in Y3 and continuing until Y37 Fuel Cost (NG): $4.25/MBTU constant for duration of project Plant efficiency: 50% Plant Heat rate: 6824BTU/k Whr Power Purchase Agreement: $0.11/KWH beginning in Y3 increasing 2.5% per year 2 0 23 34 35 36 37 Engineering economic analysis for proposed CCGT Useful life of project Capital Costs: 37 Years YO- $200 Million Y1- S600 Million Y2- $600 Million Electricity generate: 2,000 MW plant with capacity factor of 0.55 Annual Electricity produced: 2000MW*.55 (24 hours/day) (365days/year) Assume production starting in Y3 and continuing until Y37 Fuel Cost (NG): $4.25/MBTU constant for duration of project Plant efficiency: 50% Plant Heat rate: 6824BTU/k Whr Power Purchase Agreement: $0.11/KWH beginning in Y3 increasing 2.5% per year 2 0 23 34 35 36 37Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started