Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the following: 1. Sales amount 2. Net profit after tax 3. Receivable turnover ratio 4. Current ratio 5. Quick ratio 6. Debt to

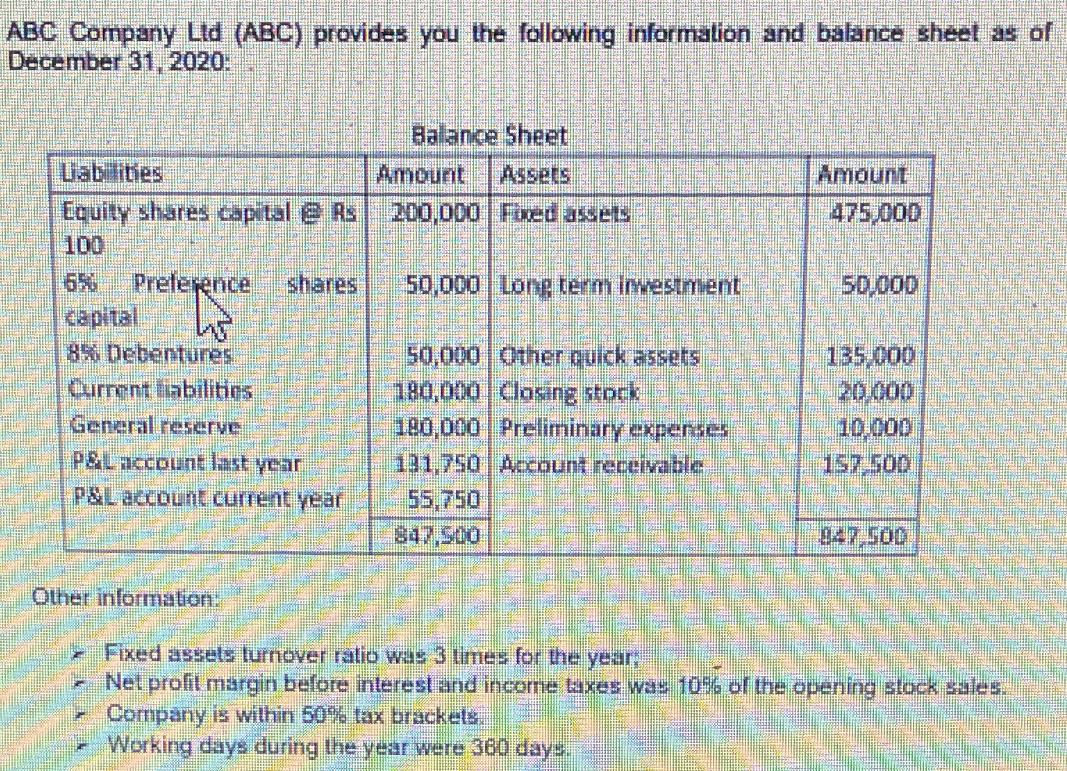

Calculate the following: 1. Sales amount 2. Net profit after tax 3. Receivable turnover ratio 4. Current ratio 5. Quick ratio 6. Debt to equity ratio 7. Return on equity Q2- interpret your answers in Q1 and give your analysis of the financial situation of ABC. You answer will have to be supported by your ratio calculations in Q1. ABC Company Ltd (ABC) provides you the following information and balance sheet as of December 31, 2020: Uab llities Equity shares capital @ Rs. 100 Preference shares capital 85 Debentures Current liabilities General reserve P&Laccount last year P&L account current year Other information. Balance Sheet Assets 200,000 Fixed assets 50,000 Long term investment 50,000 Other quick assets 180,000 Closing stock 180,000 Preliminary expenses 131,750 Account receivable 55,750 Amount 475,000 50,000 135,000 20,000 10,000 157.500 847 500 Fixed assets turnover ratio was 3 times for the year: Net profit margin before interest and income taxes was 10% of the opening stock sales. Company is within 50% tax brackets. Working days during the year were 360 days.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the financial ratios and items requested Ill use the following formulas based on the provided balance sheet information and additional details Lets calculate each in order 1 Sales amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started