Answered step by step

Verified Expert Solution

Question

1 Approved Answer

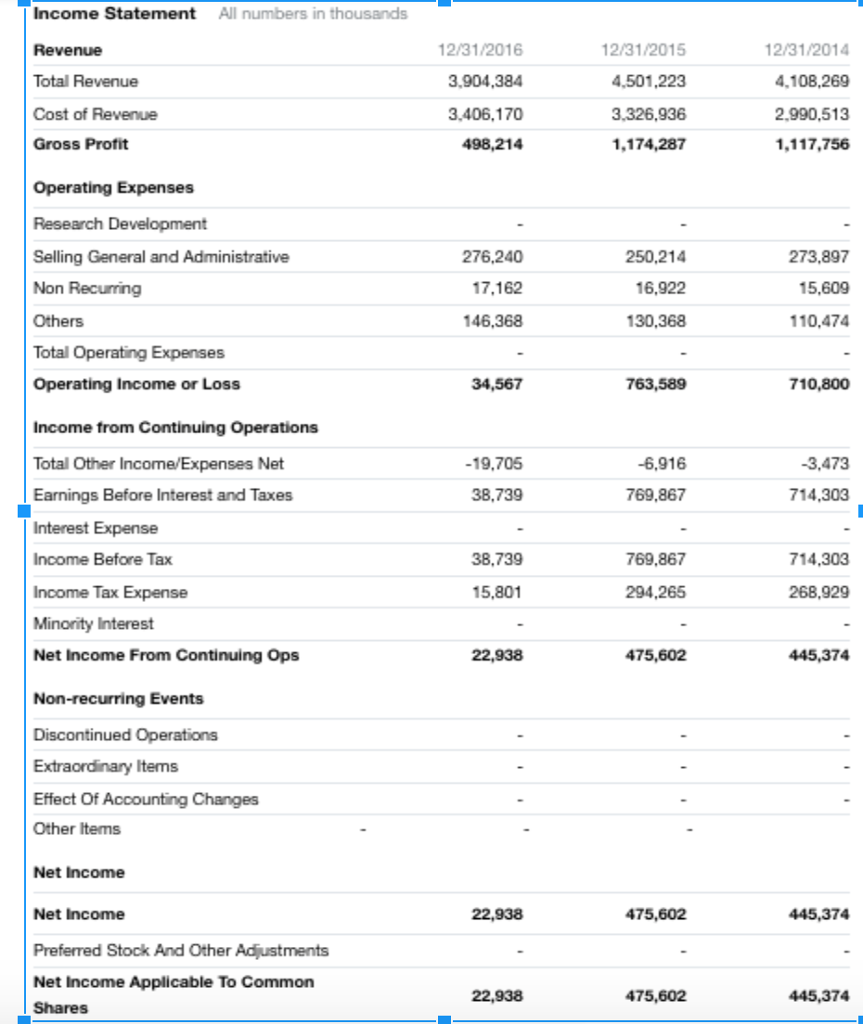

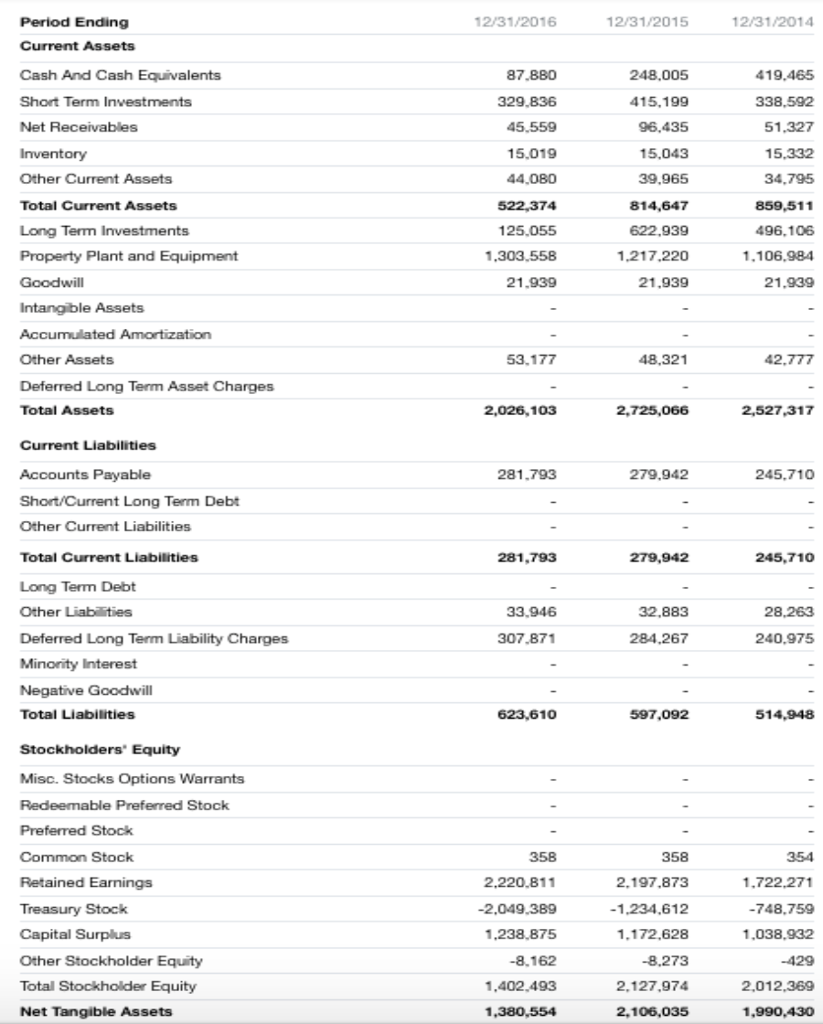

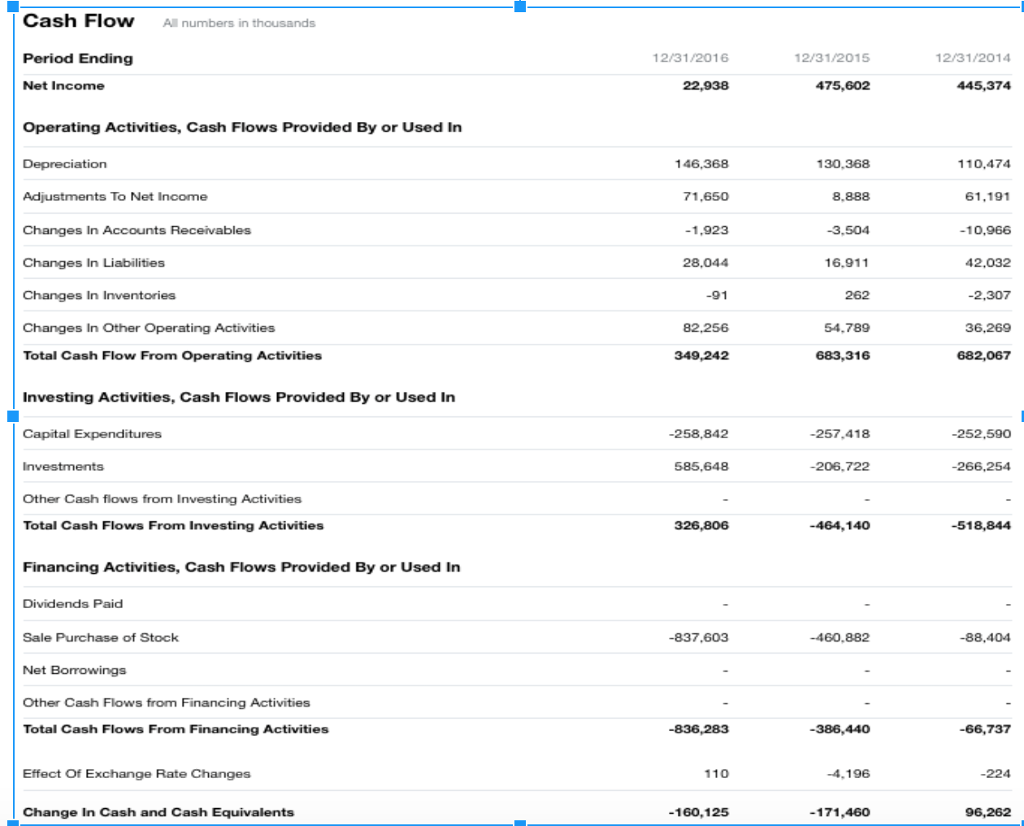

Calculate the following: A. Net working capital and net operating working capital. What are the differences between the two? B. Operating income C. Current ratio

Calculate the following:

A. Net working capital and net operating working capital. What are the differences between the two?

B. Operating income

C. Current ratio

D. Quick ratio

E. Inventory turnover ratio

F. Total assets turnover ratio

G. Debt ratio

H. Profit margin

I. ROA

J. ROE

K. P/E ratio

Explain the following:

A. What types of taxes does this company pay? Describe the advantages or disadvantages of these taxes

B. What is the importance of accurate financials?

C. Explain the ratios you calculated above

Income Statement Revenue Total Revenue Cost of Revenue Gross Profit All numbers in thousands 2/31/2016 ,904,384 3.406.170 498,214 2/31/2015 4,501,223 3,326,936 1,174,287 2/31/2014 .108,269 2.990,513 1,117,756 Operating Expenses Research Development Selling General and Administrative Non Recumring Others otal Operating Expenses Operating Income or Loss Income from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest and Taxes Interest Expense Income Before Tax Income Tax Expense Minority Interest Net Income From Continuing Ops Non-recurring Events Discontinued Operations Extraordinary Items Effect Of Accounting Changes Other Items 276,240 17,162 146,368 250,214 16,922 130,368 273,897 5,609 110,474 34,567 763,589 710,800 3,473 714,303 19.705 6,916 38,739 769,867 38,739 769,867 714,303 15,801 294,265 268,929 22,938 475,602 445,374 Net Income Net Income Preferred Stock And Other Adjustments Net Income Applicable To Common Shares 22,938 475,602 445,374 22,938 475,602 445,374

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started