Answered step by step

Verified Expert Solution

Question

1 Approved Answer

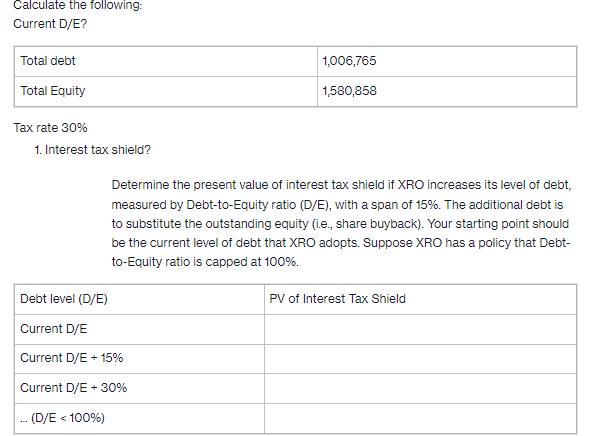

Calculate the following: Current D/E? Total debt Total Equity Tax rate 30% 1. Interest tax shield? 1,006,765 1,580,858 Determine the present value of interest

Calculate the following: Current D/E? Total debt Total Equity Tax rate 30% 1. Interest tax shield? 1,006,765 1,580,858 Determine the present value of interest tax shield if XRO increases its level of debt, measured by Debt-to-Equity ratio (D/E), with a span of 15%. The additional debt is to substitute the outstanding equity (i.e., share buyback). Your starting point should be the current level of debt that XRO adopts. Suppose XRO has a policy that Debt- to-Equity ratio is capped at 100%. Debt level (D/E) Current D/E Current D/E + 15% Current D/E + 30% (D/E < 100%) PV of Interest Tax Shield

Step by Step Solution

★★★★★

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

2 2 To calculate the interest tax shield we can use the formula Interest Tax Shield Interest Expense Tax Rate Given that the total debt is 1006765 and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started