Answered step by step

Verified Expert Solution

Question

1 Approved Answer

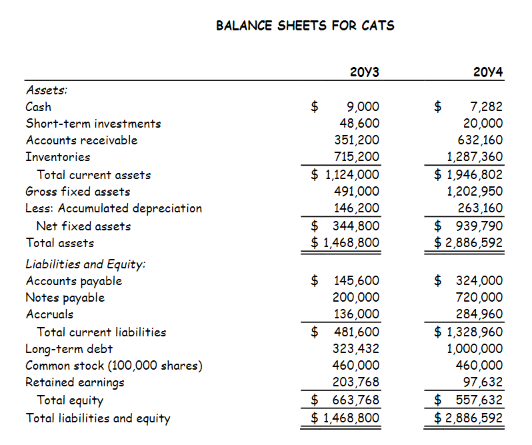

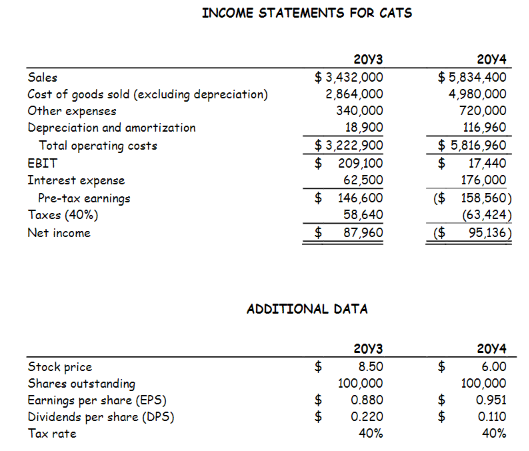

Calculate the following debt ratios for CATS for F20Y5E: debt-to-assets; debt-to- equity; market debt ratio; liabilities-to-assets; times interest earned ratio; and EBITDA coverage ratio. How

Calculate the following debt ratios for CATS for F20Y5E: debt-to-assets; debt-to- equity; market debt ratio; liabilities-to-assets; times interest earned ratio; and EBITDA coverage ratio. How does CATS compare with the industry with respect to financial leverage? What can you conclude from these ratios? Calculate the following profitability ratios for CATS for F20Y5E: net profit margin; basic earning power; return on total assets; and return on common equity. What can you say about these ratios?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started