Question

Calculate the following for 2018 using the given formulae and vividly explain the ratio analysis, referring to the calculations of the company in 2018; interpret

Calculate the following for 2018 using the given formulae and vividly explain the ratio analysis, referring to the calculations of the company in 2018; interpret all the connections of good and bad in terms of the calculation to the company:

(1)Current ratio = Current assets /Current liabilities (2)Quick ratio=(Current assets - Inventory)/Current liabilities (3)Inventory turnover = Cost of goods sold / Inventory (4)Average Collection =Accounts Receivable /Average Sales Per Day {Period=Accounts Receivable /(Annual Sales/365)} (5)Total asset turnover = Sales / Total assets (6)Debt Ratio= Total Liabilities / Total Assets (7)Times interest earned ratio = Earnings before interest and taxes / Interest (8)Gross profit margin = (Sales - Cost of sales) / Sales (9)Operating profit margin = Operating profits / Sales (10)Net profit margin = Earnings available for common stockholders / Sales (11)Earnings per share = Earnings available for Common Stockholders / Number of shares of Common Stok Outstanding (12)ROA = Earnings available for common stockholders / Total assets (13)ROE= Earnings available for common stockholders / Common stock equity (14) P/E ratio = Market price per share of common stock / Earnings per share (15)Market/Book (M/B) ratio = Market price per share of common stock /(Common Stock Equity/Number of Common Stock Outstanding) (16)DuPont=Net Income/sales x Sales/assets x Assets/ total equity

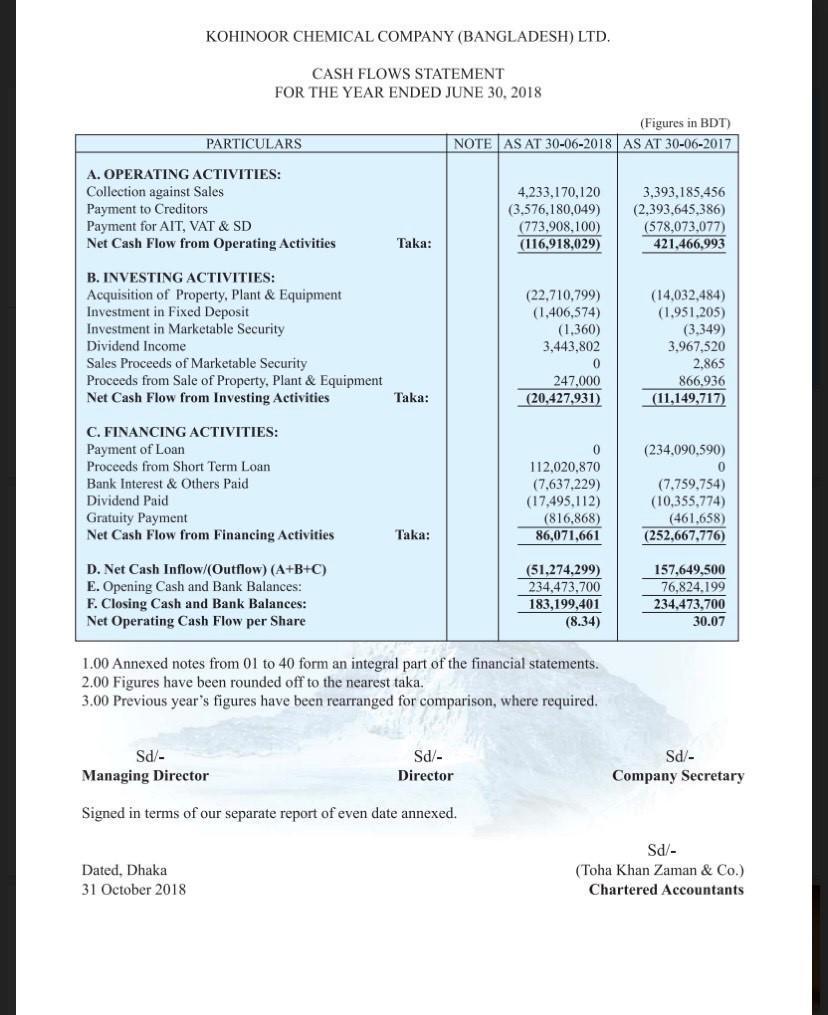

KOHINOOR CHEMICAL COMPANY (BANGLADESH) LTD. CASH FLOWS STATEMENT FOR THE YEAR ENDED JUNE 30, 2018 (Figures in BDT) AS AT 30-06-2018 AS AT 30-06-2017 PARTICULARS NOTE A. OPERATING ACTIVITIES: Collection against Sales Payment to Creditors Payment for AIT, VAT & SD Net Cash Flow from Operating Activities 4,233,170,120 (3,576,180,049) (773,908,100) (116,918,029) 3,393,185,456 (2,393,645,386) (578,073,077) 421,466,993 Taka: B. INVESTING ACTIVITIES: Acquisition of Property, Plant & Equipment Investment in Fixed Deposit Investment in Marketable Security Dividend Income Sales Proceeds of Marketable Security Proceeds from Sale of Property, Plant & Equipment Net Cash Flow from Investing Activities (22,710,799) (1,406,574) (14,032,484) (1,951,205) (3,349) 3,967,520 2,865 (1,360) 3,443,802 247,000 (20,427,931) 866,936 Taka: (11,149,717) C. FINANCING ACTIVITIES: Payment of Loan Proceeds from Short Term Loan (234,090,590) 112.020,870 Bank Interest & Others Paid (7,637,229) (17,495,112) (816,868) 86,071,661 (7,759,754) (10,355,774) (461,658) (252,667,776) Dividend Paid Gratuity Payment Net Cash Flow from Financing Activities Taka: D. Net Cash Inflow/(Outflow) (A+B+C) E. Opening Cash and Bank Balances: F. Closing Cash and Bank Balances: (51,274,299) 234,473,700 157,649,500 76,824,199 183,199,401 234,473,700 Net Operating Cash Flow per Share (8.34) 30.07 1.00 Annexed notes from 01 to 40 form an integral part of the financial statements. 2.00 Figures have been rounded off to the nearest taka. 3.00 Previous year's figures have been rearranged for comparison, where required. Sd/- Company Secretary Sd/- Sd/- Managing Director Director Signed in terms of our separate report of even date annexed. Sd/- Dated, Dhaka (Toha Khan Zaman & Co.) 31 October 2018 Chartered Accountants

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

current assetscurrent liabilities current assets inventorycurrent liabilities inventoryCOGSturnover ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started