Answered step by step

Verified Expert Solution

Question

1 Approved Answer

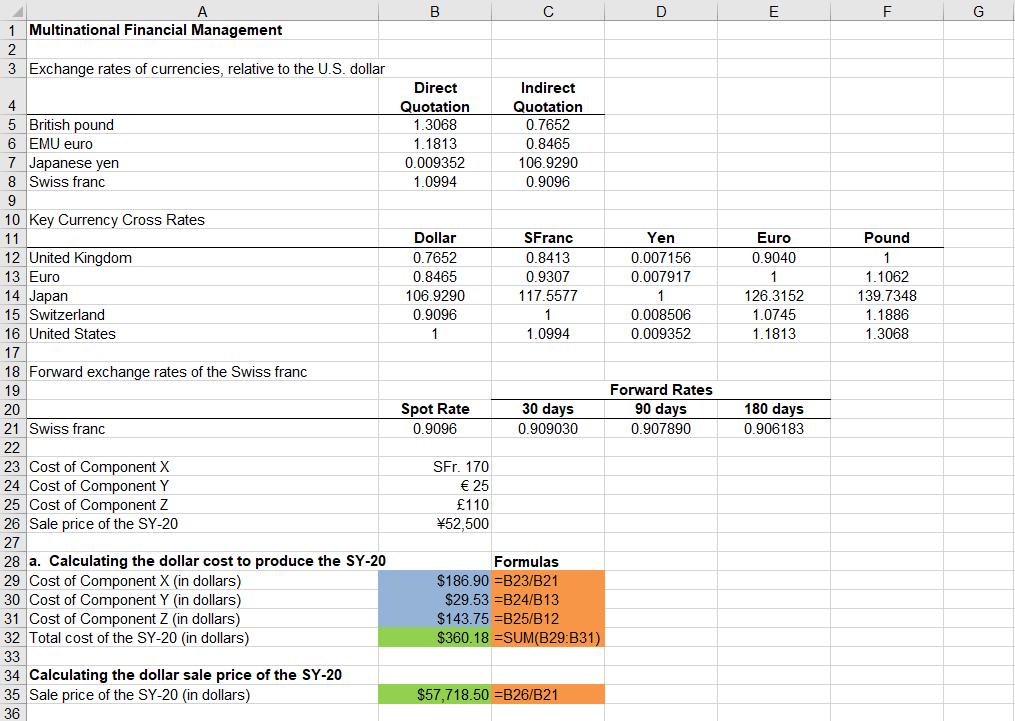

Calculate the following from The data given below A 1 Multinational Financial Management 2 3 Exchange rates of currencies, relative to the U.S. dollar 4

Calculate the following from The data given below

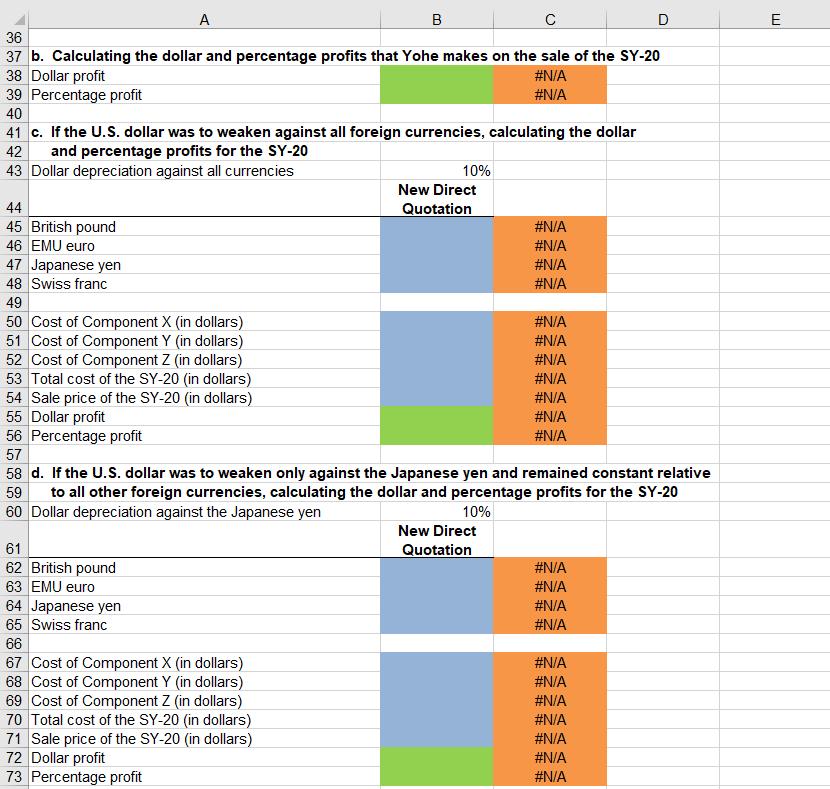

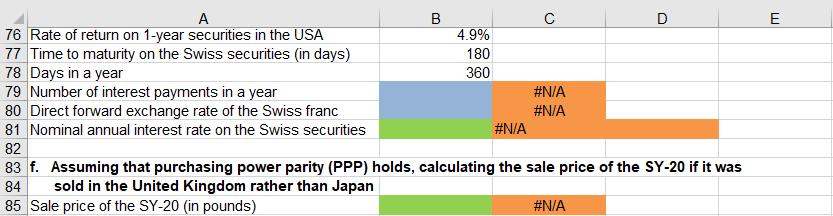

A 1 Multinational Financial Management 2 3 Exchange rates of currencies, relative to the U.S. dollar 4 5 British pound 6 EMU euro 7 Japanese yen 8 Swiss franc 9 10 Key Currency Cross Rates 11 12 United Kingdom 13 Euro 14 Japan 15 Switzerland 16 United States 17 A 18 Forward exchange rates of the Swiss franc 19 20 21 Swiss franc 22 23 Cost of Component X 24 Cost of Component Y 25 Cost of Component Z 26 Sale price of the SY-20 27 28 a. Calculating the dollar cost to produce the SY-20 29 Cost of Component X (in dollars) 30 Cost of Component Y (in dollars) 31 Cost of Component Z (in dollars) 32 Total cost of the SY-20 (in dollars) 33 34 Calculating the dollar sale price of the SY-20 35 Sale price of the SY-20 (in dollars) 36 B Direct Quotation 1.3068 1.1813 0.009352 1.0994 Dollar 0.7652 0.8465 106.9290 0.9096 1 Spot Rate 0.9096 SFr. 170 25 110 52,500 C Indirect Quotation 0.7652 0.8465 106.9290 0.9096 SFranc 0.8413 0.9307 117.5577 1 1.0994 30 days 0.909030 Formulas $186.90 B23/B21 $29.53 =B24/B13 $143.75 =B25/B12 $360.18 SUM(B29:B31) $57,718.50 =B26/B21 D Yen 0.007156 0.007917 1 0.008506 0.009352 Forward Rates 90 days 0.907890 E Euro 0.9040 1 126.3152 1.0745 1.1813 180 days 0.906183 F Pound 1 1.1062 139.7348 1.1886 1.3068 G

Step by Step Solution

★★★★★

3.42 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

a Calculating the dollar cost to produce the SY20 Cost of Component X in dollars SFr 170 09096 Spot ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started