Question

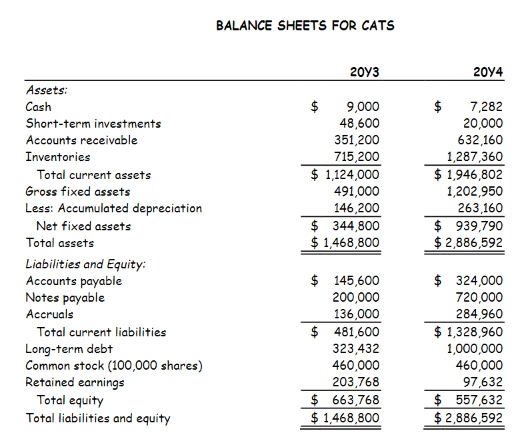

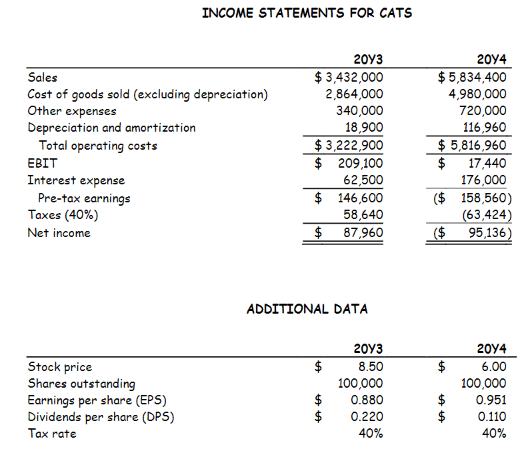

Calculate the following liquidity ratios for CATS for F20Y5E: current ratio and quick ratio. What can you say about the companys liquidity position in 20Y3,

Calculate the following liquidity ratios for CATS for F20Y5E: current ratio and quick ratio. What can you say about the companys liquidity position in 20Y3, 20Y4, and as projected for 20Y5E? We often think of ratios as being useful: (1) to managers to help run the business, (2) to bankers for credit analysis, and (3) to stockholders for stock valuation. Would these different types of analysts have an equal interest in the liquidity ratios?Calculate the following asset management ratios for CATS for F20Y5E: fixed assets turnover; total assets turnover; days sales outstanding; and the inventory turnover ratio. How does CATSs utilization of assets stack up against that of other firms in its industry?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started