Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the following missing values in the Pro Forma Income Statement using the below information: Pro Forma Income Statement Make It So Kitchens & Cabinets

Calculate the following missing values in the Pro Forma Income Statement using the below information:

| Pro Forma Income Statement | |

| Make It So Kitchens & Cabinets | |

| for Fiscal 2023 | |

| REVENUE | |

| Sales of Cabinets | 7,200,000 |

| Sales of Refurbishing | 1,680,000 |

| TOTAL REVENUE | 8,880,000 |

| - | - |

| COGS | |

| Wages & Benefits | 2,650,000 |

| Materials | 3,220,000 |

| Equipment and Depreciation | 36,000 |

| Freight and Shipping | 214,000 |

| TOTAL COGS | 6,120,000 |

| - | - |

| GROSS PROFIT | 2,760,000 |

| - | - |

| SELLING, GENERAL, & ADMIN EXPENSES | |

| Personnel Costs | 650,000 |

| Commissions | 1,200,000 |

| Credit Card Fees | 90,000 |

| Insurance | 13,800 |

| Interest on Mortgages/Loans | 30,000 |

| Marketing Expenses | 120,000 |

| Office Expenses | 76,600 |

| Property Taxes | 86,000 |

| Repairs and Maintenance | 50,000 |

| Rent - Downtown Office | 72,000 |

| Consultant - Computer Systems | 30,000 |

| TOTAL SELLING, GENERAL, & ADMIN EXPENSES | 2,418,400 |

| - | - |

| OPERATING INCOME | 341,600 |

| - | - |

| NON-OPERATING INCOME | ? - Solve for this |

| Earnings Before Taxes (EBT) | ? - Solve for this (Operating Income + Non-Operating Income) |

| Income Tax (20%) | ? - Solve for this |

| NET INCOME | ? - Solve for this (EBT + Income Tax) |

Balance Sheet Information IF Required to solve the above Questions

| Balance Sheet | ||

| Make it so Kitchens & Cabinets | ||

| For year ending December 31, 2022 | ||

| ASSETS | ||

| Current Assets | ||

| Cash | - | 1,042,900 |

| Accounts Receivable | - | 780,000 |

| Finished Inventory | - | 2,240,000 |

| Prepaid Insurance | - | 3,600 |

| Shop Supplies | - | 990,000 |

| Short Term Investments (6 - 12 mos.) | - | 750,000 |

| Total Current Assets | 5,806,500 | |

| - | - | - |

| Long-Term Assets | ||

| Long Term Investments (> 1 yr.) | 1,400,000 | |

| Land & Buildings | 6,750,000 | |

| Shop Machinery | 552,500 | |

| Less: Accumulated Depreciation | 144,000 | Total: 408,500 |

| Total Long-Term Assets | 8,558,500 | |

| TOTAL ASSETS | 14,365,000 | |

| - | - | - |

| LIABILITIES | ||

| Current Liabilities | ||

| Accounts Payable | 690,000 | |

| Commercial Paper | 810,000 | |

| Total Current Liabilities | 1,500,000 | |

| - | - | - |

| Long-Term Liabilities | ||

| Loans Payable | 540,000 | |

| Mortgage Payable | 3,100,000 | |

| Total Long-Term Liabilities | 3,640,000 | |

| TOTAL LIABILITIES | 5,140,000 | |

| - | - | - |

| STOCKHOLDER'S EQUITY | ||

| Common Stock | 7,500,000 | |

| Preferred Stock | 1,750,000 | |

| Retained Earnings (Fiscal 2022) | 975,000 | |

| TOTAL STOCKHOLDER'S EQUITY | 10,225,000 | |

| TOTAL LIABILITIES AND EQUITY | 15,365,000 |

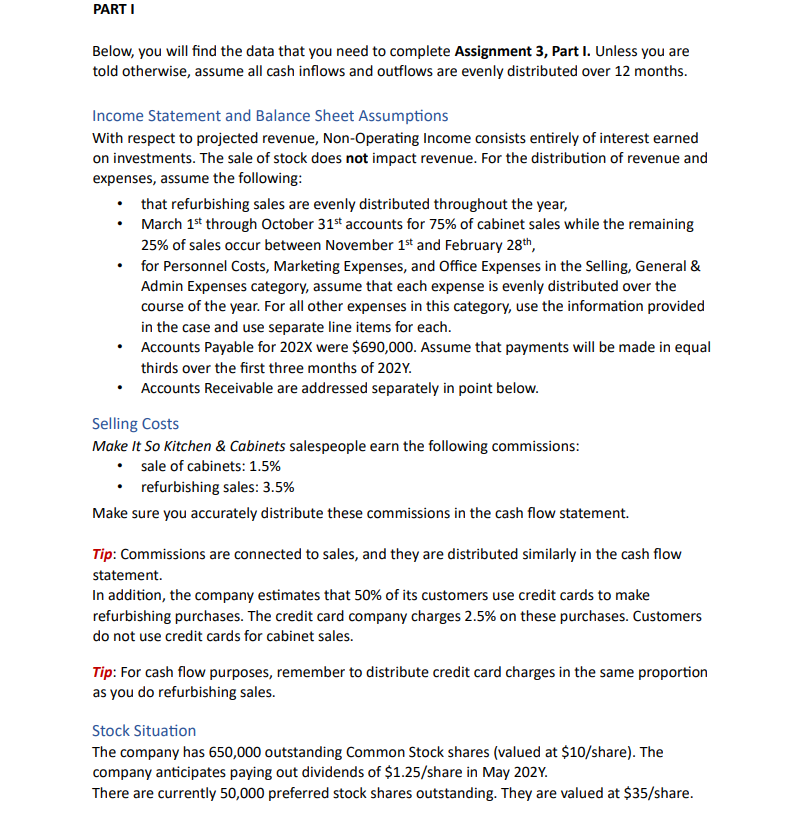

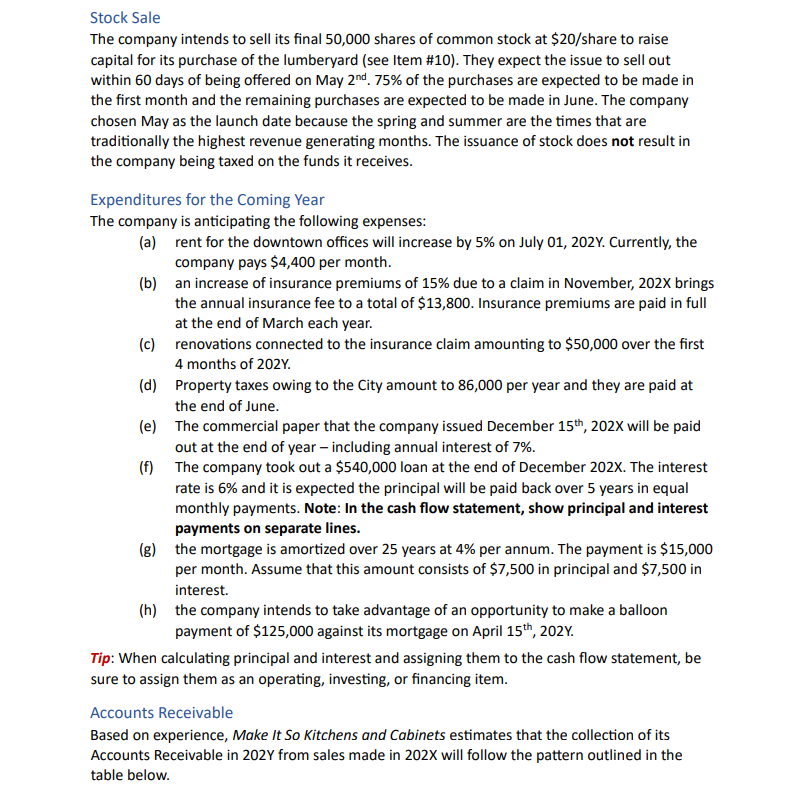

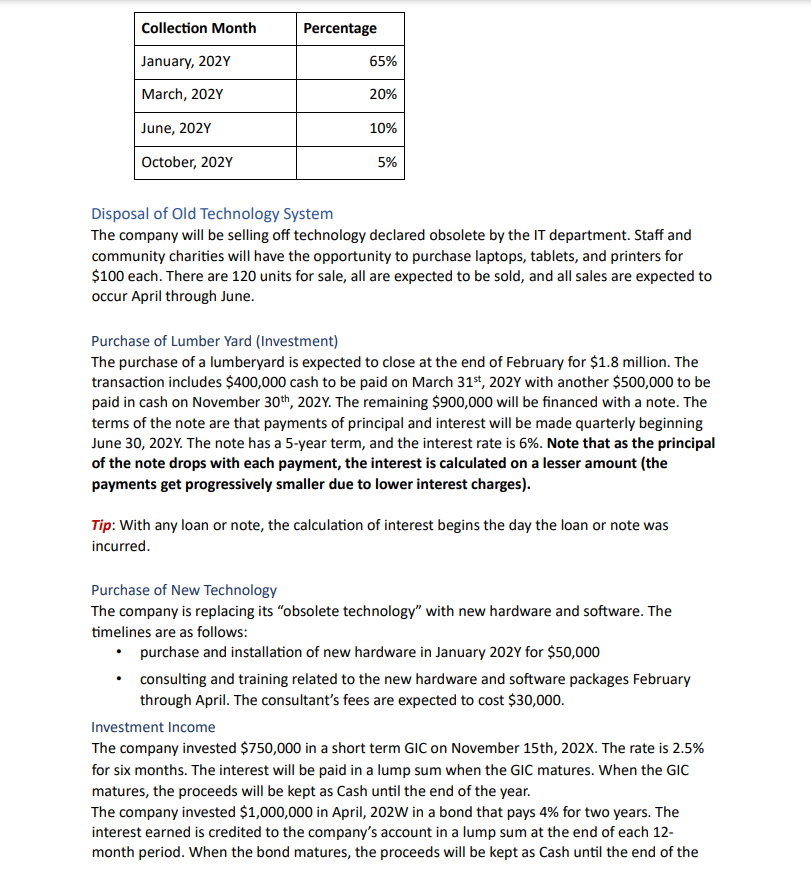

Stock Sale The company intends to sell its final 50,000 shares of common stock at $20/ share to raise capital for its purchase of the lumberyard (see Item \#10). They expect the issue to sell out within 60 days of being offered on May 2nd.75% of the purchases are expected to be made in the first month and the remaining purchases are expected to be made in June. The company chosen May as the launch date because the spring and summer are the times that are traditionally the highest revenue generating months. The issuance of stock does not result in the company being taxed on the funds it receives. Expenditures for the Coming Year The company is anticipating the following expenses: (a) rent for the downtown offices will increase by 5% on July 01,202 Y. Currently, the company pays $4,400 per month. (b) an increase of insurance premiums of 15% due to a claim in November, 202X brings the annual insurance fee to a total of $13,800. Insurance premiums are paid in full at the end of March each year. (c) renovations connected to the insurance claim amounting to $50,000 over the first 4 months of 202Y. (d) Property taxes owing to the City amount to 86,000 per year and they are paid at the end of June. (e) The commercial paper that the company issued December 15th,202X will be paid out at the end of year - including annual interest of 7%. (f) The company took out a $540,000 loan at the end of December 202X. The interest rate is 6% and it is expected the principal will be paid back over 5 years in equal monthly payments. Note: In the cash flow statement, show principal and interest payments on separate lines. (g) the mortgage is amortized over 25 years at 4% per annum. The payment is $15,000 per month. Assume that this amount consists of $7,500 in principal and $7,500 in interest. (h) the company intends to take advantage of an opportunity to make a balloon payment of $125,000 against its mortgage on April 15th,202Y. Tip: When calculating principal and interest and assigning them to the cash flow statement, be sure to assign them as an operating, investing, or financing item. Accounts Receivable Based on experience, Make It So Kitchens and Cabinets estimates that the collection of its Accounts Receivable in 202Y from sales made in 202X will follow the pattern outlined in the table below. On August 24, 202Y, a $1,000,000 bond matures. It was purchased three years ago at a rate of 5% per year. Each of the first two years, the interest was reinvested. Disposal of Old Technology System The company will be selling off technology declared obsolete by the IT department. Staff and community charities will have the opportunity to purchase laptops, tablets, and printers for $100 each. There are 120 units for sale, all are expected to be sold, and all sales are expected to occur April through June. Purchase of Lumber Yard (Investment) The purchase of a lumberyard is expected to close at the end of February for $1.8 million. The transaction includes $400,000 cash to be paid on March 31st,202Y with another $500,000 to be paid in cash on November 30th,202 Y. The remaining $900,000 will be financed with a note. The terms of the note are that payments of principal and interest will be made quarterly beginning June 30,202 Y. The note has a 5 -year term, and the interest rate is 6%. Note that as the principal of the note drops with each payment, the interest is calculated on a lesser amount (the payments get progressively smaller due to lower interest charges). Tip: With any loan or note, the calculation of interest begins the day the loan or note was incurred. Purchase of New Technology The company is replacing its "obsolete technology" with new hardware and software. The timelines are as follows: - purchase and installation of new hardware in January 202Y for $50,000 - consulting and training related to the new hardware and software packages February through April. The consultant's fees are expected to cost $30,000. Investment Income The company invested $750,000 in a short term GIC on November 15 th, 202X. The rate is 2.5% for six months. The interest will be paid in a lump sum when the GIC matures. When the GIC matures, the proceeds will be kept as Cash until the end of the year. The company invested $1,000,000 in April, 202W in a bond that pays 4% for two years. The interest earned is credited to the company's account in a lump sum at the end of each 12month period. When the bond matures, the proceeds will be kept as Cash until the end of the PART I Below, you will find the data that you need to complete Assignment 3, Part I. Unless you are told otherwise, assume all cash inflows and outflows are evenly distributed over 12 months. Income Statement and Balance Sheet Assumptions With respect to projected revenue, Non-Operating Income consists entirely of interest earned on investments. The sale of stock does not impact revenue. For the distribution of revenue and expenses, assume the following: - that refurbishing sales are evenly distributed throughout the year, - March 1st through October 31st accounts for 75% of cabinet sales while the remaining 25% of sales occur between November 1st and February 28th, - for Personnel Costs, Marketing Expenses, and Office Expenses in the Selling, General \& Admin Expenses category, assume that each expense is evenly distributed over the course of the year. For all other expenses in this category, use the information provided in the case and use separate line items for each. - Accounts Payable for 202X were $690,000. Assume that payments will be made in equal thirds over the first three months of 202Y. - Accounts Receivable are addressed separately in point below. Selling Costs Make It So Kitchen \& Cabinets salespeople earn the following commissions: - sale of cabinets: 1.5% - refurbishing sales: 3.5% Make sure you accurately distribute these commissions in the cash flow statement. Tip: Commissions are connected to sales, and they are distributed similarly in the cash flow statement. In addition, the company estimates that 50% of its customers use credit cards to make refurbishing purchases. The credit card company charges 2.5% on these purchases. Customers do not use credit cards for cabinet sales. Tip: For cash flow purposes, remember to distribute credit card charges in the same proportion as you do refurbishing sales. Stock Situation The company has 650,000 outstanding Common Stock shares (valued at $10/ share). The company anticipates paying out dividends of $1.25/ share in May 202Y. There are currently 50,000 preferred stock shares outstanding. They are valued at $35/ share. Stock Sale The company intends to sell its final 50,000 shares of common stock at $20/ share to raise capital for its purchase of the lumberyard (see Item \#10). They expect the issue to sell out within 60 days of being offered on May 2nd.75% of the purchases are expected to be made in the first month and the remaining purchases are expected to be made in June. The company chosen May as the launch date because the spring and summer are the times that are traditionally the highest revenue generating months. The issuance of stock does not result in the company being taxed on the funds it receives. Expenditures for the Coming Year The company is anticipating the following expenses: (a) rent for the downtown offices will increase by 5% on July 01,202 Y. Currently, the company pays $4,400 per month. (b) an increase of insurance premiums of 15% due to a claim in November, 202X brings the annual insurance fee to a total of $13,800. Insurance premiums are paid in full at the end of March each year. (c) renovations connected to the insurance claim amounting to $50,000 over the first 4 months of 202Y. (d) Property taxes owing to the City amount to 86,000 per year and they are paid at the end of June. (e) The commercial paper that the company issued December 15th,202X will be paid out at the end of year - including annual interest of 7%. (f) The company took out a $540,000 loan at the end of December 202X. The interest rate is 6% and it is expected the principal will be paid back over 5 years in equal monthly payments. Note: In the cash flow statement, show principal and interest payments on separate lines. (g) the mortgage is amortized over 25 years at 4% per annum. The payment is $15,000 per month. Assume that this amount consists of $7,500 in principal and $7,500 in interest. (h) the company intends to take advantage of an opportunity to make a balloon payment of $125,000 against its mortgage on April 15th,202Y. Tip: When calculating principal and interest and assigning them to the cash flow statement, be sure to assign them as an operating, investing, or financing item. Accounts Receivable Based on experience, Make It So Kitchens and Cabinets estimates that the collection of its Accounts Receivable in 202Y from sales made in 202X will follow the pattern outlined in the table below. On August 24, 202Y, a $1,000,000 bond matures. It was purchased three years ago at a rate of 5% per year. Each of the first two years, the interest was reinvested. Disposal of Old Technology System The company will be selling off technology declared obsolete by the IT department. Staff and community charities will have the opportunity to purchase laptops, tablets, and printers for $100 each. There are 120 units for sale, all are expected to be sold, and all sales are expected to occur April through June. Purchase of Lumber Yard (Investment) The purchase of a lumberyard is expected to close at the end of February for $1.8 million. The transaction includes $400,000 cash to be paid on March 31st,202Y with another $500,000 to be paid in cash on November 30th,202 Y. The remaining $900,000 will be financed with a note. The terms of the note are that payments of principal and interest will be made quarterly beginning June 30,202 Y. The note has a 5 -year term, and the interest rate is 6%. Note that as the principal of the note drops with each payment, the interest is calculated on a lesser amount (the payments get progressively smaller due to lower interest charges). Tip: With any loan or note, the calculation of interest begins the day the loan or note was incurred. Purchase of New Technology The company is replacing its "obsolete technology" with new hardware and software. The timelines are as follows: - purchase and installation of new hardware in January 202Y for $50,000 - consulting and training related to the new hardware and software packages February through April. The consultant's fees are expected to cost $30,000. Investment Income The company invested $750,000 in a short term GIC on November 15 th, 202X. The rate is 2.5% for six months. The interest will be paid in a lump sum when the GIC matures. When the GIC matures, the proceeds will be kept as Cash until the end of the year. The company invested $1,000,000 in April, 202W in a bond that pays 4% for two years. The interest earned is credited to the company's account in a lump sum at the end of each 12month period. When the bond matures, the proceeds will be kept as Cash until the end of the PART I Below, you will find the data that you need to complete Assignment 3, Part I. Unless you are told otherwise, assume all cash inflows and outflows are evenly distributed over 12 months. Income Statement and Balance Sheet Assumptions With respect to projected revenue, Non-Operating Income consists entirely of interest earned on investments. The sale of stock does not impact revenue. For the distribution of revenue and expenses, assume the following: - that refurbishing sales are evenly distributed throughout the year, - March 1st through October 31st accounts for 75% of cabinet sales while the remaining 25% of sales occur between November 1st and February 28th, - for Personnel Costs, Marketing Expenses, and Office Expenses in the Selling, General \& Admin Expenses category, assume that each expense is evenly distributed over the course of the year. For all other expenses in this category, use the information provided in the case and use separate line items for each. - Accounts Payable for 202X were $690,000. Assume that payments will be made in equal thirds over the first three months of 202Y. - Accounts Receivable are addressed separately in point below. Selling Costs Make It So Kitchen \& Cabinets salespeople earn the following commissions: - sale of cabinets: 1.5% - refurbishing sales: 3.5% Make sure you accurately distribute these commissions in the cash flow statement. Tip: Commissions are connected to sales, and they are distributed similarly in the cash flow statement. In addition, the company estimates that 50% of its customers use credit cards to make refurbishing purchases. The credit card company charges 2.5% on these purchases. Customers do not use credit cards for cabinet sales. Tip: For cash flow purposes, remember to distribute credit card charges in the same proportion as you do refurbishing sales. Stock Situation The company has 650,000 outstanding Common Stock shares (valued at $10/ share). The company anticipates paying out dividends of $1.25/ share in May 202Y. There are currently 50,000 preferred stock shares outstanding. They are valued at $35/ share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started