Question

Calculate the following (not using excel): Your manager requires you to provide full calculations for the market values for each source of capital, the after-tax

Calculate the following (not using excel):

Your manager requires you to provide full calculations for the market values for each source of capital, the after-tax costs of each source and the weighted average cost of capital (WACC) for Short Stop.

Notes: Short Stops bank has advised that the interest rate on any new debt finance provided for projects would be 5% p.a. if the debt issue is of similar risk, time to maturity and coupon rate. There are currently 1,000,000 preference shares on issue, which pay a dividend of $1.20 per share. The preference shares currently sell for $11.45. Short Stops existing 50,000,000 ordinary shares currently sell for $1.88 each. Short Stop recently paid a dividend of $0.19 per share. Historically, dividends have increased at an annual rate of 3% p.a. and are expected to continue to do so in the future. Short Stops company tax rate is 30%.

Your manager requires you to provide full calculations for the market values for each source of capital, the after-tax costs of each source and the weighted average cost of capital (WACC) for Short Stop. Investors have communicated to Short Stop management that they require 12% p.a. before they are willing to invest money in the company. Identify, for your manager with a plausible rationale, whether the current WACC is enough to attract investors who require this rate of return.

Your manager understands that in valuing the equity component of the WACC, the dividend discount model is used. She requires a detailed discussion on the dividend valuation model, specifically on how it can be used for both preference shares and ordinary shares, as well as any inherent limitations with the model.

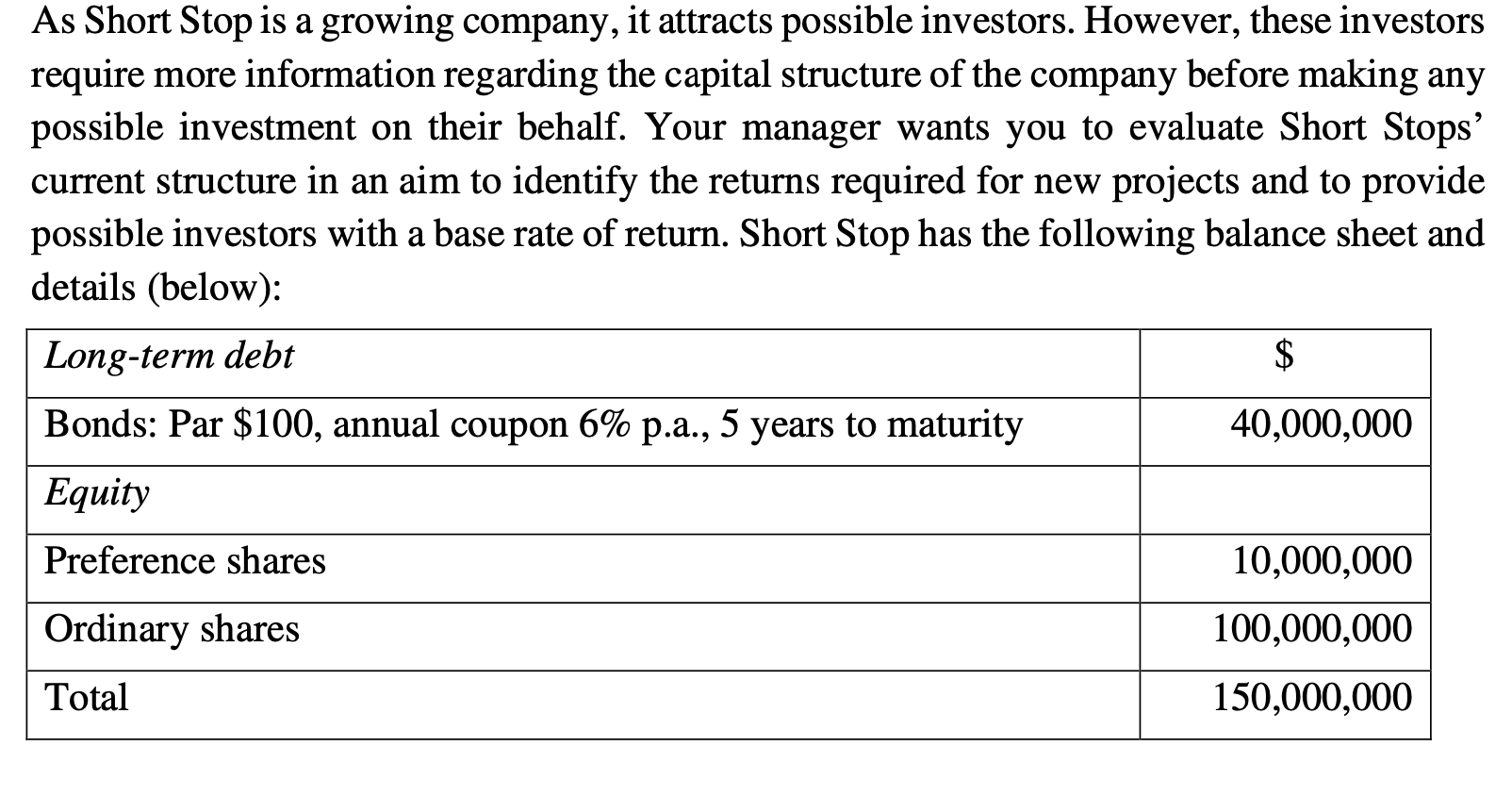

As Short Stop is a growing company, it attracts possible investors. However, these investors require more information regarding the capital structure of the company before making any possible investment on their behalf. Your manager wants you to evaluate Short Stops' current structure in an aim to identify the returns required for new projects and to provide possible investors with a base rate of return. Short Stop has the following balance sheet and details (below)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started