Answered step by step

Verified Expert Solution

Question

1 Approved Answer

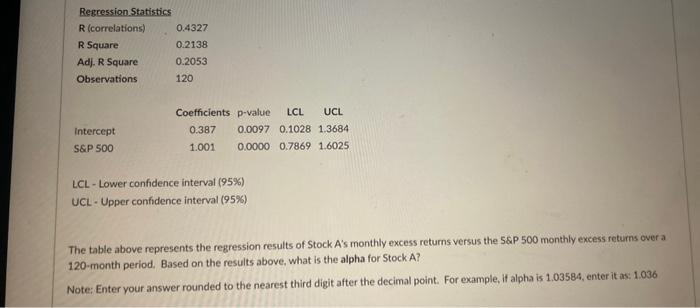

calculate the following question from the data given below Regression Statistics R (correlations) R Square Adj. R Square Observations Intercept S&P 500 0.4327 0.2138 0.2053

calculate the following question from the data given below

Regression Statistics R (correlations) R Square Adj. R Square Observations Intercept S&P 500 0.4327 0.2138 0.2053 120 Coefficients p-value LCL UCL 0.0097 0.1028 1.3684 0.0000 0.7869 1.6025 0.387 1.001 LCL-Lower confidence interval (95%) UCL- Upper confidence interval (95%) The table above represents the regression results of Stock A's monthly excess returns versus the S&P 500 monthly excess returns over a 120-month period. Based on the results above, what is the alpha for Stock A? Note: Enter your answer rounded to the nearest third digit after the decimal point. For example, if alpha is 1.03584, enter it as: 1.036

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Alpha in finance represents the excess return of a stock or portfolio compared ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started