Answered step by step

Verified Expert Solution

Question

1 Approved Answer

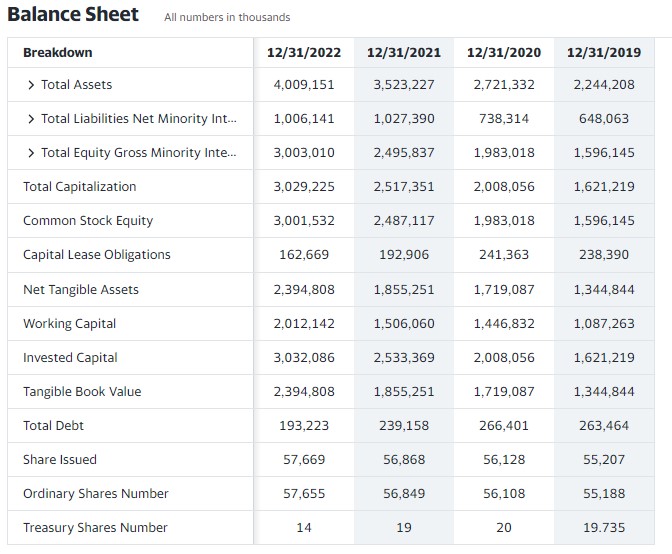

Calculate the following ratios: 3 profitability ratios, 3 Asset Utilization ratios, 2 Liquidity ratios and, 3 debt ratios for all 3 years. 2) Please provide

Calculate the following ratios:

- 3 profitability ratios,

- 3 Asset Utilization ratios,

- 2 Liquidity ratios and,

- 3 debt ratios for all 3 years.

2) Please provide an explanation on the financial status of the company

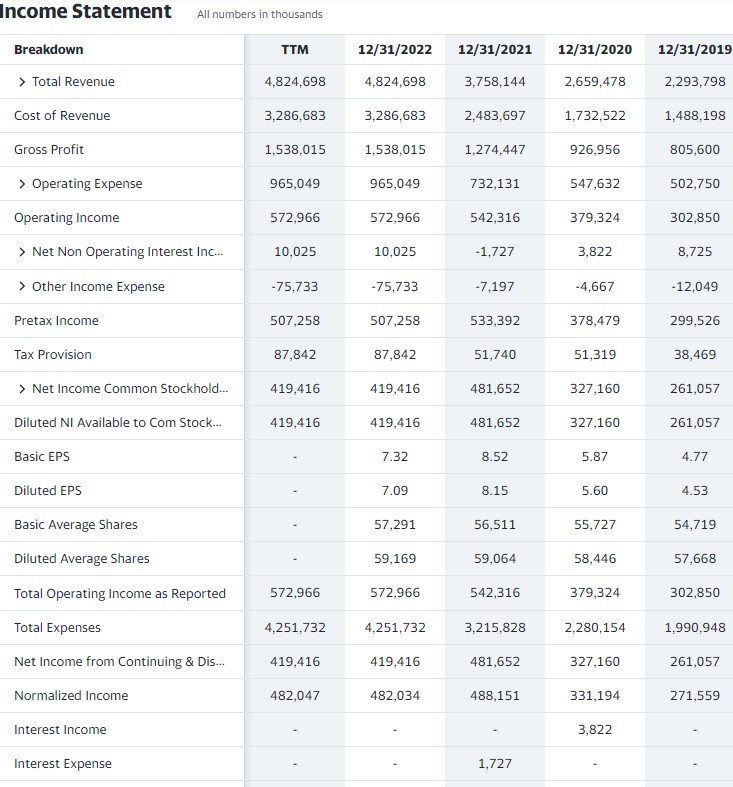

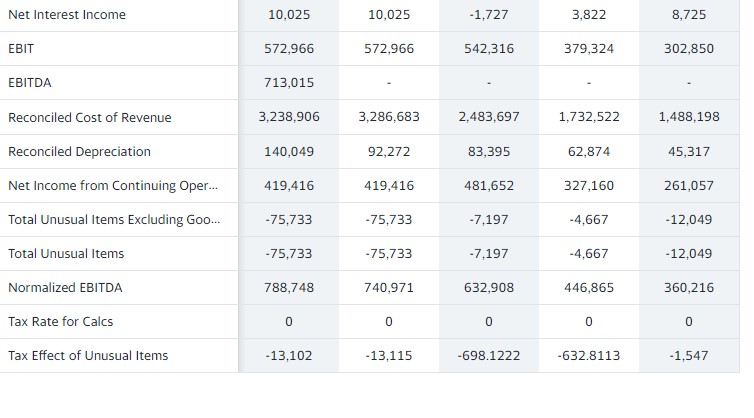

Income Statement Breakdown > Total Revenue Cost of Revenue All numbers in thousands TTM 12/31/2022 12/31/2021 12/31/2020 12/31/2019 4,824,698 4,824,698 3,758,144 2,659,478 2,293,798 3,286,683 3,286,683 2,483,697 1,732,522 1,488,198 Gross Profit 1,538,015 1,538,015 1,274,447 926,956 805,600 > Operating Expense 965,049 965,049 732,131 547,632 502,750 Operating Income 572,966 572,966 542,316 379,324 302,850 > Net Non Operating Interest Inc... 10,025 10,025 -1,727 3,822 8,725 > Other Income Expense -75,733 -75,733 -7,197 -4,667 -12,049 Pretax Income 507,258 507,258 533,392 378,479 299,526 Tax Provision 87,842 87,842 51,740 51,319 38,469 > Net Income Common Stockhold... 419,416 419,416 481,652 327,160 261,057 Diluted NI Available to Com Stock.... 419,416 419,416 481,652 327,160 261,057 Basic EPS 7.32 8.52 5.87 4.77 Diluted EPS 7.09 8.15 5.60 4.53 Basic Average Shares 57,291 56,511 55,727 54,719 Diluted Average Shares 59,169 59,064 58,446 57,668 Total Operating Income as Reported 572,966 572,966 542,316 379,324 302,850 Total Expenses 4,251,732 4,251,732 3,215,828 2,280,154 1,990,948 Net Income from Continuing & Dis... 419,416 419,416 481,652 327,160 261,057 Normalized Income 482,047 482,034 488,151 331,194 271,559 Interest Income 3,822 Interest Expense 1,727

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started