Question

Calculate the following ratios for Level Up Ltd for the 2023 financial year: Current ratio Quick ratio (Acid test ratio) Debt ratio Debt to equity

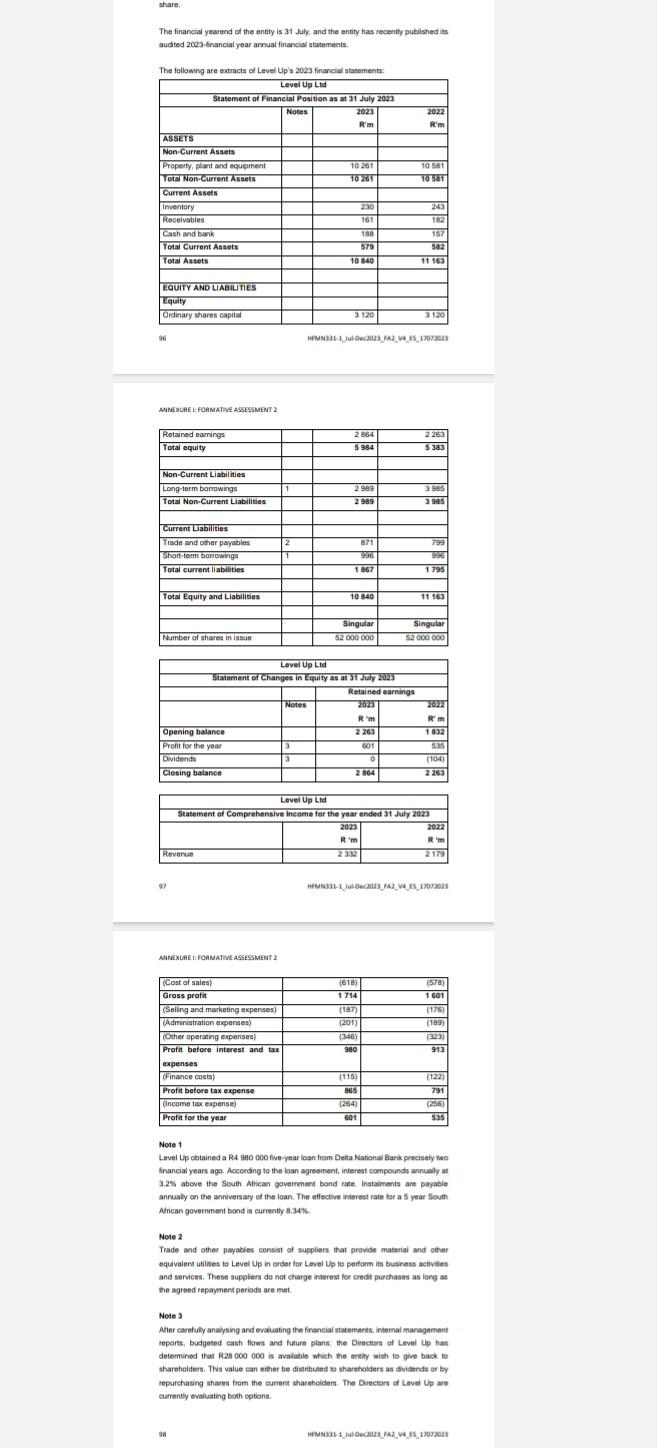

Calculate the following ratios for Level Up Ltd for the 2023 financial year: Current ratio Quick ratio (Acid test ratio) Debt ratio Debt to equity (Debt: Equity ratio) (6 marks) 1.2. Analyse the extracts from the financial statements and answers to question 1.1. Identify the type of working capital finance policy Level Up Ltd has and motivate your answer. Supplement your answer by explaining why Level Up Ltd would want to employ this working capital finance policy. (6 marks) 1.3. Advise the directors of Level Up Ltd whether the above working capital finance policy is best for Level Up Ltd and motivate your advice. (6 marks) 1.4. Draft a report to the directors of Level Up Ltd in which you advise them whether the entity should distribute value back to the shareholders by Option 1: Declaring a dividend, or Option 2: Through a repurchase of shares from the shareholders. Separately for each option, include the effect that each option will have on the following 2023 financial year figures, in your report: Share price per share Earnings per share Price earnings ratio Dividend per share Net asset value of Level Up Ltd per share.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started