Answered step by step

Verified Expert Solution

Question

1 Approved Answer

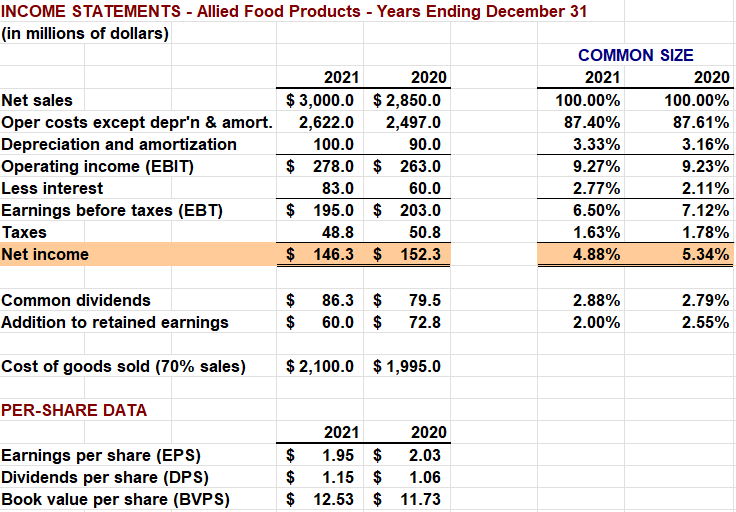

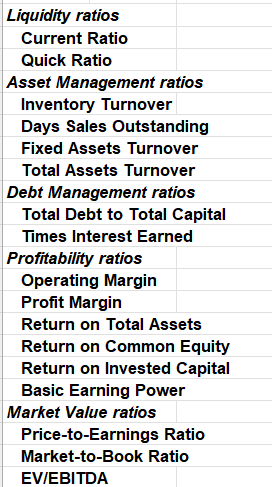

Calculate the following ratios on the table below for year 2021 only Also Calculate the Free Cash Flow for 2021's You are provided with the

Calculate the following ratios on the table below for year 2021 only

Also Calculate the Free Cash Flow for 2021's

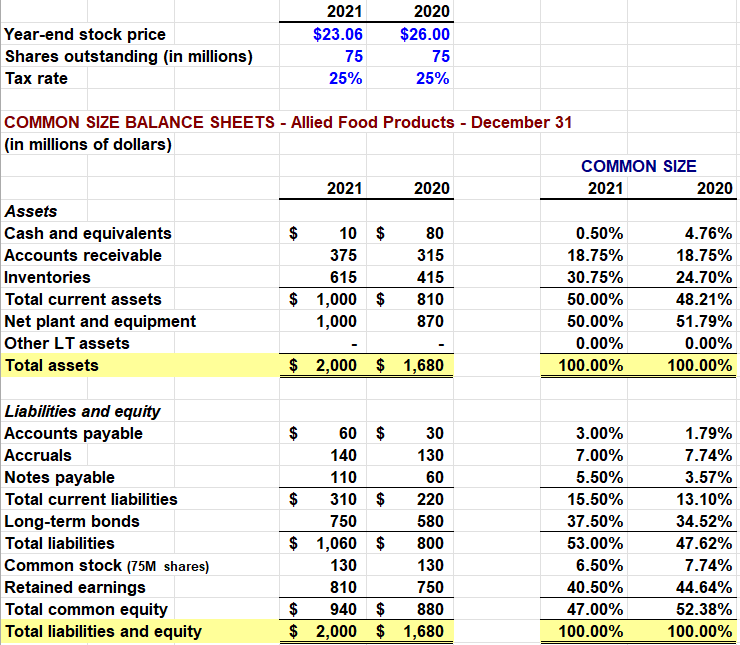

You are provided with the following financial statements data for a firm:

Year-end stock price Shares outstanding (in millions) Tax rate Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Other LT assets Total assets Liabilities and equity Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total liabilities Common stock (75M shares) Retained earnings COMMON SIZE BALANCE SHEETS - Allied Food Products - December 31 (in millions of dollars) Total common equity Total liabilities and equity 2021 $23.06 75 25% $ 2021 10 $ 375 615 $ 1,000 $ 1,000 - 60 $ 2020 $26.00 140 110 $ 310 $ 750 75 $ 1,060 $ 130 25% $2,000 $ 1,680 2020 80 315 415 810 870 30 130 60 220 580 800 130 750 880 810 $ 940 $ $2,000 $ 1,680 COMMON SIZE 2021 0.50% 18.75% 30.75% 50.00% 50.00% 0.00% 100.00% 3.00% 7.00% 5.50% 15.50% 37.50% 53.00% 6.50% 40.50% 47.00% 100.00% 2020 4.76% 18.75% 24.70% 48.21% 51.79% 0.00% 100.00% 1.79% 7.74% 3.57% 13.10% 34.52% 47.62% 7.74% 44.64% 52.38% 100.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the requested ratios for the year 2021 lets go through each one Liquidity Ratios 1 Current Ratio Current Assets Current Liabilities Current Assets 1000 million Current Liabilities 310 mil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started