Answered step by step

Verified Expert Solution

Question

1 Approved Answer

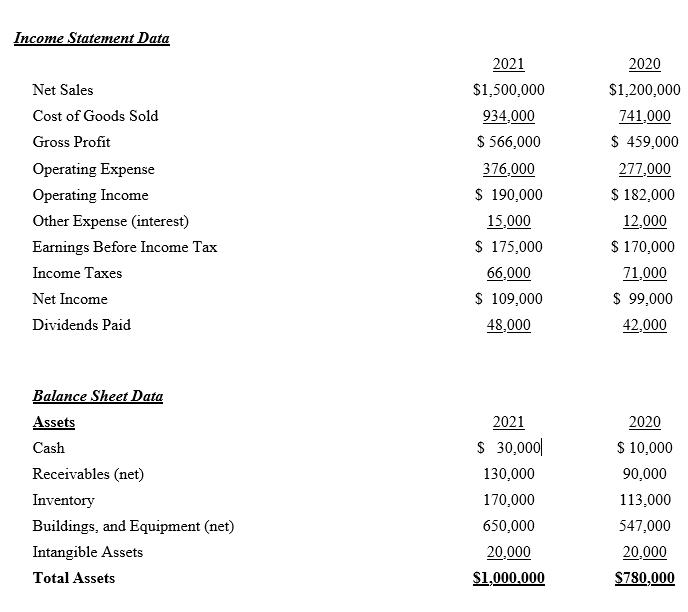

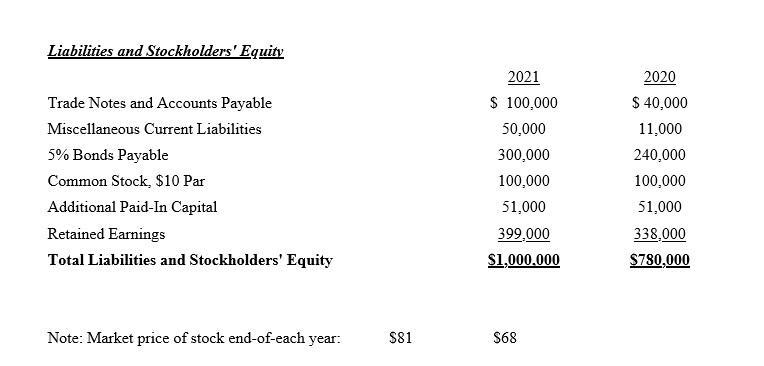

Calculate the followings -Debt to equity ratio -Operating Profit Margin -Net profit margin -Return on assets -Return on equity Income Statement Data Net Sales Cost

Calculate the followings

-Debt to equity ratio

-Operating Profit Margin

-Net profit margin

-Return on assets

-Return on equity

Income Statement Data Net Sales Cost of Goods Sold Gross Profit Operating Expense Operating Income Other Expense (interest) Earnings Before Income Tax Income Taxes Net Income Dividends Paid Balance Sheet Data Assets Cash Receivables (net) Inventory Buildings, and Equipment (net) Intangible Assets Total Assets 2021 $1,500,000 934,000 $ 566,000 376,000 $ 190,000 15,000 $ 175,000 66,000 $ 109,000 48,000 2021 $ 30,000 130,000 170,000 650,000 20,000 $1,000,000 2020 $1,200,000 741,000 $ 459,000 277,000 $ 182,000 12,000 $ 170,000 71,000 $ 99,000 42,000 2020 $ 10,000 90,000 113,000 547,000 20,000 $780,000

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the ratios we need to use the following formulas Debt to Equity Ratio Total Liabilities ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started