Answered step by step

Verified Expert Solution

Question

1 Approved Answer

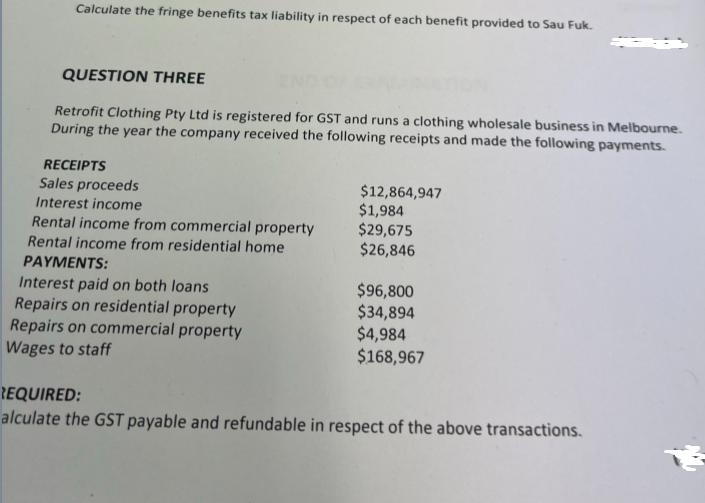

Calculate the fringe benefits tax liability in respect of each benefit provided to Sau Fuk. QUESTION THREE Retrofit Clothing Pty Ltd is registered for

Calculate the fringe benefits tax liability in respect of each benefit provided to Sau Fuk. QUESTION THREE Retrofit Clothing Pty Ltd is registered for GST and runs a clothing wholesale business in Melbourne. During the year the company received the following receipts and made the following payments. RECEIPTS Sales proceeds Interest income Rental income from commercial property Rental income from residential home PAYMENTS: Interest paid on both loans Repairs on residential property Repairs on commercial property Wages to staff $12,864,947 $1,984 $29,675 $26,846 $96,800 $34,894 $4,984 $168,967 REQUIRED: alculate the GST payable and refundable in respect of the above transactions.

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the GST payable and refundable for Retrofit Clothing Pty Ltd we need to determine the G...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started