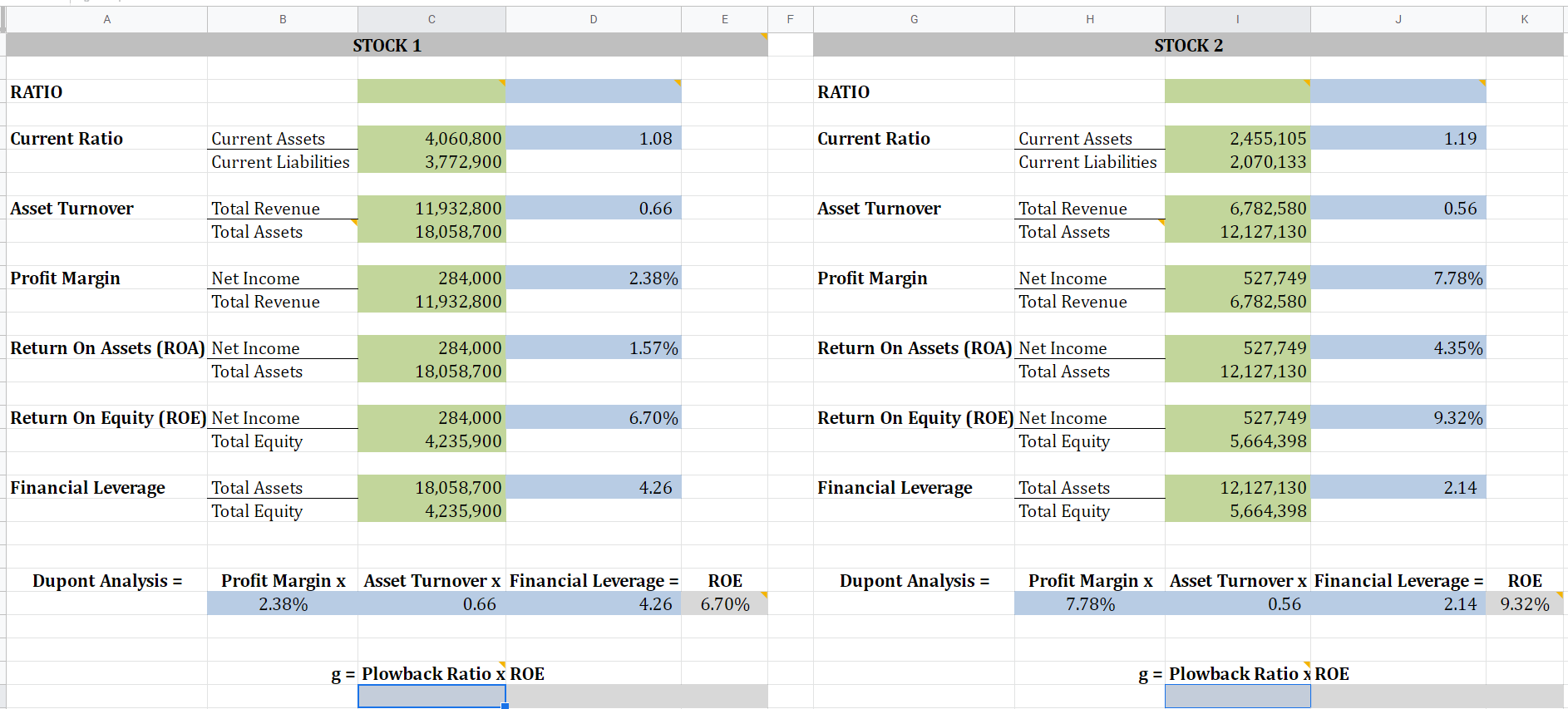

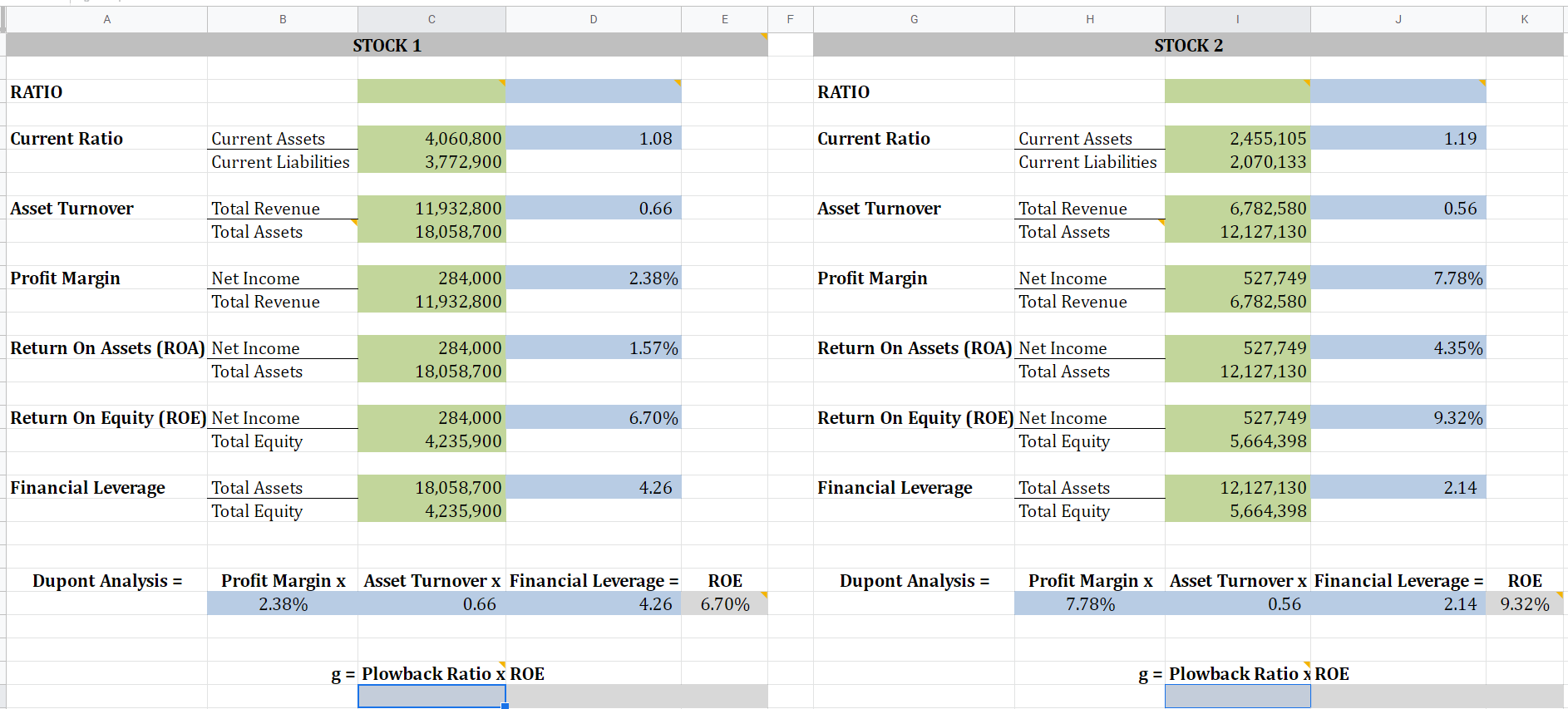

Calculate the growth rate (g) using the plowback ratio x ROE

B D E F G H K STOCK 1 STOCK 2 RATIO RATIO Current Ratio 1.08 Current Ratio 1.19 Current Assets Current Liabilities 4,060,800 3,772,900 Current Assets Current Liabilities 2,455,105 2,070,133 Asset Turnover 0.66 Asset Turnover 0.56 Total Revenue Total Assets 11,932,800 18,058,700 Total Revenue Total Assets 6,782,580 12,127,130 Profit Margin 2.38% Profit Margin 7.78% Net Income Total Revenue 284,000 11,932,800 Net Income Total Revenue 527,749 6,782,580 1.57% 4.35% Return On Assets (ROA) Net Income Total Assets 284,000 18,058,700 Return On Assets (ROA) Net Income Total Assets 527,749 12,127,130 Return On Equity (ROE) Net Income Total Equity 6.70% 9.32% 284,000 4,235,900 Return On Equity (ROE) Net Income Total Equity 527,749 5,664,398 Financial Leverage 4.26 Financial Leverage 2.14 Total Assets Total Equity 18,058,700 4,235,900 Total Assets Total Equity 12,127,130 5,664,398 Dupont Analysis Profit Margin x Asset Turnover x Financial Leverage = 2.38% 0.66 4.26 ROE 6.70% Dupont Analysis Profit Margin x Asset Turnover x Financial Leverage = 7.78% 0.56 2.14 ROE 9.32% g= Plowback Ratio x ROE g= Plowback Ratio x ROE B D E F G H K STOCK 1 STOCK 2 RATIO RATIO Current Ratio 1.08 Current Ratio 1.19 Current Assets Current Liabilities 4,060,800 3,772,900 Current Assets Current Liabilities 2,455,105 2,070,133 Asset Turnover 0.66 Asset Turnover 0.56 Total Revenue Total Assets 11,932,800 18,058,700 Total Revenue Total Assets 6,782,580 12,127,130 Profit Margin 2.38% Profit Margin 7.78% Net Income Total Revenue 284,000 11,932,800 Net Income Total Revenue 527,749 6,782,580 1.57% 4.35% Return On Assets (ROA) Net Income Total Assets 284,000 18,058,700 Return On Assets (ROA) Net Income Total Assets 527,749 12,127,130 Return On Equity (ROE) Net Income Total Equity 6.70% 9.32% 284,000 4,235,900 Return On Equity (ROE) Net Income Total Equity 527,749 5,664,398 Financial Leverage 4.26 Financial Leverage 2.14 Total Assets Total Equity 18,058,700 4,235,900 Total Assets Total Equity 12,127,130 5,664,398 Dupont Analysis Profit Margin x Asset Turnover x Financial Leverage = 2.38% 0.66 4.26 ROE 6.70% Dupont Analysis Profit Margin x Asset Turnover x Financial Leverage = 7.78% 0.56 2.14 ROE 9.32% g= Plowback Ratio x ROE g= Plowback Ratio x ROE