Question

Calculate the growth rates of the M1 and M2 money supply from the previous year. (Enter your responses rounded to one decimal place. Use a

Calculate the growth rates of the M1 and M2 money supply from the previous year. (Enter your responses rounded to one decimal place. Use a minus sign to enter negative numbers.)

M1 Growth Rate for 2010,2011,2012

M2 Growth Rate for 2010,2011,2012

Why are the growth rates of M1 and M2 so different? ( Select the correct answer)

A.The components of M2 are rising much more rapidly compared to the components of M1.

B.The M2 monetary aggregate is usually more volatile than M1; therefore, M2 is rising much more rapidly.

C.The M2 monetary aggregate includes all the components of M1, and it always rises more rapidly than M1.

D.The components of M1 are rising much more rapidly compared to the components of M2.

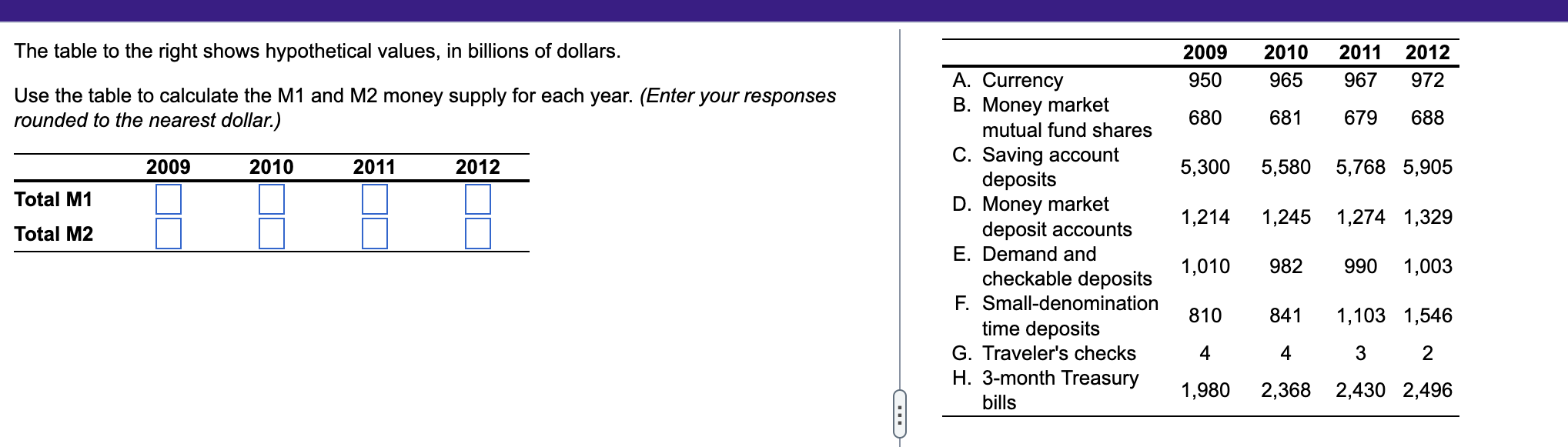

The table to the right shows hypothetical values, in billions of dollars. Use the table to calculate the M1 and M2 money supply for each year. (Enter your responses rounded to the nearest dollar.) 2009 2010 2011 2012 Total M1 Total M2 A. Currency B. Money market mutual fund shares C. Saving account deposits D. Money market deposit accounts E. Demand and checkable deposits F. Small-denomination time deposits G. Traveler's checks H. 3-month Treasury bills 2009 2010 2011 2012 950 965 967 972 680 681 679 688 5,300 5,580 5,768 5,905 1,214 1,245 1,274 1,329 1,010 982 990 1,003 810 4 1,980 841 1,103 1,546 4 3 2 2,368 2,430 2,496Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started