Answered step by step

Verified Expert Solution

Question

1 Approved Answer

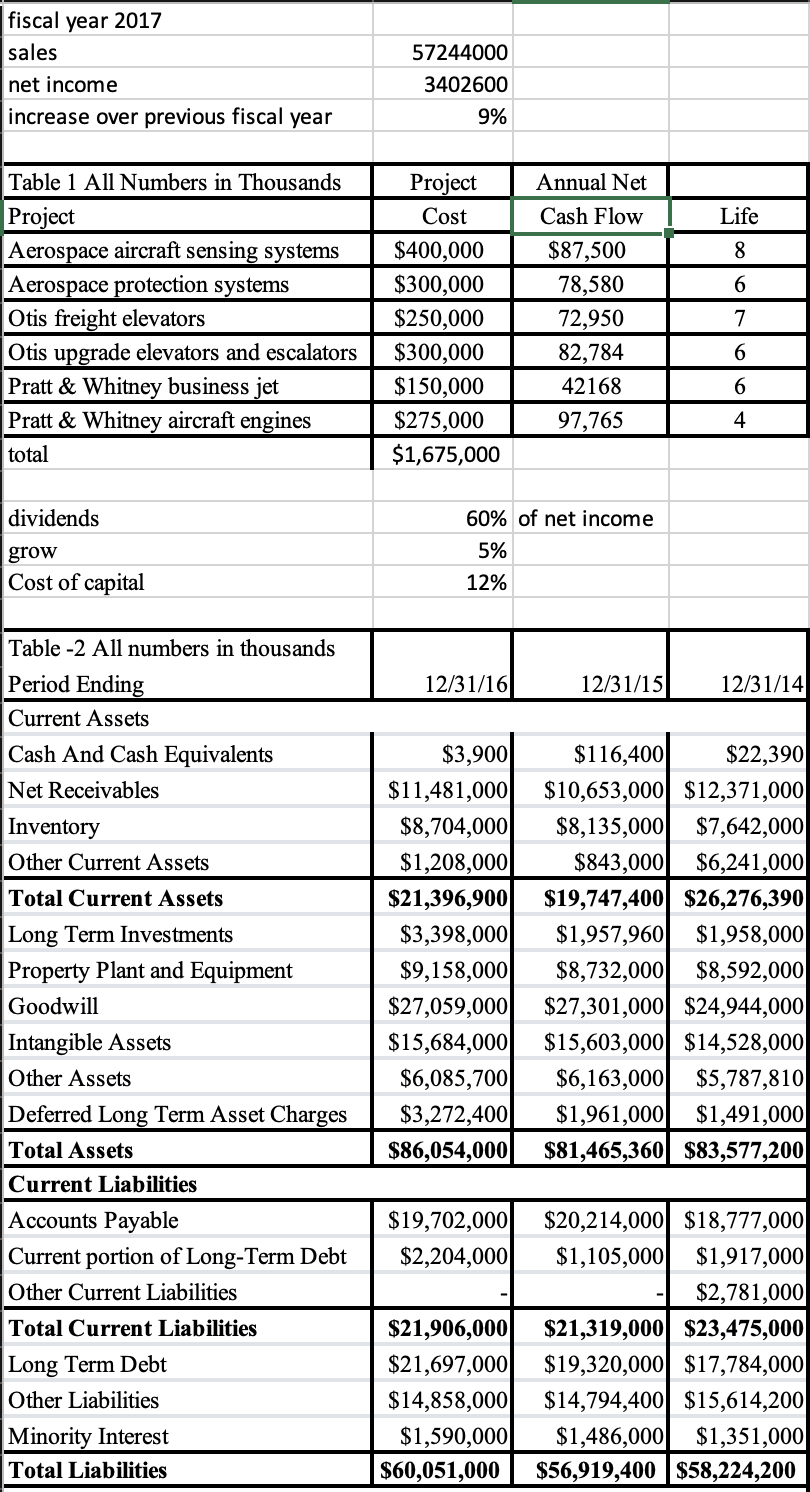

Calculate the internal rate of return (IRR) of each project and compare them against the book value and market value weighted average cost of capital.

Calculate the internal rate of return (IRR) of each project and compare them against the book value and market value weighted average cost of capital.

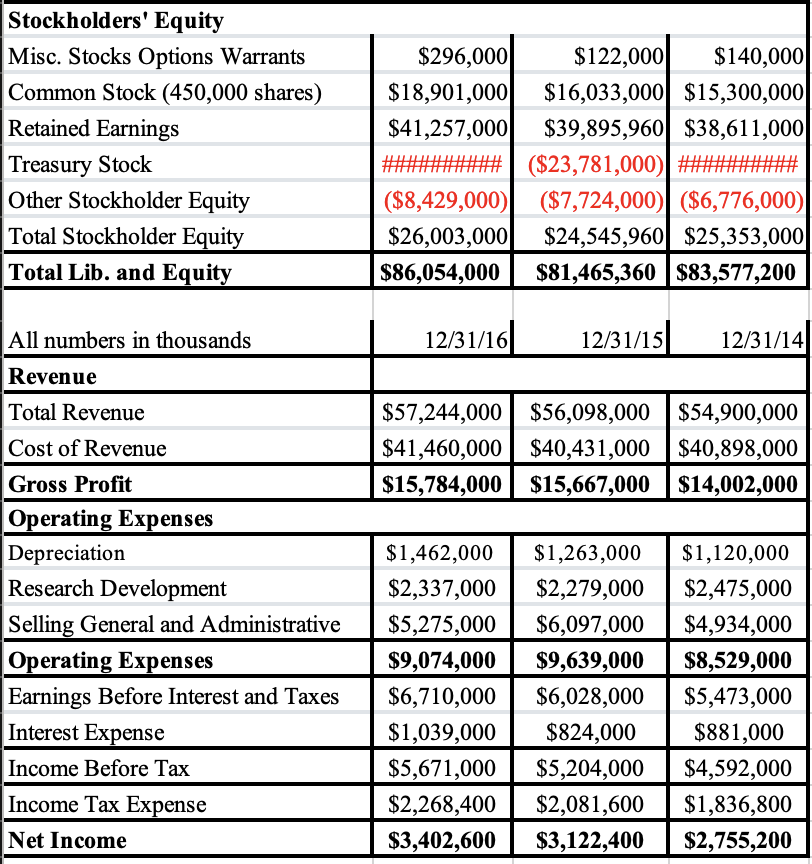

Stockholders' Equity \begin{tabular}{l|r|r|r|} \hline Misc. Stocks Options Warrants & $296,000 & $122,000 & $140,000 \\ \hline Common Stock (450,000 shares) & $18,901,000 & $16,033,000 & $15,300,000 \\ Retained Earnings & $41,257,000 & $39,895,960 & $38,611,000 \\ \hline Treasury Stock & ######### & ($23,781,000) & ######### \\ \hline Other Stockholder Equity & ($8,429,000) & ($7,724,000) & ($6,776,000) \\ \hline Total Stockholder Equity & $26,003,000 & $24,545,960 & $25,353,000 \\ \hline Total Lib. and Equity & $86,054,000 & $81,465,360 & $83,577,200 \\ \hline \end{tabular} Stockholders' Equity \begin{tabular}{l|r|r|r|} \hline Misc. Stocks Options Warrants & $296,000 & $122,000 & $140,000 \\ \hline Common Stock (450,000 shares) & $18,901,000 & $16,033,000 & $15,300,000 \\ Retained Earnings & $41,257,000 & $39,895,960 & $38,611,000 \\ \hline Treasury Stock & ######### & ($23,781,000) & ######### \\ \hline Other Stockholder Equity & ($8,429,000) & ($7,724,000) & ($6,776,000) \\ \hline Total Stockholder Equity & $26,003,000 & $24,545,960 & $25,353,000 \\ \hline Total Lib. and Equity & $86,054,000 & $81,465,360 & $83,577,200 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started