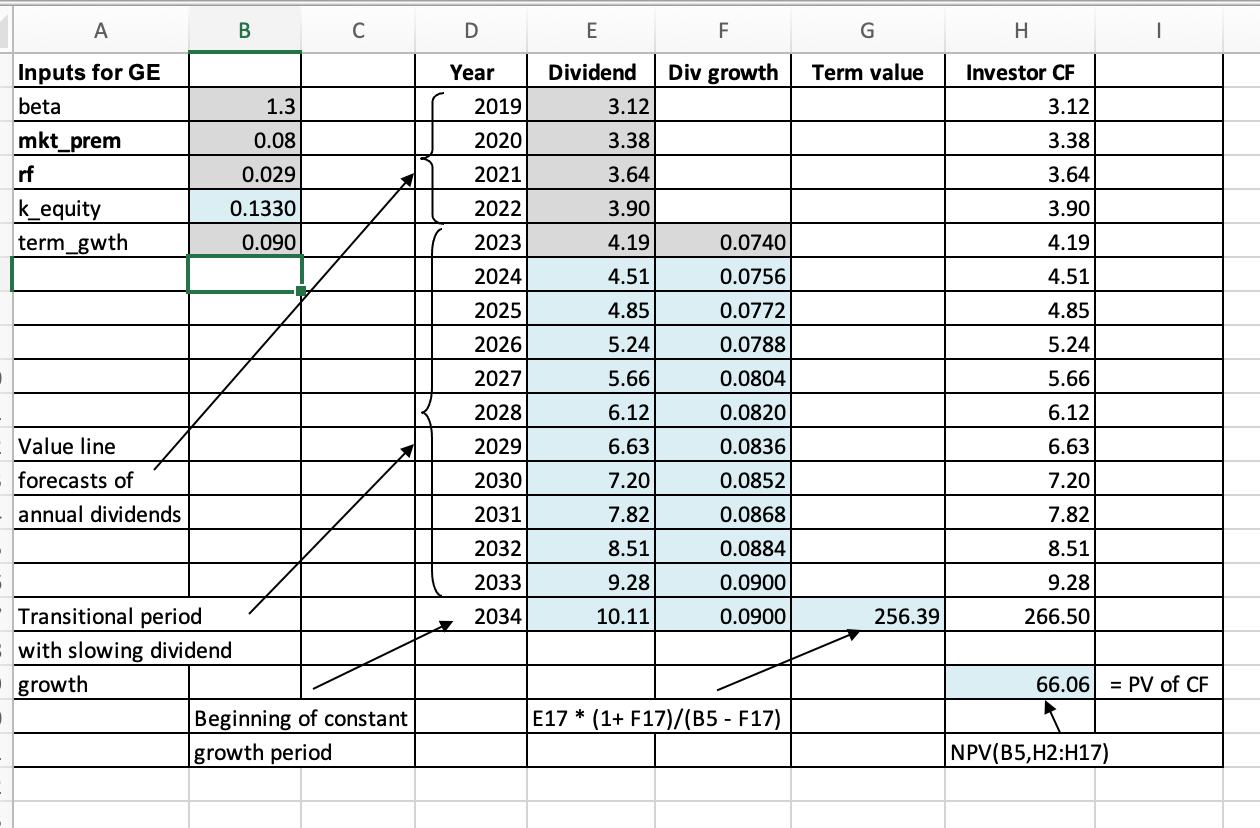

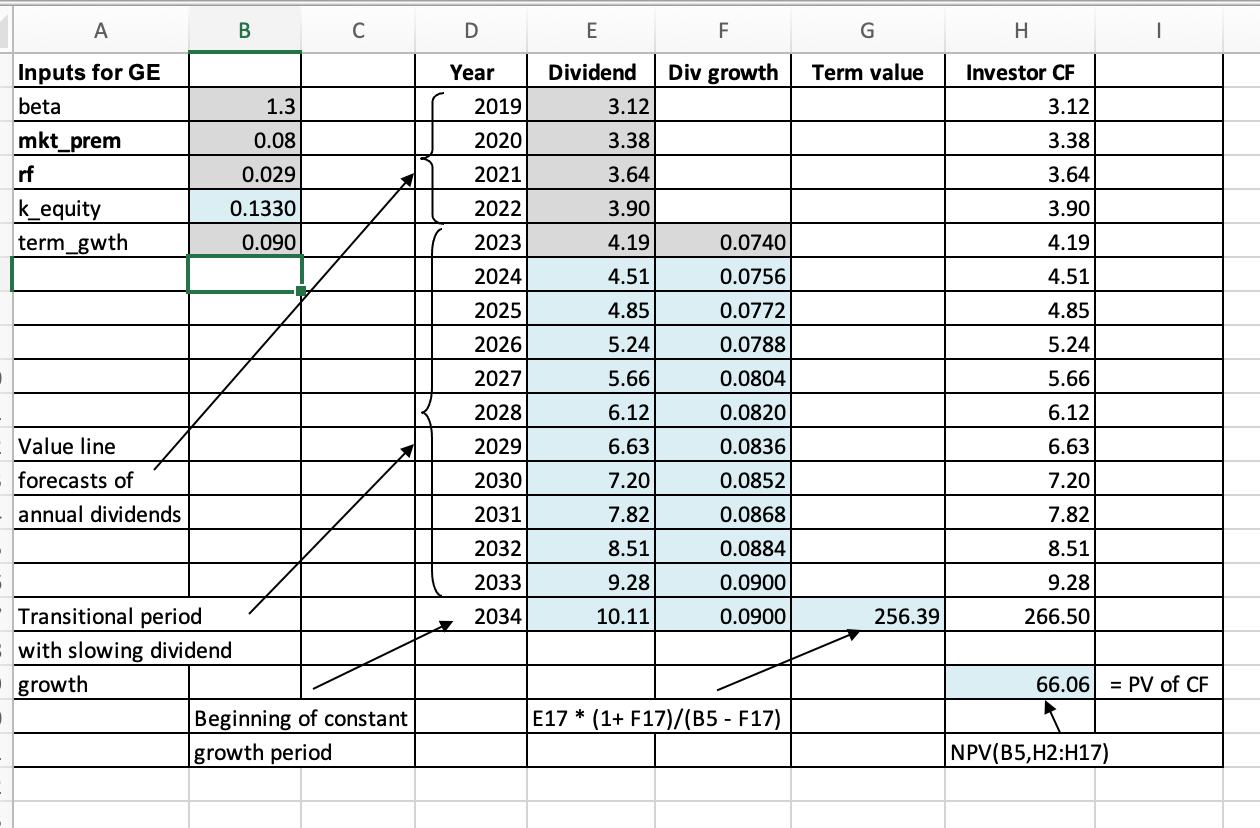

Calculate the intrinsic value of Rio Tinto in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1. Treat each scenario independently. a. The terminal growth rate will be 8.00%. (Round your answer to 2 decimal places.) Intrinsic value b. Rio Tinto's actual beta is 1.01. (Round your answer to 2 decimal places.) Intrinsic value c. The market risk premium is 9.10%. (Round your answer to 2 decimal places.) Intrinsic value A B D E F TI G H Year Dividend Div growth Term value Investor CF Inputs for GE beta 1.3 2019 3.12 3.12 0.08 2020 3.38 3.38 2021 3.64 3.64 mkt_prem rf k_equity term_gwth 0.029 0.1330 2022 3.90 4.19 0.090 2023 0.0740 3.90 4.19 4.51 4.51 0.0756 2024 2025 4.85 4.85 5.24 0.0772 0.0788 2026 5.24 2027 5.66 0.0804 5.66 2028 6.12 6.12 0.0820 0.0836 2029 6.63 6.63 Value line forecasts of annual dividends 2030 7.20 0.0852 7.20 7.82 2031 7.82 0.0868 8.51 2032 2033 8.51 9.28 0.0884 0.0900 9.28 2034 10.11 0.0900 256.39 266.50 Transitional period with slowing dividend growth Beginning of constant growth period 66.06 = PV of CF E17 * (1+ F17)/(B5 - F17) NPV(B5,H2:H17) Calculate the intrinsic value of Rio Tinto in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1. Treat each scenario independently. a. The terminal growth rate will be 8.00%. (Round your answer to 2 decimal places.) Intrinsic value b. Rio Tinto's actual beta is 1.01. (Round your answer to 2 decimal places.) Intrinsic value c. The market risk premium is 9.10%. (Round your answer to 2 decimal places.) Intrinsic value A B D E F TI G H Year Dividend Div growth Term value Investor CF Inputs for GE beta 1.3 2019 3.12 3.12 0.08 2020 3.38 3.38 2021 3.64 3.64 mkt_prem rf k_equity term_gwth 0.029 0.1330 2022 3.90 4.19 0.090 2023 0.0740 3.90 4.19 4.51 4.51 0.0756 2024 2025 4.85 4.85 5.24 0.0772 0.0788 2026 5.24 2027 5.66 0.0804 5.66 2028 6.12 6.12 0.0820 0.0836 2029 6.63 6.63 Value line forecasts of annual dividends 2030 7.20 0.0852 7.20 7.82 2031 7.82 0.0868 8.51 2032 2033 8.51 9.28 0.0884 0.0900 9.28 2034 10.11 0.0900 256.39 266.50 Transitional period with slowing dividend growth Beginning of constant growth period 66.06 = PV of CF E17 * (1+ F17)/(B5 - F17) NPV(B5,H2:H17)