Answered step by step

Verified Expert Solution

Question

1 Approved Answer

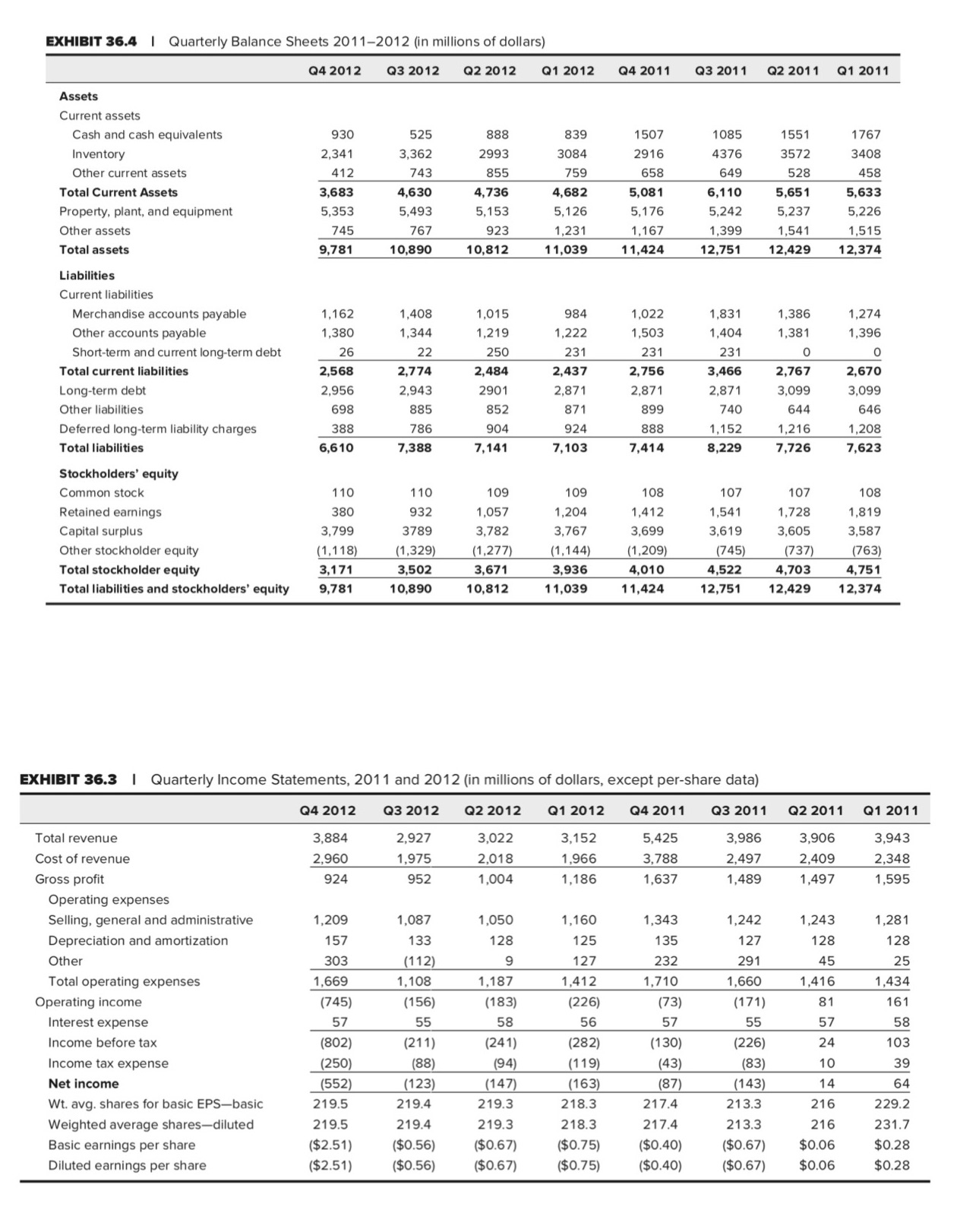

Calculate the inventory turnover, pay sales outstanding, days payable outstanding, days payable merchandise outstanding for each quarter. Explain how these ratios can answer question 2.2.How

Calculate the inventory turnover, pay sales outstanding, days payable outstanding, days payable merchandise outstanding for each quarter. Explain how these ratios can answer question 2.2.How has J.C. Penney managed its working capital accounts over the past eight quarters? Is there an opportunity to squeeze more cash from any of these accounts?

EXHIBIT 36.41 Quarterly Balance Sheets 2011-2012 (in millions of dollars) Q4 2012 Q3 2012 Q2 2012 Q1 2012 Q4 2011 Q3 2011 Q2 2011 Q1 2011 Assets Current assets Cash and cash equivalents 930 525 888 839 1507 1085 1551 1767 Inventory 2,341 3,362 2993 3084 2916 4376 3572 3408 Other current assets 412 743 855 759 658 649 528 458 Total Current Assets 3,683 4,630 4,736 4,682 5,081 6,110 5,651 5,633 Property, plant, and equipment 5,353 5,493 5,153 5,126 5,176 5,242 5,237 5,226 Other assets 745 767 923 1,231 1,167 1,399 1,541 1,515 Total assets 9,781 10,890 10,812 11,039 11,424 12,751 12,429 12,374 Liabilities Current liabilities Merchandise accounts payable 1,162 1,408 1,015 984 1,022 1,831 1,386 1,274 Other accounts payable 1,380 1,344 1,219 1,222 1,503 1,404 1,381 1,396 Short-term and current long-term debt 26 22 250 231 231 231 0 0 Total current liabilities 2,568 2,774 2,484 2,437 2,756 3,466 2,767 2,670 Long-term debt 2,956 2,943 2901 2,871 2,871 2,871 3,099 3,099 Other liabilities 698 885 852 871 899 740 644 646 Deferred long-term liability charges 388 786 904 924 888 1,152 1,216 1,208 Total liabilities 6,610 7,388 7,141 7,103 7,414 8,229 7,726 7,623 Stockholders' equity Common stock 110 110 109 109 108 107 107 108 Retained earnings Capital surplus 380 932 1,057 1,204 1,412 1,541 1,728 1,819 3,799 3789 3,782 3,767 3,699 3,619 3,605 3,587 Other stockholder equity (1,118) (1,329) (1,277) (1,144) (1,209) (745) (737) (763) Total stockholder equity 3,171 3,502 3,671 3,936 4,010 4,522 4,703 4,751 Total liabilities and stockholders' equity 9,781 10,890 10,812 11,039 11,424 12,751 12,429 12,374 EXHIBIT 36.3 | Quarterly Income Statements, 2011 and 2012 (in millions of dollars, except per-share data) Q4 2012 Q3 2012 Q2 2012 Q1 2012 Q4 2011 Q3 2011 Q2 2011 Q1 2011 Total revenue 3,884 2,927 3,022 3,152 5,425 3,986 3,906 3,943 Cost of revenue 2,960 1,975 2,018 1,966 3,788 2,497 2,409 2,348 Gross profit 924 952 1,004 1,186 1,637 1,489 1,497 1,595 Operating expenses Selling, general and administrative 1,209 1,087 1,050 1,160 1,343 1,242 1,243 1,281 Depreciation and amortization 157 133 128 125 135 127 128 128 Other 303 (112) 9 127 232 291 45 25 Total operating expenses 1,669 1,108 1,187 1,412 1,710 1,660 1,416 1,434 Operating income Interest expense (745) (156) (183) (226) (73) (171) 81 161 57 55 58 56 57 55 57 58 Income before tax (802) (211) (241) (282) (130) (226) 24 103 Income tax expense (250) (88) (94) (119) (43) (83) 10 39 Net income (552) (123) (147) (163) (87) (143) 14 64 Wt. avg. shares for basic EPS-basic 219.5 219.4 219.3 218.3 217.4 213.3 216 229.2 Weighted average shares-diluted 219.5 219.4 219.3 218.3 217.4 213.3 216 231.7 Basic earnings per share ($2.51) ($0.56) ($0.67) ($0.75) ($0.40) ($0.67) $0.06 $0.28 Diluted earnings per share ($2.51) ($0.56) ($0.67) ($0.75) ($0.40) ($0.67) $0.06 $0.28

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started