- Calculate the IRR of this project utilizing a 12% discount rate and a 15% cap rate. Ms. Brown was able to secure a loan for $1,540,000 and an equity investor agreed to invest the remaining $660,000 in exchange for 20% ownership in the project

- What is the loan-to-value ratio for this project?

- What would the investors ROI be for this project if the restaurant achieved its budgeted operating results for the year?

- If the investor has a hurdle rate of 15%, does this project meet or exceed the investors requirements?

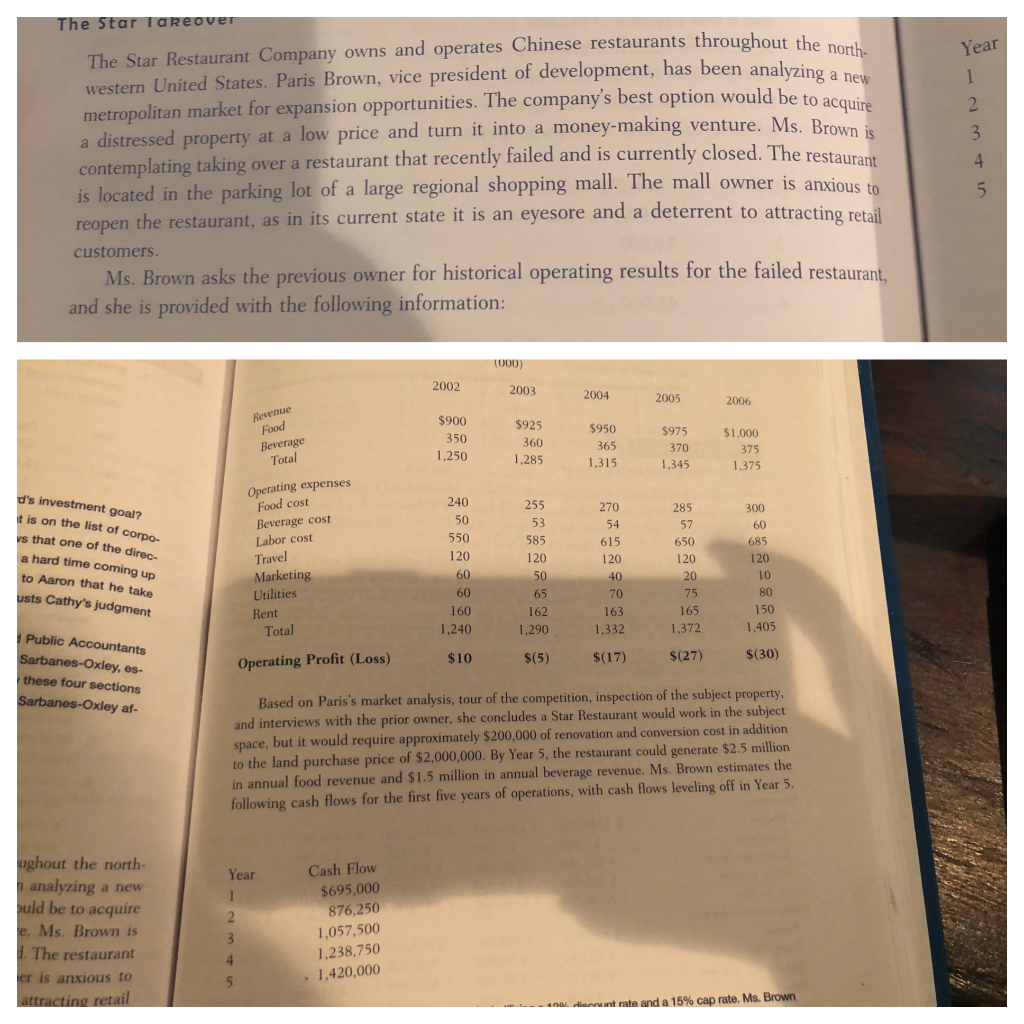

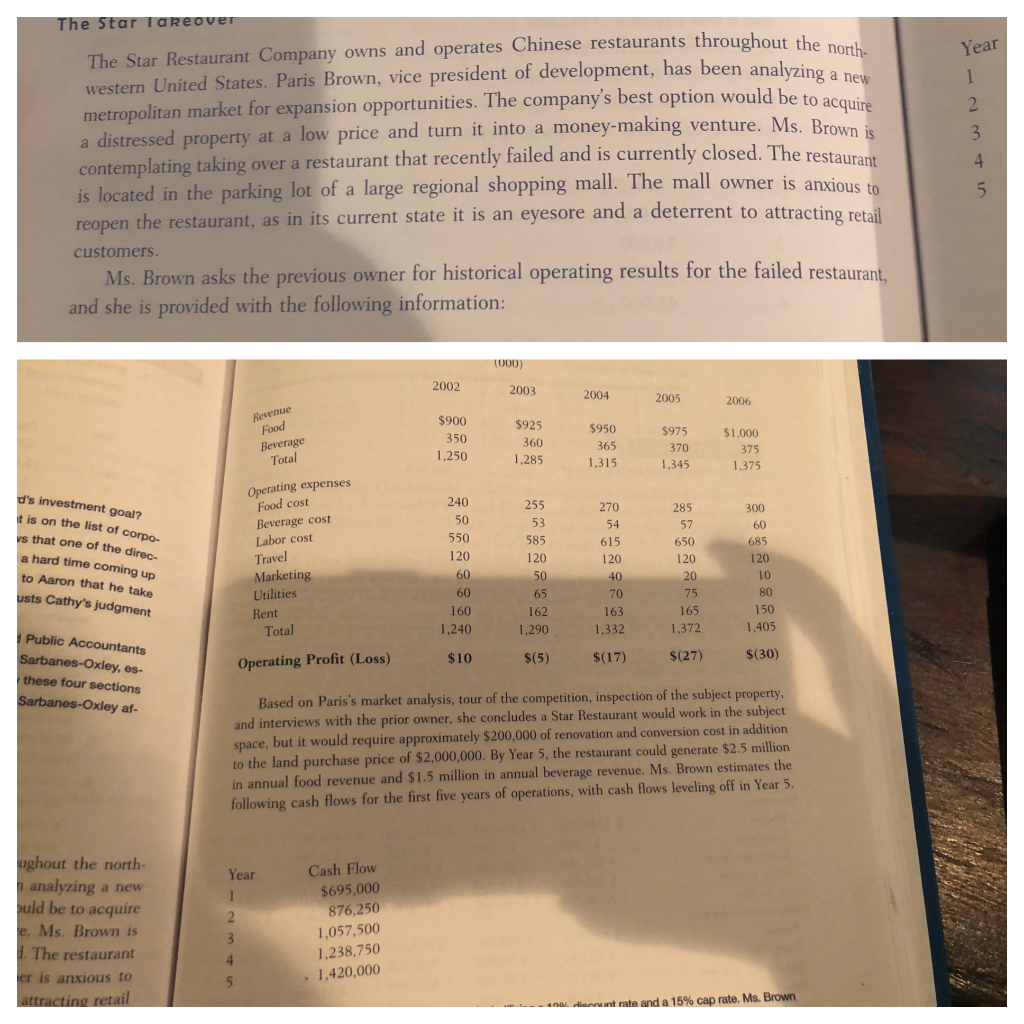

The Star Takeover Year The Star Restaurant Company owns and operates Chinese restaurants throughout the north. western United States. Paris Brown, vice president of development, has been analyzing a new metropolitan market for expansion opportunities. The company's best option would be to acquire a distressed property at a low price and turn it into a money-making venture. Ms. Brown is contemplating taking over a restaurant that recently failed and is currently closed. The restaurant is located in the parking lot of a large regional shopping mall. The mall owner is anxious to the restaurant, as in its current state it is an eyesore and a deterrent to attracting retail 2 3 4 5 reopen customers. Ms. Brown asks the previous owner for historical operating results for the failed restaurant, and she is provided with the following information: (000) 2002 2003 2004 2005 2006 Revenue Food Beverage Total $900 350 1,250 $925 360 1,285 $950 365 1,315 $975 370 1,345 $1,000 375 1,375 d's investment goal? t is on the list of corpo- vs that one of the direc- a hard time coming up to Aaron that he take usts Cathy's judgment Operating expenses Food cost Beverage cost Labor cost Travel Marketing Utilities Rent Total 240 50 550 120 60 60 160 1,240 255 53 585 120 50 65 162 1,290 270 54 615 120 40 70 163 1,332 285 57 650 120 20 75 165 1,372 300 60 685 120 10 80 150 1,405 $10 $(5) Operating Profit (Loss) $(17) $(27) $(30) Public Accountants Sarbanes-Oxley, es- these four sections Sarbanes-Oxley af- Based on Paris's market analysis, tour of the competition, inspection of the subject property, and interviews with the prior owner, she concludes a Star Restaurant would work in the subject space, but it would require approximately $200,000 of renovation and conversion cost in addition to the land purchase price of $2,000,000. By Year 5, the restaurant could generate $2.5 million in annual food revenue and $1.5 million in annual beverage revenue. Ms. Brown estimates the following cash flows for the first five years of operations, with cash flows leveling off in Year 5. Year ughout the north- analyzing a new puld be to acquire e. Ms. Brown is The restaurant er is anxious to attracting retail Cash Flow $695,000 876,250 1,057,500 1,238,750 1,420,000 3 4 5 4 dienunt rate and a 15% cap rate. Ms. Brown The Star Takeover Year The Star Restaurant Company owns and operates Chinese restaurants throughout the north. western United States. Paris Brown, vice president of development, has been analyzing a new metropolitan market for expansion opportunities. The company's best option would be to acquire a distressed property at a low price and turn it into a money-making venture. Ms. Brown is contemplating taking over a restaurant that recently failed and is currently closed. The restaurant is located in the parking lot of a large regional shopping mall. The mall owner is anxious to the restaurant, as in its current state it is an eyesore and a deterrent to attracting retail 2 3 4 5 reopen customers. Ms. Brown asks the previous owner for historical operating results for the failed restaurant, and she is provided with the following information: (000) 2002 2003 2004 2005 2006 Revenue Food Beverage Total $900 350 1,250 $925 360 1,285 $950 365 1,315 $975 370 1,345 $1,000 375 1,375 d's investment goal? t is on the list of corpo- vs that one of the direc- a hard time coming up to Aaron that he take usts Cathy's judgment Operating expenses Food cost Beverage cost Labor cost Travel Marketing Utilities Rent Total 240 50 550 120 60 60 160 1,240 255 53 585 120 50 65 162 1,290 270 54 615 120 40 70 163 1,332 285 57 650 120 20 75 165 1,372 300 60 685 120 10 80 150 1,405 $10 $(5) Operating Profit (Loss) $(17) $(27) $(30) Public Accountants Sarbanes-Oxley, es- these four sections Sarbanes-Oxley af- Based on Paris's market analysis, tour of the competition, inspection of the subject property, and interviews with the prior owner, she concludes a Star Restaurant would work in the subject space, but it would require approximately $200,000 of renovation and conversion cost in addition to the land purchase price of $2,000,000. By Year 5, the restaurant could generate $2.5 million in annual food revenue and $1.5 million in annual beverage revenue. Ms. Brown estimates the following cash flows for the first five years of operations, with cash flows leveling off in Year 5. Year ughout the north- analyzing a new puld be to acquire e. Ms. Brown is The restaurant er is anxious to attracting retail Cash Flow $695,000 876,250 1,057,500 1,238,750 1,420,000 3 4 5 4 dienunt rate and a 15% cap rate. Ms. Brown