Calculate the liquidity ratios for all years. Explain your findings.

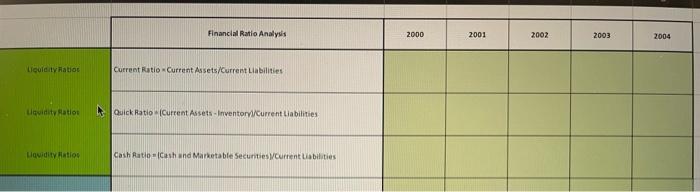

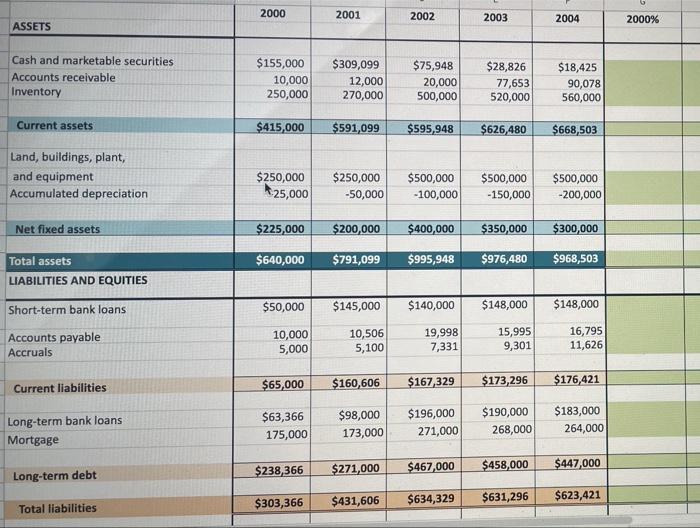

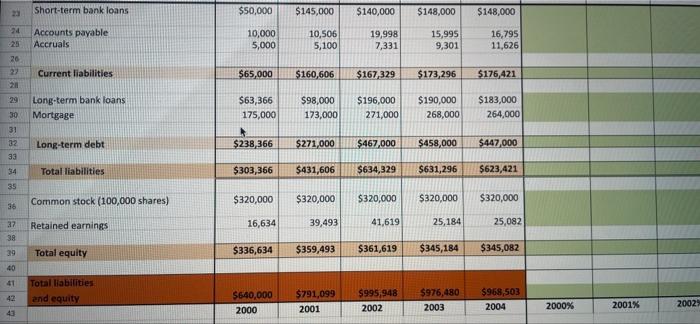

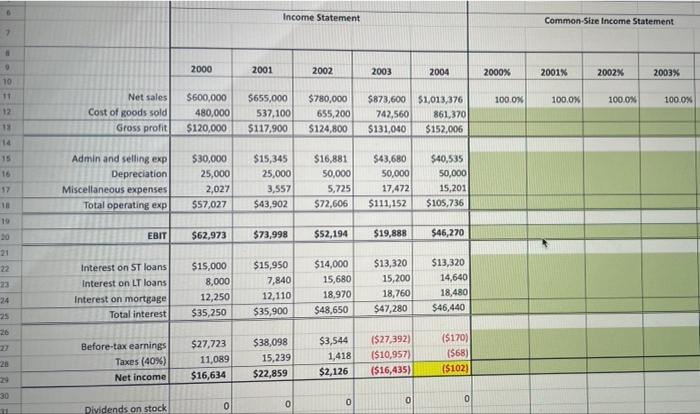

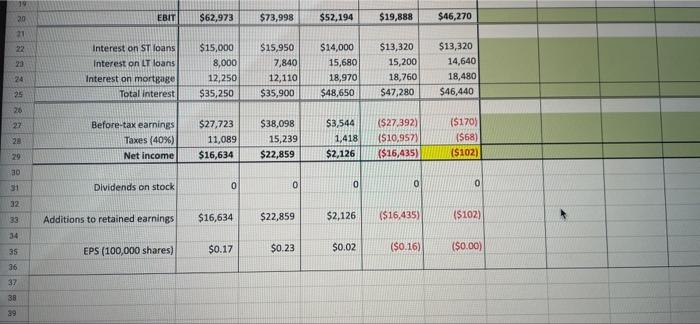

Liquidity Ratios Liquidity Ratios Liquidity Ratios Financial Ratio Analysis Current Ratio Current Assets/Current Liabilities Quick Ratio (Current Assets-Inventoryl/Current Liabilities Cash Ratio (Cash and Marketable Securities/Current Liabilities. 2000 2001 2002 2003 2004 ASSETS Cash and marketable securities Accounts receivable Inventory Current assets Land, buildings, plant, and equipment Accumulated depreciation Net fixed assets Total assets LIABILITIES AND EQUITIES Short-term bank loans. Accounts payable Accruals Current liabilities Long-term bank loans Mortgage Long-term debt Total liabilities 2000 2001 2004 $155,000 $309,099 $75,948 $18,425 10,000 12,000 20,000 77,653 90,078 250,000 270,000 500,000 520,000 560,000 $415,000 $591,099 $595,948 $626,480 $668,503 $250,000 $250,000 $500,000 $500,000 $500,000 25,000 -50,000 -100,000 -150,000 -200,000 $200,000 $400,000 $350,000 $300,000 $791,099 $995,948 $976,480 $968,503 $145,000 $140,000 $148,000 $148,000 10,506 19,998 15,995 16,795 5,100 7,331 9,301 11,626 $65,000 $160,606 $167,329 $173,296 $176,421 $63,366 $98,000 $196,000 $190,000 $183,000 173,000 175,000 271,000 268,000 264,000 $238,366 $271,000 $467,000 $458,000 $447,000 $303,366 $431,606 $634,329 $631,296 $623,421 $225,000 $640,000 $50,000 10,000 5,000 2002 2003 $28,826 2000% 23 Short-term bank loans 24 Accounts payable Accruals 26 Current liabilities Long-term bank loans Mortgage Long-term debt Total liabilities Common stock (100,000 shares) Retained earnings Total equity Total liabilities and equity ARSA #A#29599 33 36 $50,000 $145,000 $140,000 $148,000 $148,000 10,000 10,506 19,998 15,995 16,795 5,000 5,100 7,331 9,301 11,626 $65,000 $160,606 $167,329 $173,296 $176,421 $63,366 $98,000 $196,000 $190,000 $183,000 175,000 173,000 271,000 268,000 264,000 $238,366 $271,000 $467,000 $458,000 $447,000 $303,366 $431,606 $634,329 $631,296 $623,421 $320,000 $320,000 $320,000 $320,000 $320,000 16,634 39,493 41,619 25,184 25,082 $336,634 $359,493 $361,619 $345,184 $345,082 $640,000 $791,099 $968,503 $995,948 2002 $976,480 2003 2000 2001 2004 2000% 2001% 2002 7 I 9 10 11 12 18 14 15 16 17 18 19 21 24 25 26 27 28 30 31 Net sales Cost of goods sold Gross profit Admin and selling exp Depreciation Miscellaneous expenses Total operating exp EBIT Interest on ST loans Interest on LT loans Interest on mortgage Total interest Before-tax earnings Taxes (40%) Net income Dividends on stock Income Statement 2000 2001 2002 2003 2004 $655,000 $780,000 $873,600 $1,013,376 $600,000 480,000 537,100 655,200 742,560 861,370 $120,000 $117.900 $124,800 $131,040 $152,006 $30,000 $15,345 $16,881 $43,680 $40,535 25,000 25,000 50,000 50,000 2,027 3,557 5,725 17,472 $72,606 $111,152 $19,888 $13,320 $57,027 $62,973 $15,000 8,000 12,250 $35,250 $27,723 11,089 $16,634 0 $43,902 $73,998 $52,194 $15,950 $14,000 7,840 12,110 $35,900 $38,098 15,239 $22,859 0 15,680 18,970 $48,650 $3,544 1,418 $2,126 0 15,200 18,760 $47,280 ($27,392) ($10,957) ($16,435) 0 50,000 15,201 $105,736 $46,270 $13,320 14,640 18,480 $46,440 ($170) ($68) ($102) 0 2000% 100.0% Common-Size Income Statement 2001% 2002% 2003% 100.0% 100.0% 100.0% ZARNAZA 19 20 21 22 23 26 27 28 29 30 31 32 33 34 35 36 37 38 39 EBIT Interest on ST loans Interest on LT loans Interest on mortgage Total interest Before-tax earnings Taxes (40%) Net income Dividends on stock Additions to retained earnings EPS (100,000 shares) $62,973 $15,000 8,000 12,250 $35,250 $27,723 11,089 $16,634 $16,634 $0.17 0 $52,194 $14,000 7,840 15,680 12,110 18,970 $35,900 $48,650 $38,098 $3,544 15,239 $22,859 0 $22,859 $0.23 $73,998 $15,950 1,418 $2,126 0 $2,126 $0.02 $19,888 $13,320 15,200 18,760 $47,280 ($27,392) ($10,957) ($16,435) 0 ($16,435) ($0.16) $46,270 $13,320 14,640 18,480 $46,440 ($170) ($68) ($102) 0 ($102) ($0.00)