Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the maximum itemized deductions the married taxpayers (both under 65) can deduct in 2020 -AGI is $100,000 -Medical expenses $14,000 -State withholding tax $9,000

Calculate the maximum itemized deductions the married taxpayers (both under 65) can deduct in 2020

-AGI is $100,000

-Medical expenses $14,000

-State withholding tax $9,000

-Real estate tax $6,700

-Qualified mortgage interest $12,500

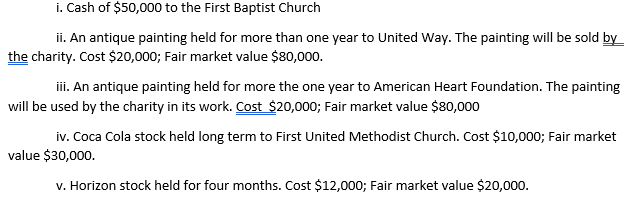

-Charitable contributions to qualified charities:

i. Cash of $50,000 to the First Baptist Church ii. An antique painting held for more than one year to United Way. The painting will be sold by the charity. Cost $20,000; Fair market value $80,000. iii. An antique painting held for more the one year to American Heart Foundation. The painting will be used by the charity in its work. Cost $20,000; Fair market value $80,000 iv. Coca Cola stock held long term to First United Methodist Church. Cost $10,000; Fair market value $30,000. v. Horizon stock held for four months. Cost $12,000; Fair market value $20,000.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

itizen hs hie t either gurntee stndrd derivtin r intemized llwne frm GIdjusted net slry t rrive t vi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started