Answered step by step

Verified Expert Solution

Question

1 Approved Answer

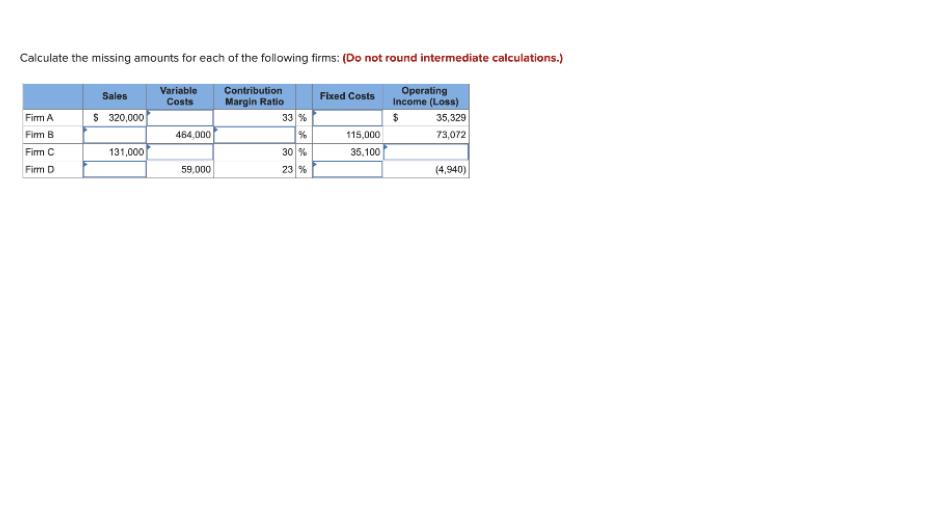

Calculate the missing amounts for each of the following firms: (Do not round intermediate calculations.) Variable Costs Contribution Operating Income (Loss) Sales Fixed Costs

Calculate the missing amounts for each of the following firms: (Do not round intermediate calculations.) Variable Costs Contribution Operating Income (Loss) Sales Fixed Costs Margin Ratio S 320,000 Firm A 33 % 35,329 73,072 Fim B 464,000 115,000 Firm C 131,000 30 % 35, 100 Firm D 59,000 23 % (4,940)

Step by Step Solution

★★★★★

3.26 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Firm A Total contribution margin Sales Contribution margin ratio 320000 31 99200 Sales Variable costs Contribution margin Variable costs Sales Contribution margin 320000 99200 220800 Variable costs Contribution margin Fixed cost Operating income or loss 99200 Fixed cost 38865 Fixed cost 99200 38865 Fixed cost 60335 Firm B Contribution margin Fixed cost Operating income or loss Contribution margin Fixed cost Operating income or loss 117000 74544 191544 Contribution margin Sales Variable costs Contribution margin Sales Variable costs Contribution margin 464000 191544 Sales 655544 Total contribution margin Sales Contribution margin ratio Contribution margin ratio Total contribution margin 100 Sales 191544 100 655544 Contribution margin ratio 29 Firm C Total contribution margin Sales Contribution margin ratio 131000 30 Total contribution margin 39300 Sales Variable costs Contribution margin Variable costs Sales Contribution margin 131000 39300 Variable costs 91700 Contribution margin Fixed cost Operating income or loss 39300 35800 Operating income or loss Operating income 3500 Firm D Sales Variable costs Contribution margin 100 Variable costs 25 Variable costs 75 Sales Variable cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started