Question

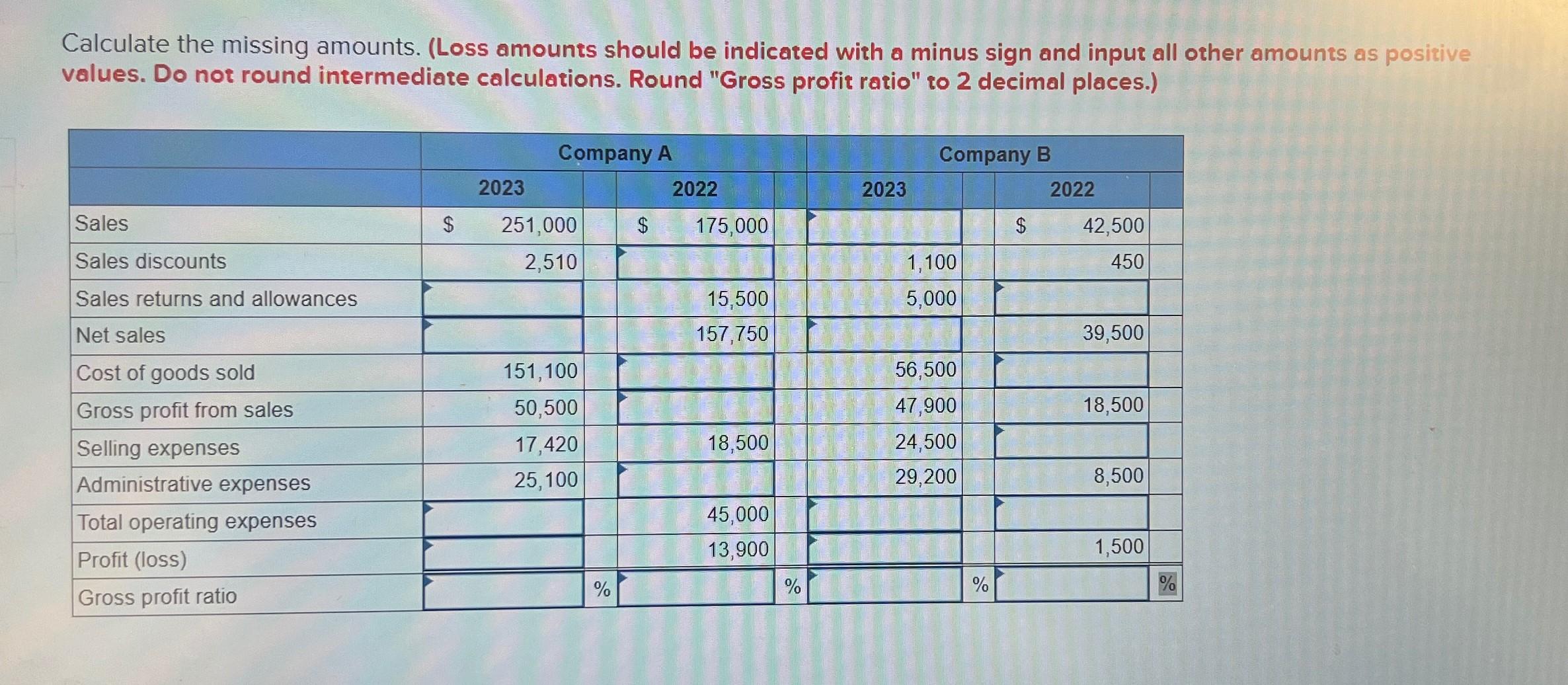

Calculate the missing amounts. (Loss amounts should be indicated with a minus sign and input all other amounts as positive values. Do not round

Calculate the missing amounts. (Loss amounts should be indicated with a minus sign and input all other amounts as positive values. Do not round intermediate calculations. Round "Gross profit ratio" to 2 decimal places.) Company A Company B 2023 2022 2023 2022 Sales $ 251,000 $ 175,000 $ 42,500 Sales discounts Sales returns and allowances 2,510 1,100 450 15,500 5,000 Net sales Cost of goods sold 157,750 39,500 151,100 56,500 Gross profit from sales 50,500 47,900 18,500 Selling expenses 17,420 18,500 24,500 Administrative expenses 25,100 29,200 8,500 Total operating expenses 45,000 Profit (loss) 13,900 1,500 Gross profit ratio % % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App