Question

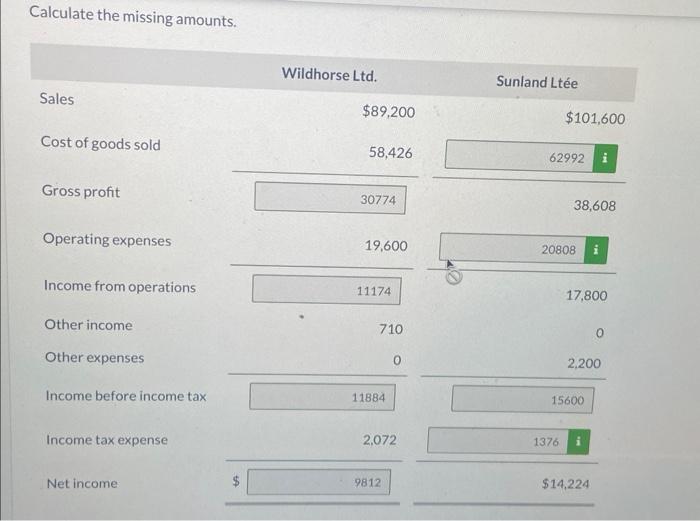

Calculate the missing amounts. Sales Cost of goods sold Gross profit Operating expenses Income from operations Other income Other expenses Income before income tax

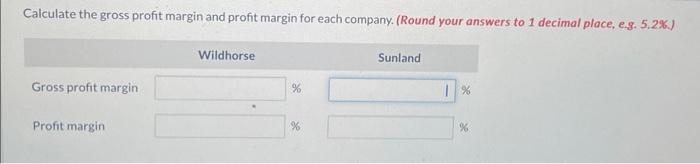

Calculate the missing amounts. Sales Cost of goods sold Gross profit Operating expenses Income from operations Other income Other expenses Income before income tax Income tax expense Net income tA Wildhorse Ltd. $89,200 58,426 30774 19,600 11174 710 11884 0 2,072 9812 Sunland Lte $101,600 62992 38,608 20808 1376 17,800 2,200 15600 $14,224 Calculate the gross profit margin and profit margin for each company. (Round your answers to 1 decimal place, e.g. 5.2%.) Gross profit margin Profit margin Wildhorse % se Sunland 1% %

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

financial numbers for Wildhorse Ltd and Sunland Lte and asked to calculate the missing amounts and t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for Business Decision Making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine

7th Canadian edition

1119368456, 978-1119211587, 1119211581, 978-1119320623, 978-1119368458

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App