Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the monthly returns for each of the stocks: a. Calculate the arithmetic average monthly return for each stock. (3 points) b. Calculate the geometric

Calculate the monthly returns for each of the stocks:

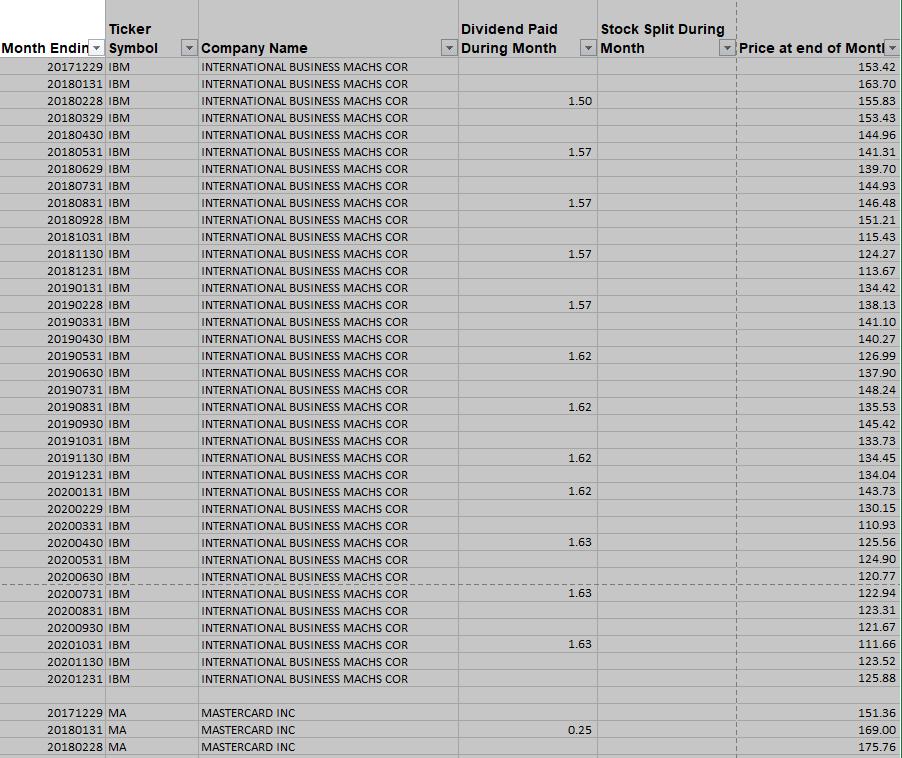

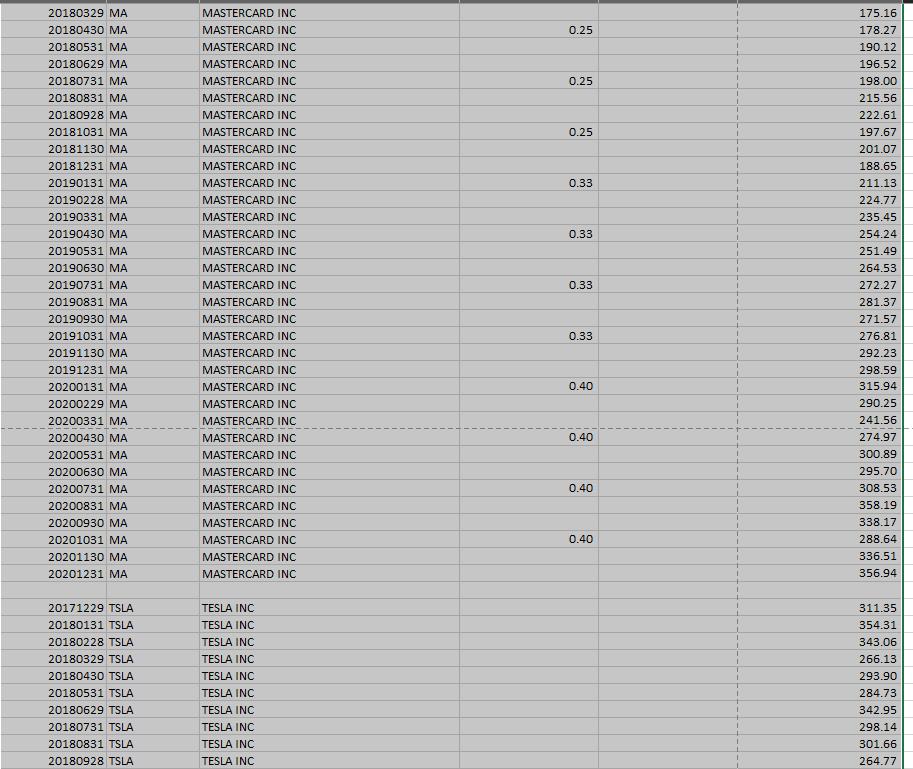

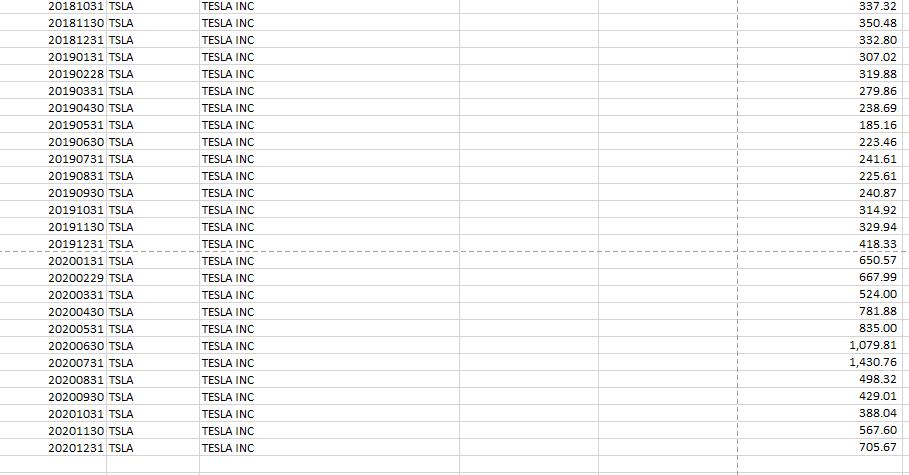

Ticker Month Endin Symbol 20171229 IBM 20180131 IBM 20180228 IBM 20180329 IBM 20180430 IBM 20180531 IBM 20180629 IBM 20180731 IBM 20180831 IBM 20180928 IBM 20181031 IBM 20181130 IBM 20181231 IBM 20190131 IBM 20190228 IBM 20190331 IBM 20190430 IBM 20190531 IBM 20190630 IBM 20190731 IBM 20190831 IBM 20190930 IBM 20191031 IBM 20191130 IBM 20191231 IBM 20200131 IBM 20200229 IBM 20200331 IBM 20200430 IBM 20200531 IBM 20200630 IBM 20200731 IBM 20200831 IBM 20200930 IBM 20201031 IBM 20201130 IBM 20201231 IBM 20171229 MA 20180131 MA 20180228 MA Company Name INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR INTERNATIONAL BUSINESS MACHS COR MASTERCARD INC MASTERCARD INC MASTERCARD INC Dividend Paid During Month Month 1.50 1.57 1.57 1.57 1.57 1.62 1.62 1.62 1.62 1.63 1.63 1.63 Stock Split During 0.25 Price at end of Montl 153.42 163.70 155.83 153.43 144.96 141.31 139.70 144.93 146.48 151.21 115.43 124.27 113.67 134.42 138.13 141.10 140.27 126.99 137.90 148.24 135.53 145.42 133.73 134.45 134.04 143.73 130.15 110.93 125.56 124.90 120.77 122.94 123.31 121.67 111.66 123.52 125.88 1 1 151.36 169.00 175.76

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

procedure a Arithmetic Average Monthly Return Calculate the monthly return for each month For example for IBM in January 2018 the return would be Price at end of Jan 2018 Price at end of Dec 2017 Pric...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started