Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the M-squared (M) measure for the Gold fund and Silver fund. Comment on their performance relative to the market and relative to each other.

Calculate the M-squared (M²) measure for the Gold fund and Silver fund. Comment on their performance relative to the market and relative to each other.

Calculate the Jensen alpha for the Gold fund and Silver fund. Comment on their performance relative to each other.

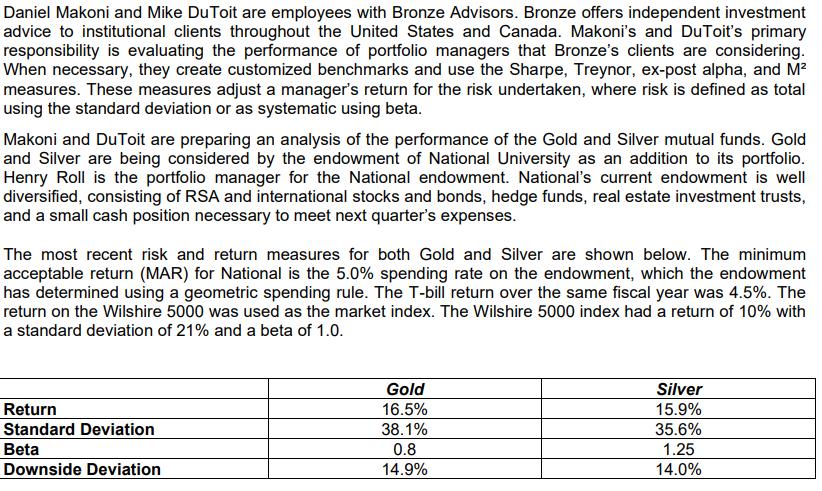

Daniel Makoni and Mike DuToit are employees with Bronze Advisors. Bronze offers independent investment advice to institutional clients throughout the United States and Canada. Makoni's and DuToit's primary responsibility is evaluating the performance of portfolio managers that Bronze's clients are considering. When necessary, they create customized benchmarks and use the Sharpe, Treynor, ex-post alpha, and M measures. These measures adjust a manager's return for the risk undertaken, where risk is defined as total using the standard deviation or as systematic using beta. Makoni and DuToit are preparing an analysis of the performance of the Gold and Silver mutual funds. Gold and Silver are being considered by the endowment of National University as an addition to its portfolio. Henry Roll is the portfolio manager for the National endowment. National's current endowment is well diversified, consisting of RSA and international stocks and bonds, hedge funds, real estate investment trusts, and a small cash position necessary to meet next quarter's expenses. The most recent risk and return measures for both Gold and Silver are shown below. The minimum acceptable return (MAR) for National is the 5.0% spending rate on the endowment, which the endowment has determined using a geometric spending rule. The T-bill return over the same fiscal year was 4.5%. The return on the Wilshire 5000 was used as the market index. The Wilshire 5000 index had a return of 10% with a standard deviation of 21% and a beta of 1.0. Return Standard Deviation Beta Downside Deviation Gold 16.5% 38.1% 0.8 14.9% Silver 15.9% 35.6% 1.25 14.0%

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 M2 of Gold Fund Return of Gold Fund MAR Market Return MAR Downside Deviation M2 of Gold Fu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started