Answered step by step

Verified Expert Solution

Question

1 Approved Answer

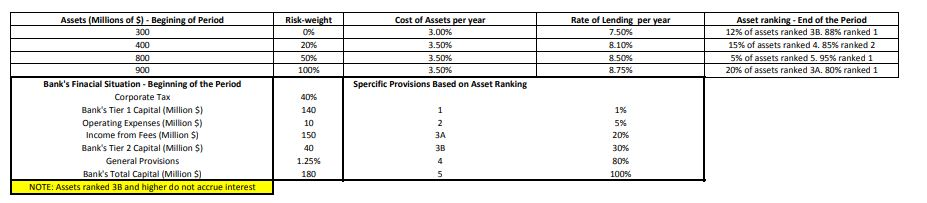

Calculate the net income of the bank after one year of operations using the accruals principle Assets (Millions of $) - Begining of Period I

Calculate the net income of the bank after one year of operations using the accruals principle

Assets (Millions of $) - Begining of Period I 300 Risk-weight 0% 20% 50% 100% Cost of Assets per year 3.00% 3.50% 3.50% 400 800 900 Rate of Lending per year 7.50% 8.109% 8-50% 8.75% Asset ranking - End of the Period 12% of assets ranked 3B. 88% ranked 1 15% of assets ranked 4, 85% ranked 2 5% of assets ranked 5.95% ranked 1 20% of assets ranked 3A. 80% ranked 1 5096 Spercific Provisions Based on Asset Ranking 40% 140 1% Bank's Finacial Situation - Beginning of the Period Corporate Tax Bank's Tier 1 Capital (Million $) Operating Expenses (Million $) Income from Fees (Million $) Bank's Tier 2 Capital (Million $) General Provisions Bank's Total Capital (Million $) NOTE: Assets ranked 3B and higher do not accrue interest 10 150 5% 20% 1.25% 30% 80% 100% 180Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started