Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the net income of the partnership and the distribution to each partner. You are required to present a complete analysis, briefly explaining the treatment

Calculate the net income of the partnership and the distribution to each partner.

Calculate the net income of the partnership and the distribution to each partner.You are required to present a complete analysis, briefly explaining the treatment of all items and/or elements in this question, including references to appropriate legislation, case law and/or tax rulings. Disregard GST.

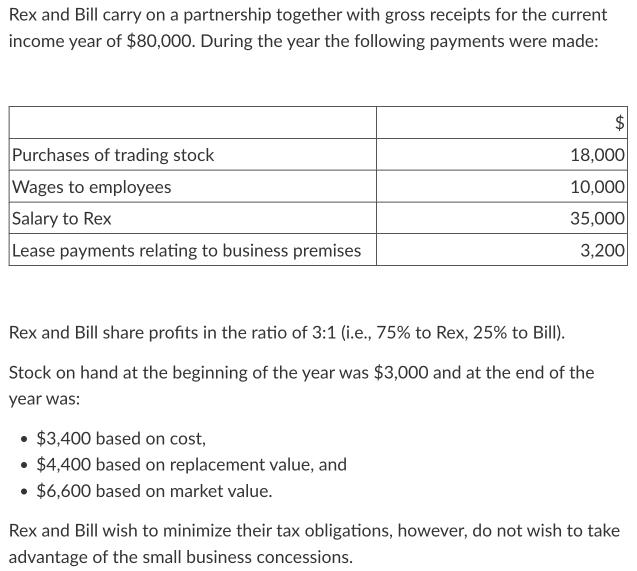

Rex and Bill carry on a partnership together with gross receipts for the current income year of $80,000. During the year the following payments were made: Purchases of trading stock Wages to employees Salary to Rex Lease payments relating to business premises $ 18,000 10,000 35,000 3,200 Rex and Bill share profits in the ratio of 3:1 (i.e., 75% to Rex, 25% to Bill). Stock on hand at the beginning of the year was $3,000 and at the end of the year was: $3,400 based on cost, $4,400 based on replacement value, and $6,600 based on market value. Rex and Bill wish to minimize their tax obligations, however, do not wish to take advantage of the small business concessions.

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net income of the partnership and the distribution to each partner we need to follo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started