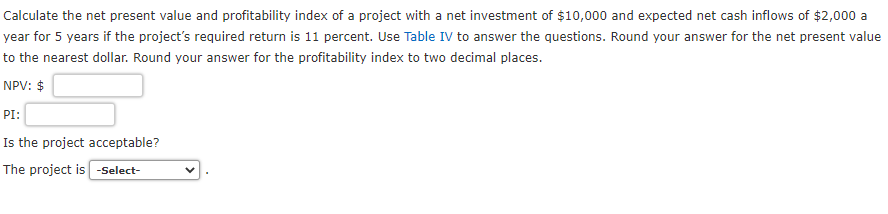

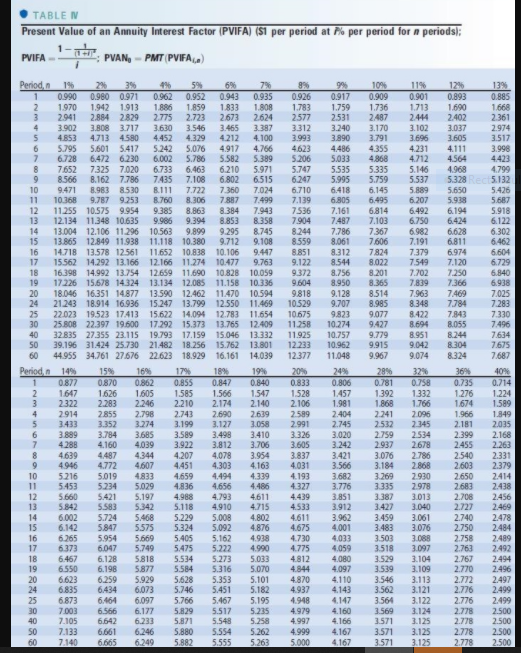

Calculate the net present value and profitability index of a project with a net investment of $10,000 and expected net cash inflows of $2,000 a year for 5 years if the project's required return is 11 percent. Use Table IV to answer the questions. Round your answer for the net present value to the nearest dollar. Round your answer for the profitability index to two decimal places. NPV: $ PI: Is the project acceptable? The project is -Select- TABLEM Present Value of an Annuity Interest Factor (PVIFA) ($1 per period at Po per period for a periods: PVIFA PVAN, - PMT PVIFA, 0.952 0.926 1.783 2.577 3312 3.993 4623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 99 0.917 1.759 2.531 3.240 3.890 4486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 786 8,061 8.312 8.544 8.756 8.950 9.128 9.707 9.823 10.274 10.757 10.962 11.048 Period, 19 4% 5% 1 0.990 0.980 0,971 0.962 0.943 0.935 2 1970 1.942 1.913 1.886 1.859 1.833 1.808 3 2.941 2.884 2829 2.775 2.723 2.673 2.624 4 3.902 3.808 3.717 3.630 3.546 3.465 3.397 5 4853 4.713 4580 4.452 4.329 4212 4.100 6 5.795 5.601 5417 5.242 5.076 4.912 4.766 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 8 7,652 7.325 7.020 6.733 6.463 6.210 5.971 9 8.566 8.1627.786 7435 7.108 6.802 6.515 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 11 10.368 9.787 9.253 8.760 8.306 7887 7.499 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 13.004 12.106 11.296 10.563 9.899 9.295 8.745 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 17 15562 14.292 13.166 12.166 11.274 10.477 9.763 18 16,398 14.992 13.754 12.659 11.690 10.828 10.059 19 17226 15.678 14.324 13.134 12.085 11.158 10.336 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 24 21.243 18.914 16.936 15.247 13.799 12.550 11.469 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 30 25.808 22.397 19.600 17.292 15.373 13.765 12.409 40 32835 27.355 23.115 19.793 17.159 15.046 13.332 SO 39.196 31.424 25.730 21.482 18.256 15.762 13.801 60 44.955 34.761 27.676 22.623 18.929 16.161 14.039 Period, 149 15% 169 179 189 19% 1 0.877 0.870 0.862 0.855 0.847 0.840 2 1647 1.626 1.605 1.585 1.566 1.547 3 2322 2.283 2.246 2.210 2.174 2.140 4 2914 2855 2.798 2.743 2.690 2.639 5 3.433 3.352 3.274 3.199 3.127 3.058 6 3889 3.784 3.685 3.589 3.499 3.410 7 4288 4.160 4,039 3.922 3.812 3.706 8 4.639 4487 4.344 4.207 4.078 3.954 9 4946 4.772 4,607 4451 4.303 4.163 10 5.216 5.019 4833 4.659 4.494 4,339 11 5.453 5.234 5.029 4.836 4.656 4.486 12 5660 5.421 5.197 4.793 4.611 13 5.842 5.583 5.342 5.118 4.910 4.715 14 6.002 5.724 5.468 5.229 5.008 4.802 15 6.142 5.847 5.575 5.324 5.092 4.876 16 6.265 5.954 5.669 5.405 5.162 4.938 17 6.373 6.047 5.749 5.475 5.222 4.990 18 6.467 6.128 5.818 5.534 5.273 5.033 19 6.550 6.198 5.877 5.584 5.316 5.070 20 6.623 6.259 5.929 5.628 5.353 5.101 24 6.835 6.434 6,073 5.746 5.451 5.182 25 6.873 6.464 6.097 5.766 5.467 5.195 30 7.003 6.566 6.177 5.829 5.517 5.235 40 7.105 6.642 6.233 5.871 5.548 5.258 SO 7.133 6,661 6.246 5.880 5.554 5.262 60 7.140 6.665 6.249 5.882 5.555 5.263 8.244 8.559 8.851 9.122 9.372 9604 9.818 10.529 10.675 11.258 11.925 12.233 12.377 20% 0.833 1.528 2.106 109 0.909 1.736 2487 3.170 3.791 4355 4868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7824 8.022 8.201 8.365 8.514 8.985 9.077 9.427 9.779 9.915 9.967 28% 0.781 1.392 1.868 11% 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 7.191 7.379 7.549 7.702 7.839 7.963 8.348 8.422 8.694 8.951 9.042 9.074 32% 0.758 1332 1.766 2.096 2.345 2.534 2.678 2.786 2868 2930 2.978 12% 0.893 0.885 1.690 1.668 2.402 2.361 3.037 2.974 3.605 3.517 4.111 3.998 4.564 4.423 4.968 4.799 5.328e5.132 5.650 5.426 5.938 5687 6.194 5.918 6.122 6.628 6.302 6.811 6.462 6.974 6,604 7.120 6.729 7.250 6.840 7.366 6.938 7.469 7,025 7784 7.283 7.843 7.330 8.055 7.496 7.634 8.304 7.675 8.324 7.687 364 40% 0.735 0.714 1.276 1.224 1.674 1.589 1.966 1.949 2.181 2.035 2.399 2.168 2.455 2.263 2.540 2.331 2.603 2.379 2.650 2.414 2.683 2.438 2.708 2456 2.727 2.469 2.740 2.478 2.750 2.484 2.758 2.489 2.763 2.492 2.767 2.494 2.770 2.496 2.772 2.497 2.776 2.499 2.776 2.499 2.778 2.500 2.778 2.500 2.778 2.500 2.778 2.500 2.589 2.241 2.532 2.758 2.937 3.076 3.184 3.269 3335 3.387 4988 3.013 2.991 3.326 3.605 3.837 4.031 4.193 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.844 4.870 4.937 4.948 4.979 4.997 4.999 5.000 249 0.806 1.457 1.981 2.404 2.745 3.020 3.242 3.421 3.566 3.682 3.776 3.851 3.912 3.962 4,001 4,033 4,059 4,080 4.097 4.110 4.143 4.147 4.160 4.166 4.167 4.167 3.459 3.483 3.503 3.518 3.529 3.539 3.546 3.562 3.564 3.569 3.571 3.571 3.571 3.040 3.061 3.076 3088 3.097 3.104 3.109 3.113 3.121 3.122 3.124 3.125 3.125 3.125