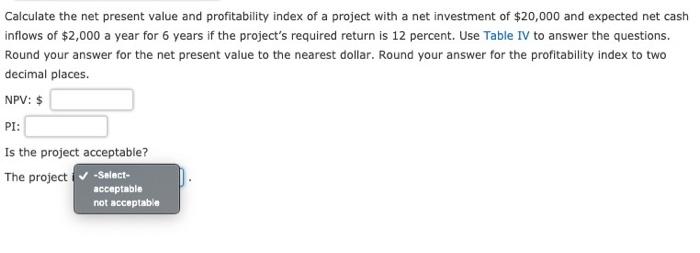

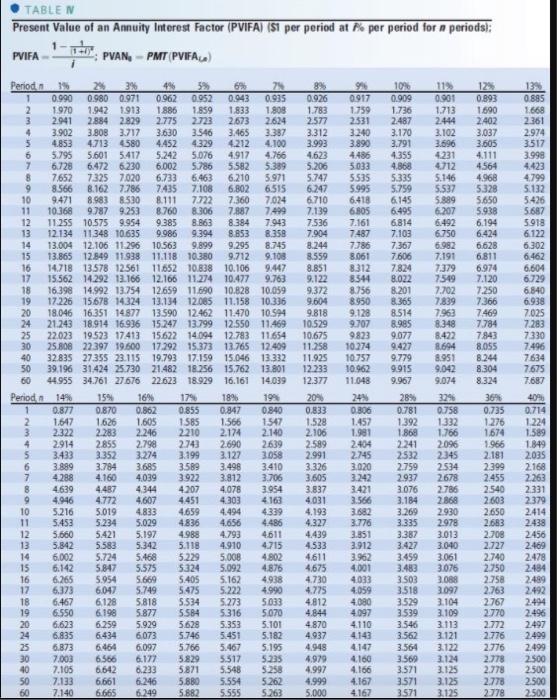

Calculate the net present value and profitability index of a project with a net investment of $20,000 and expected net cash inflows of $2,000 a year for 6 years if the project's required return is 12 percent. Use Table IV to answer the questions. Round your answer for the net present value to the nearest dollar. Round your answer for the profitability index to two decimal places. NPV: $ PI: Is the project acceptable? The project -Select- acceptable not acceptable TABLE Present Value of an Annuity Interest Factor (PVIFA) (51 per period at Po per period for a periods): PVIFA ; PVAN, - PMT PVIFAA i 0.901 1.713 2.444 3.102 3.696 4231 4.712 S.146 1.9 5.537 0917 1.759 2531 3.240 3.890 4485 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.386 8,061 8312 8.544 8.756 8950 9.128 9.707 9823 10.274 10.757 10.962 11.048 5.889 6.207 6.492 6.750 6.982 7.191 7.379 7549 7.702 7.839 7.963 8.348 8.422 8.694 8.951 9.042 9.074 12% 0.893 1.690 2.402 3,037 3.605 4.111 4564 4.968 5328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.784 7.843 8.055 8.244 8.304 8.324 Period 2 3% 4% 59 1 090 0.980 0.971 0.962 0052 0.943 0.935 2 1.970 1.942 1913 1886 1.859 1.833 1.809 3 2.941 2.884 2.829 2.775 2.673 2.624 4 3.902 3.808 3.717 3.630 3.546 3.465 3387 4.853 4.713 580 4.452 4329 4.212 4.100 6 5.795 5,601 5.417 5.242 5.076 4.917 4.766 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 7,652 7325 7020 6.733 6.463 6.210 5.971 9 8566 8.162 7.786 7.435 7.108 6.802 6.515 10 9.471 8.983 8530 8.111 7.722 7.360 7.024 11 10.368 9.787 9.253 8.760 8.306 7.887 7499 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 13 12.134 11.348 10635 9.986 9.394 8.853 8.358 14 13.004 12.106 11.296 10.563 9,899 9.295 8.745 15 13.865 12.849 11.938 11.118 10:380 9.712 9.108 16 14.718 13.578 12.561 11652 10.838 10.106 9.447 17 15562 14.292 13.166 12.166 11.274 10.477 9.763 18 16,398 14.992 13.754 12659 11.690 10.828 10.059 19 17.226 15678 14324 13.134 12.085 11.158 10.336 20 18.046 16.351 14877 13.590 12.462 11.470 10.594 24 21.243 18.914 16.936 15.247 13.799 12.550 11.469 25 22.023 19.523 17413 15.622 14.094 12.783 11.654 30 25.808 2239719.500 17.292 15.373 13.765 12.409 40 32835 27355 23.115 19.793 17.159 15.046 13.332 50 39.196 31.424 25.730 21.482 18.256 15.762 13.801 60 44.955 34.761 27676 22.623 18.929 16.161 14.039 Periods 14% 15% 16% 179 18% 1994 0.877 0.870 0.862 0.855 0.847 0.840 2 1647 1.626 1.605 156 1.547 2.322 2.283 2.246 2210 2.174 2.140 2.914 2.855 2.798 2.743 2.690 2639 5 3.433 3352 3.274 3.199 3.127 3.058 6 3.899 3.784 3.685 3.589 3.498 3.410 7 4.288 4.160 4,039 3922 3.812 3.706 8 4.639 4487 4344 4207 4.078 3.954 4946 4.772 4.607 4451 4303 4.163 10 5216 5.019 4.833 4659 4.494 4339 11 5.453 5.234 5.029 4836 4.656 4.486 12 5.660 5.421 5.197 4.988 4.793 4611 13 5.842 5.583 5.342 5.118 4.910 4.715 14 6.002 5.724 5.468 5.229 5.008 4802 15 6.142 5.847 5.575 5324 5.092 4.876 16 6.265 5.954 5.669 5.405 5.162 4938 17 6.373 6,047 5.749 5.475 4990 18 6.467 6.128 5.818 5.534 5.273 5.033 19 6.550 6.198 5.877 5.584 5316 5.070 20 6.623 6.259 5.929 5628 5.353 5.101 24 6.835 6434 6,073 5.746 5.451 5.182 25 6.873 6464 6.097 5.766 5.467 5.195 30 7.003 6.566 6.177 5.829 5.517 5.235 40 7.105 6.642 6.233 5871 5.548 5.258 50 7.133 6.661 6.246 5.880 5.554 5.262 60 7.140 6665 6.249 5.882 5.555 5.263 99 0.926 1.783 2577 3.312 3.993 4623 5.206 5747 6.247 6.710 7.139 7.536 7904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 10.529 10.675 11.258 11.925 12.233 12.377 204 0.833 1.528 2.106 2.589 2.991 3.326 3,605 3.837 4031 4.193 4.327 4.439 4.533 4611 4.675 4.730 4.775 4.812 4.644 4.870 4937 4948 4,979 4.997 4.999 5.000 10% 0.909 1.736 2.487 3.170 3.791 4.355 4,868 5.335 5.759 6.145 6.495 6814 7.103 7.367 7.606 7824 8.022 8.201 8.365 8.514 8.985 9.077 9.427 9.779 9.915 9.967 28% 0.781 1.392 1.868 2.241 2532 2.759 2.937 3.076 3.184 3.269 3.335 3.387 3.427 3.459 3.483 3503 3.518 3529 3.539 3.546 3.562 3.564 3.569 3.571 3571 3.571 139 0 Ep5 1668 2.361 2974 3517 3998 4423 4.799 5.132 5.426 5.687 5918 6.122 6.302 6.462 6,604 6.729 6.840 6.938 7.025 7.283 7330 7.496 7634 7675 7.687 4 0.714 1.224 1.589 1.849 2.035 2.168 2263 2331 2379 2414 2.438 2456 2.469 2.478 2484 2489 2492 2.494 2.496 2497 2.499 2.499 2.500 2.500 2.500 2500 1.566 0.806 1.457 1.981 2404 2.745 3.020 3.242 3421 3.566 3.682 3.776 3.851 3.912 3.962 4.001 4033 4.059 4.080 4.097 4110 4.143 4147 4.160 4.166 4.167 4.167 0758 1332 1.766 2.096 2345 2.534 2678 2.786 2.868 2.930 2.978 3.013 3.040 3.061 3.076 10 3.097 3.104 3.109 3.113 3.121 3.122 3.124 3.125 3.125 3.125 0.735 1.276 1674 1966 2.181 2.399 2.455 2.540 2.603 2650 2.683 2.708 2.727 2.740 2.750 2.758 2.763 2767 2.770 2.772 2.776 2.776 2.778 2.778 2.778 2778