Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the net present value and profitability index of a project with a net investment of $30,000 and expected net cash inflows of $10,000 a

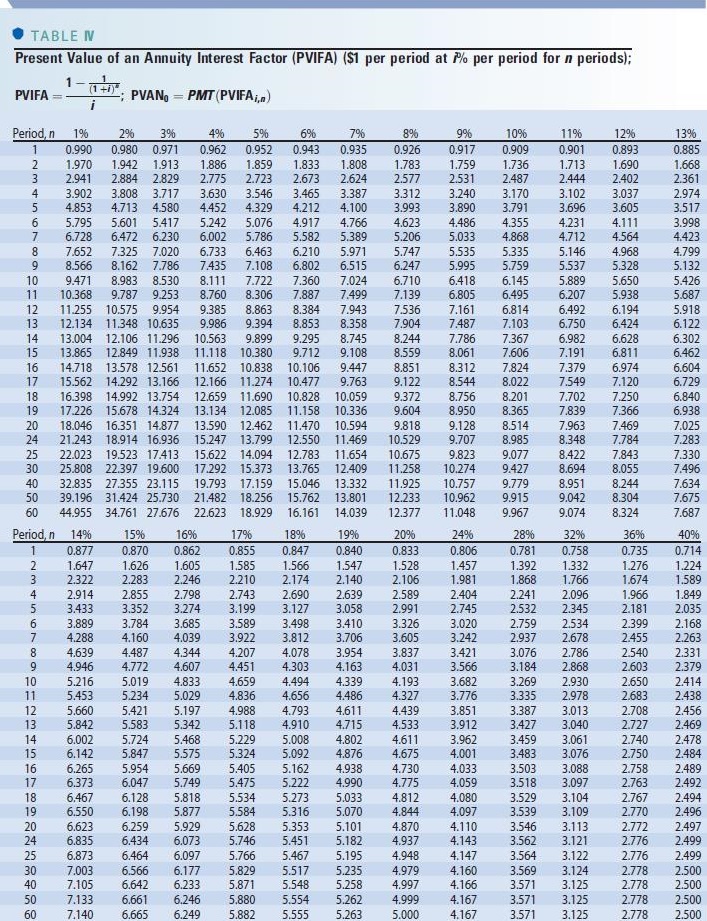

Calculate the net present value and profitability index of a project with a net investment of $30,000 and expected net cash inflows of $10,000 a year for 7 years if the project's required return is 13 percent. Use Table IV to answer the questions. Round your answer for the net present value to the nearest dollar. Round your answer for the profitability index to two decimal places.

NPV: $

TABLE N Present Value of an Annuity Interest Factor (PVIFA) ($1 per period at 7% per period for a periods); - PVAN PMT (PVIFA,,n) PVIFA Period, n 1% 7% 8% 2% 3% 0.980 0.971 1.942 1.913 1 0.990 2 1.970 6% 0.943 0.935 1.833 1.808 0.926 1.783 2.673 2.624 2.577 3.312 3.240 3.465 3.387 4.212 4.100 3.993 3.890 4.486 5.033 5.535 5.335 5.995 5.759 7.139 6.805 4% 5% 0.962 0.952 1.886 1.859 3 2.941 2.884 2.829 2.775 2.723 3.902 3.808 3.717 3.630 3.546 4.853 4.713 4.580 4.452 4.329 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 24 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.707 8.985 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 30 25.808 22.397 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 40 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 50 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 60 44.955 34.761 27.676 22.623 18.929 16.161 14.039 12.377 11.048 9.967 WN 45678 CM 16 17 18 19 Period, n 14% 1234567 15% 0.877 0.870 1.647 1.626 2.283 30 40 50 60 2.322 2.914 2.855 3.352 3.433 3.889 3.784 4.160 16% 0.862 1.605 2.246 2.798 3.274 17% 0.855 1.585 2.210 19% 18% 0.847 0.840 1.566 1.547 2.174 2.140 2.743 2.690 3.199 3.127 3.589 3.922 3.685 7 4.288 4.039 8 4.487 4.344 4.207 4.078 9 10 4.639 4.946 4.772 4.607 4.451 5.216 5.019 4.833 4.659 4.494 11 5.453 5.234 5.029 4.836 4.656 12 5.660 5.421 5.197 4.988 4.793 4.611 13 5.842 5.583 5.342 6.002 5.724 5.468 6.142 5.847 5.575 5.118 4.910 4.715 14 4.802 15 5.092 4.876 16 5.669 5.405 5.162 4.938 6.265 5.954 17 6.373 6.047 5.749 5.475 5.222 4.990 5.534 5.273 5.033 18 6.467 19 20 6.128 5.818 6.550 6.198 5.877 5.584 5.316 5.070 6.623 6.259 5.929 5.628 5.353 5.101 24 6.835 6.434 6.073 5.746 5.451 5.182 25 6.873 6.464 6.097 7.003 6.566 6.177 7.105 6.642 6.233 7.133 6.661 6.246 5.766 5.467 5.195 5.829 5.871 5.880 7.140 6.665 6.249 5.882 5.555 20% 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.954 3.837 4.303 4.163 4.031 4.339 4.193 4.486 4.327 3.498 3.812 2.639 3.058 3.410 3.706 5.229 5.008 5.324 7.536 7.161 7.904 7.487 8.244 8.559 9% 10% 0.917 0.909 1.759 1.736 2.531 2.487 3.170 3.791 4.355 4.868 4.439 4.533 7.786 8.061 8.312 7.824 8.544 8.022 24% 0.806 1.457 1.981 2.404 2.745 8.756 8.201 8.950 8.365 3.020 3.242 3.421 3.566 6.145 6.495 6.814 7.103 4.611 4.675 4.730 4.033 4.775 4.059 7.367 7.606 4.812 4.080 4.097 4.844 4.870 4.110 4.937 4.143 4.147 4.948 5.517 5.235 4.979 5.548 5.258 4.997 5.554 5.262 4.999 5.263 5.000 4.160 4.166 4.167 4.167 28% 0.781 1.392 1.868 11% 0.901 1.713 2.444 2.241 2.532 2.402 3.102 3.037 3.696 3.605 9.128 8.514 7.963 7.469 8.348 7.784 8.422 7.843 8.694 8.055 4.231 4.111 4.712 4.564 5.146 4.968 5.537 5.328 5.889 5.650 6.207 5.938 6.194 6.424 6.492 6.750 6.982 6.628 7.191 6.811 7.379 7.549 7.702 7.839 32% 0.758 12% 0.893 1.690 1.332 1.766 2.096 2.345 3.682 3.269 2.930 3.776 3.335 2.978 3.851 3.387 3.013 3.912 3.427 3.040 3.962 3.459 3.061 4.001 3.483 3.076 8.951 8.244 9.042 8.304 9.074 8.324 2.759 2.534 2.937 2.678 3.076 2.786 3.184 2.868 3.503 3.088 3.518 3.097 3.529 3.104 3.539 3.109 3.546 3.113 3.562 3.121 3.564 3.122 3.569 3.124 3.571 3.125 3.571 3.571 6.974 7.120 3.125 3.125 7.250 7.366 36% 0.735 1.276 1.674 1.966 2.181 2.399 2.455 2.540 2.603 2.650 2.683 2.708 2.727 2.740 2.750 13% 0.885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.604 6.729 6.840 6.938 7.025 7.283 7.330 7.496 7.634 7.675 7.687 40% 0.714 1.224 1.589 1.849 2.035 2.168 2.263 2.331 2.379 2.414 2.438 2.456 2.469 2.478 2.484 2.489 2.492 2.758 2.763 2.767 2.770 2.772 2.497 2.776 2.499 2.776 2.499 2.778 2.500 2.778 2.500 2.778 2.500 2.778 2.500 2.494 2.496

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer r Initial Investment 30000 Expected Net Cash of low 10000 per year fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started