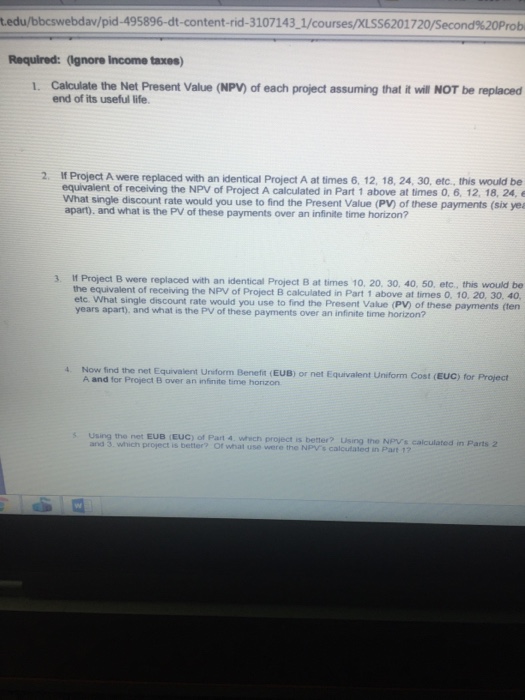

Calculate the Net Present Value (NPV) of each project assuming that it will NOT be replaced end of its useful life. If Protect A were replaced with an identical Project A at times 6, 12, 18, 24, 30, etc. This would be equivalent of receiving the NPV of Project A calculated in Pair 1 above at limes 0, 6, 12, 18, 24. What single discount rate would you use to find the Present Value (PV) of these payments and what is the PV of these payments over an infinite time horizon? M Project B were replaced with an identical Project B at times 10, 20, 30, 40, 50, etc. This would be the equivalent of receiving the NPV of Protect B calculated in Part 1 above at times 0, 10, 20, 30, 40, etc. What single discount rate would you use to find the Present Value (PV) of these payments (ten years apart) and what is the PV of these payments over an infant time horizon? Now find the not Equivalent Uniform Benefit (EUB) or net Equivalent Uniform Coal (EUC) for Protect A and for Protect B over an infinite time horizon. Using the net EUB (EUC) of Pan 4 which protect is better? Using the NPV's calculated in Parts 2 and 3 which project is better? Of what use were the NPV's calculated in Part 1? Calculate the Net Present Value (NPV) of each project assuming that it will NOT be replaced end of its useful life. If Protect A were replaced with an identical Project A at times 6, 12, 18, 24, 30, etc. This would be equivalent of receiving the NPV of Project A calculated in Pair 1 above at limes 0, 6, 12, 18, 24. What single discount rate would you use to find the Present Value (PV) of these payments and what is the PV of these payments over an infinite time horizon? M Project B were replaced with an identical Project B at times 10, 20, 30, 40, 50, etc. This would be the equivalent of receiving the NPV of Protect B calculated in Part 1 above at times 0, 10, 20, 30, 40, etc. What single discount rate would you use to find the Present Value (PV) of these payments (ten years apart) and what is the PV of these payments over an infant time horizon? Now find the not Equivalent Uniform Benefit (EUB) or net Equivalent Uniform Coal (EUC) for Protect A and for Protect B over an infinite time horizon. Using the net EUB (EUC) of Pan 4 which protect is better? Using the NPV's calculated in Parts 2 and 3 which project is better? Of what use were the NPV's calculated in