Question

Calculate the Net Present Value (NPV) of each project assuming that it will NOT be replaced at the end of its useful life. 2. If

Calculate the Net Present Value (NPV) of each project assuming that it will NOT be replaced at the end of its useful life.

Calculate the Net Present Value (NPV) of each project assuming that it will NOT be replaced at the end of its useful life.2. If Project A were replaced with an identical Project A at times 11, 22, 33, 44, 55, and 66, this would be the equivalent of receiving the NPV of Project A calculated in Part 1 above at times 0, 11, 22, 33, 44, 55, 66. What single discount rate would you use to find the Present Value (PV) of these seven payments, and what is the NPV of these seven amounts?

3. If Project B were replaced with an identical Project B at times 7, 14, 21, 28, 35, 42, 49, 56, 63 and 70, this would be the equivalent of receiving the NPV of Project B calculated in Part 1 above at times 0, 7, 14, 21, 28, 35, 42, 49, 56, 63 and 70. What single discount rate would you use to find the Present Value (PV) of these eleven payments, and what is the NPV of these eleven amounts?

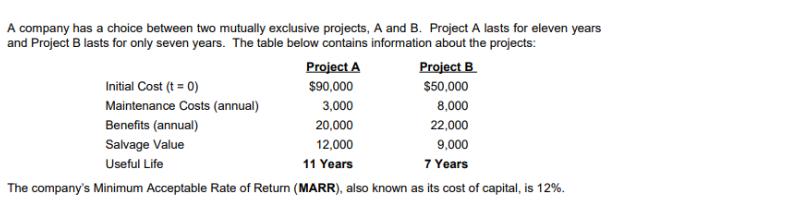

A company has a choice between two mutually exclusive projects, A and B. Project A lasts for eleven years and Project B lasts for only seven years. The table below contains information about the projects: Initial Cost (t =0) Maintenance Costs (annual) Project A $90,000 Project B $50,000 3,000 8,000 Benefits (annual) 20,000 22,000 12,000 9,000 Salvage Value Useful Life 11 Years 7 Years The company's Minimum Acceptable Rate of Return (MARR), also known as its cost of capital, is 12%.

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 For Project A Initial Cost 90000 Annual Maintenance Costs 3000 Annual Benefits 20000 Salvage Value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started