Answered step by step

Verified Expert Solution

Question

1 Approved Answer

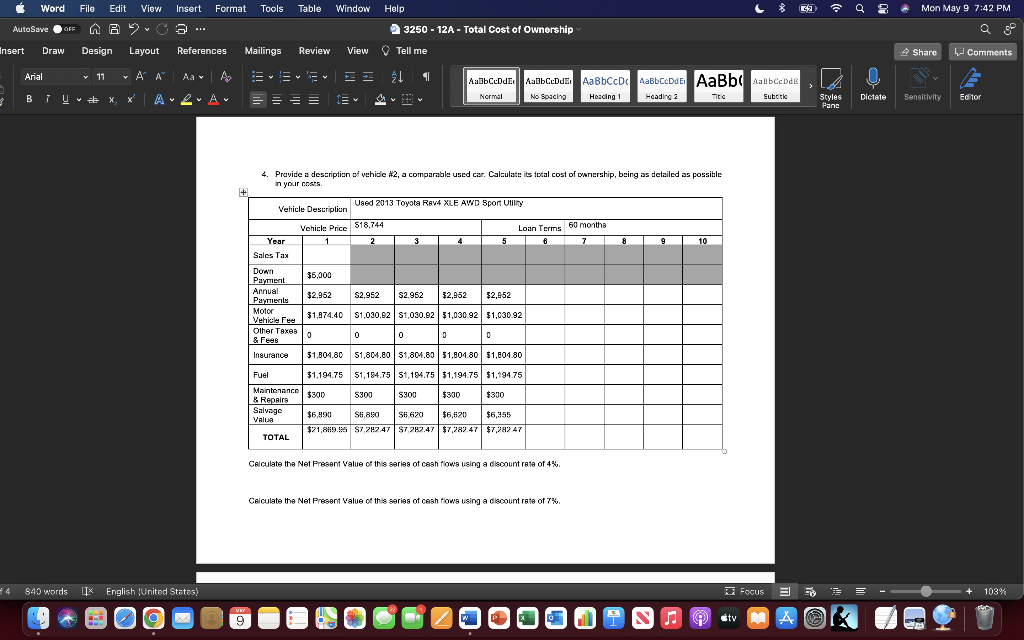

Calculate the Net Present Value of this series of cash flows using a discount rate of 4%. (need help calculating this) Calculate the Net Present

Calculate the Net Present Value of this series of cash flows using a discount rate of 4%. (need help calculating this)

Calculate the Net Present Value of this series of cash flows using a discount rate of 7%. (need help calculating this)

Word Format Tools Table Window 2 Mon May 9 7:42 PM File Edit View Insert A AOS AutoSave OFF Help 3250 - 12A - Total Cost of Ownership Tell me Insert Draw Design Layout References Mailings Review View Share Comments Arial v 11 Al A E + + 21 1 AaBbCDAL: ABCDE AaBbCcDc AaBbCEDE AaBbc Aabbccbde , B UvX 2 ALA- 2A- No Spacing Normal = = = = TEC Heading 1 Heading 2 Subotic Styles Panc Dictate Sensitivity Editor 4. Pravide a description of vehicle #2, a comparable used car. Calculate its total cost of Dership, being as detailed as possible in your Used 2013 Toyota Rav4 XLE AWD Sport Utility Vehicle Descripliun Vehicle Price $18.744 Loan Terms 60 months 6 7 Year 1 2 3 3 4 5 89 10 Sales Tax 35,000 Down Payment Annual Payments Motor Vehicle Fee 32.952 S2,952 $2.952 32,952 $2,952 $1,874.40 S1,030.82 $1,030.92 31,030.92 $1,030.92 $ Other Tereslo 0 0 0 0 & Fees Insurance $1,804.80 $1,804.80 $1,804.8051,804.80 $1,804.80 $1,194.75 51,154.75 51,184.75 $1,194.75 $1,194.75 Fuel Maintenance 5300 $ S300 $300 $300 $300 & & Repairs Salvage VAUJA $5.990 St 8110 SE 620 $6,620 $6,855 $21,8119.96 $7.282.47 $7.282.47 $7,282 47 $7,782 47 TOTAL Calculate the Net Present Value of this series of cash flows using a discount rate of 4% Calculate the Net Present Value of this series of cash flows using a discount rate of 7% a + 4 840 words 1x English United States) Focus 3 FO + 103% UNY 9 N 9tv AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started