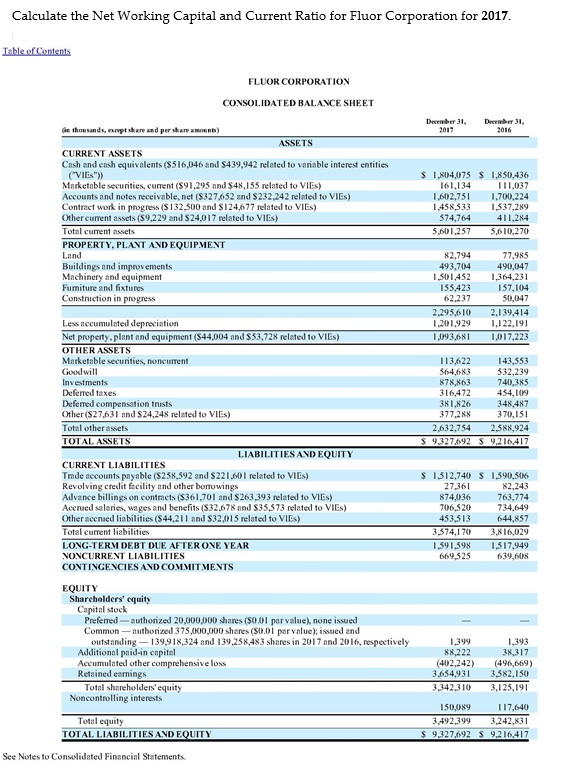

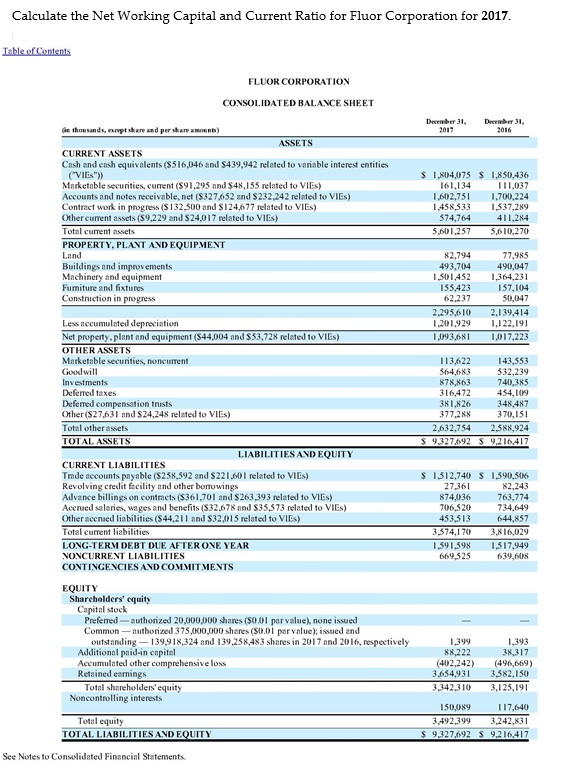

Calculate the Net Working Capital and Current Ratio for Fluor Corporation for 2017 FLUOR CORPORATION CONSOLIDATED BALANCE SHEET Dcember 3 Decr 31 thousands, noptshare and per share amounts) ASSETS CURRENT ASSETS Cash and cnsh equivalents (S516,046 and $439,942 related to vaniable interest entities CVIEs") Marketable securities, current ($91 ,295 and $48, I 55 related to VIEs) Accounts and notes receivable, net ($327,652 and S232,242 related to VIEs) Contraet work in progress ($132.500 and $124,677 related to VIEs Other curent assets ($9,229 and $24,017 related to VIEs) Total cument assets 1,804,075 1,850,436 111,037 1602,751 ,700,224 1458533 537,289 574.764 5,601,257 5,610,270 PROPERTY, PLANT AND EQUIPMENT Land Buildings and improvements Machinery and equipment Fumiture and fixtures Constnuction in progress 82,794 493,704 77,985 1501.432 1364,23 157,104 50,047 2295610 2,139,414 1,201,929 22,191 1017,223 153,423 62,237 Less accumulated depreciation Net property.plant and equipment (344,004 and $33,728 related to VIEs) OTHER ASSETS Marketable securities, noncument Goodwill 1093,681 113,622 532,239 64,683 43.553 Deferred taxes Deferred compensation trusts Other (S27,63 and $24,248 related to VIES) Total other assets TOTAL ASSETS 740,385 54,109 348,487 370,151 2,632,754 2,588,924 316472 381,826 377,288 LIABILITIES AND EQUITY CURRENT LIABILITIES Trade accounts payable ($238,592 and S221 601 related to VIEs) Revolving eredit Eecility and other bomowings Advance billings on contraets ($361,701 and $263,393 related to VIEs) Accnaed salaries, wages and benefits (S32.678 and $33,573 related to VIEs) Otheraccnaed liabilities ($44,211 and S32,015 related to VIEs) Total curent liabilities LONG-TERM DEBT DUE AFTER ONE YEAR NONCURRENT LIABILITIES CONTINGENCIESAND COMMITMENTS 1312,740 1590,506 82,243 874,036 763,774 734.649 644,857 574,170 3,816,029 1591598 1517,949 639,608 27,361 06520 45351 669,525 EQUITY Copital stock Preferred-authonized 20,000,000 shares ($0.01 par value, none issued Common-authorized 375,000,000 shares ($0.01 parvalue) issued and outstanding -139918,324 and 139,238,483 shares in 2017 and 2016, respectively Additional paid-in capital Accumulated other comprehensive loss Retained earnings 1399 88222 1,393 402,242) (496,669) 3634,93 3582,150 3342310 3,125,191 117,640 3492,399 3242,831 Total shareholders'equity Noncontrolling interests 150,089 Total equity TOTAL LIABILITIES AND EQUITY See Notes to Consolidated Financial Statements