calculate the NPV

i just need help calculating the NPV. not the essay assignment.

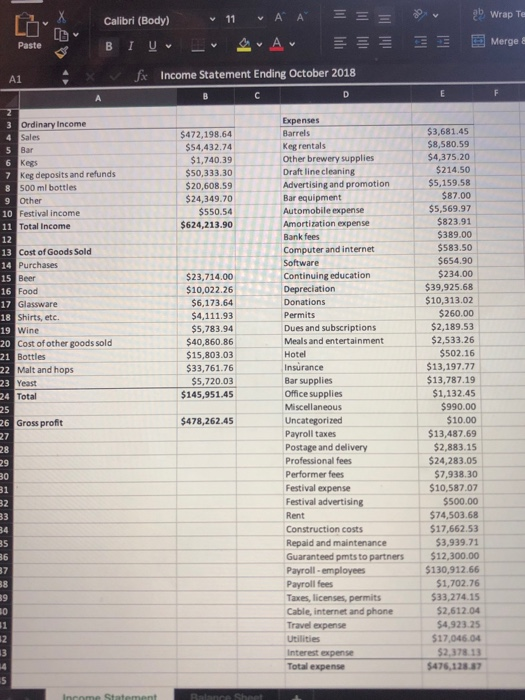

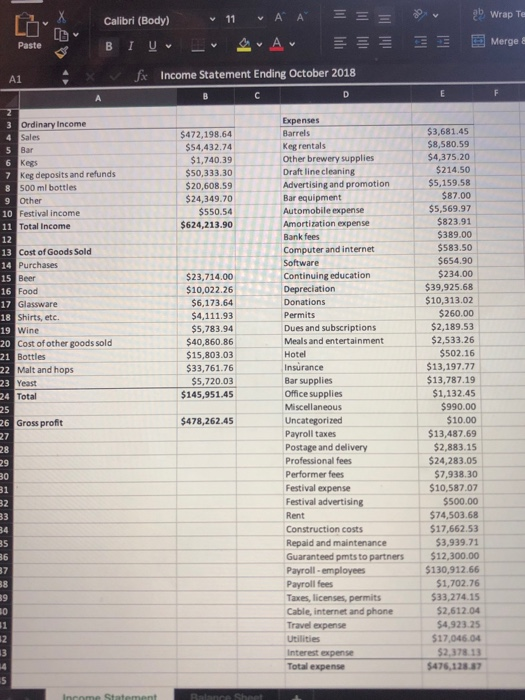

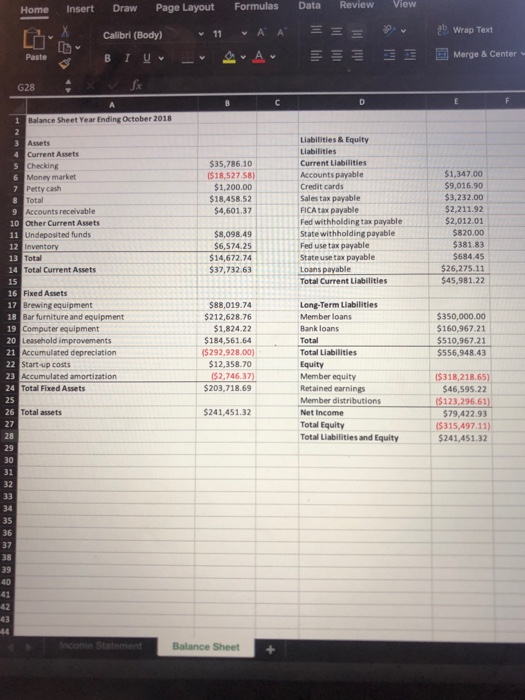

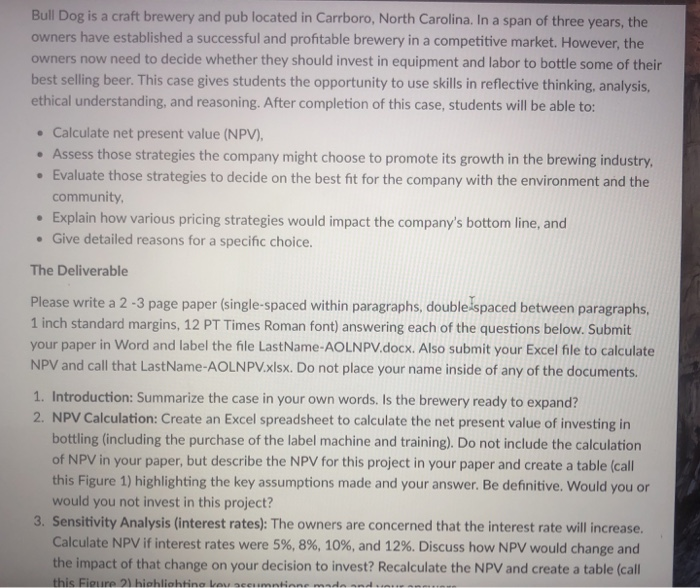

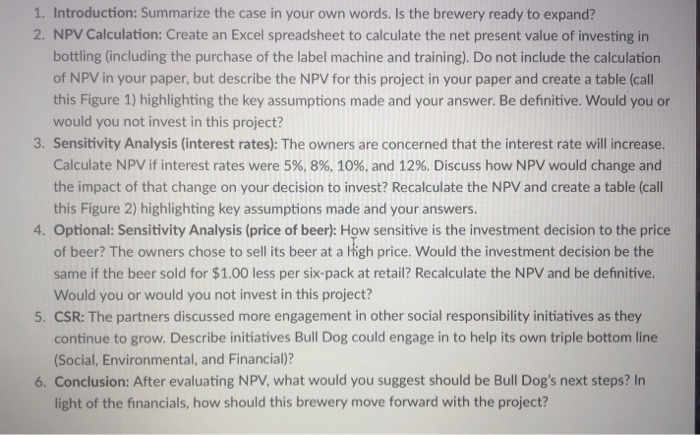

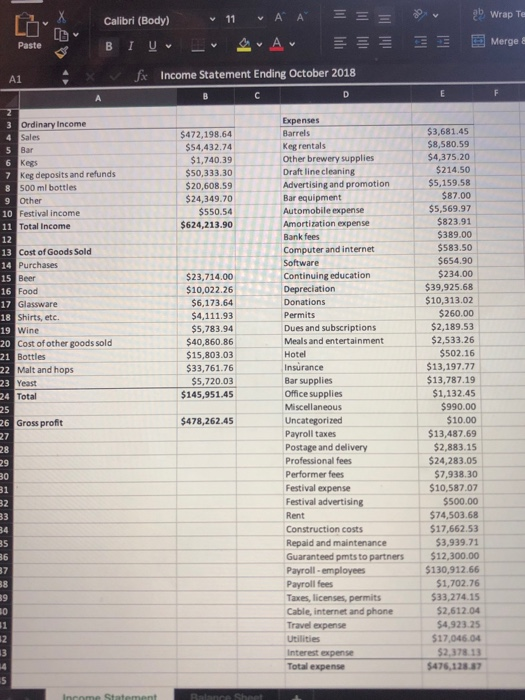

2b wrap Te L't Calibri (Body) 11 AA E Paste fi Income Statement Ending October 2018 Expenses Ordinary Inc 3,681.45 $8,580.59 4,375.20 $214.50 $5,159.58 $472,198.64 $54,432.74 $1,740.39 $50,333.30 $20,608.59 $24,349.70 550.54 624,213.90 Keg rentals Other brewery supplies Draft line cleaning Advertising and promotion Bar equipment Automobile expense Amortization expense Bank fees Computer and internet Kegs Keg deposits and refunds 500 ml bottles $87.00 $5,569.97 $823.91 Festival income Total Income 10 $389.00 $583.50 Cost of Goods Sold 654.90 $234.00 $39,925.68 $10,313.02 $260.00 $2,189.53 $23,714.00 10,022.26 6,173.64 $4,111.93 5,783.94 $40,860.86 15,803.03 33,761.76 $5,720.03 $145,951.45 Continuing education Depreciation 15 16 17 18 19 20 Donations Glassware Shirts, etc Wine Cost ofother goods sold Permits Dues and subscriptions Meals and entertainment Hotel Insurance Bar supplies Office supplies Miscellaneous Uncategorized Payroll taxes Postage and delivery Professional fees Performer fees Festival expense Festival advertising 2,533.26 $502.16 $13,197.77 $13,787.19 $1,132.45 $990.00 $10.00 13,487.69 $2,883.15 $24,283.05 $7,938.30 $10,587.07 $500.00 $74,503.68 $17,662.53 3,939.71 $12,300.00 130,912.66 $1,702.76 33,274.15 52,612.04 Malt and hops 23 25 26 27 478,262.45 Gross profit Construction costs Repaid and maintenance Guaranteed pmts to partners Payroll - employees Payroll fees Taxes, licenses, permits Cable, internet and phone Travel expense 35 36 8 $4,923.2S 17,046.04 12 $2,378 13 476,128.7 Total expense Review View Home Insert Draw Page Layout Formulas Data b Wrap Text Calibri (Body) Merge & Center v B 1 yv -v v Paste G28 Balance Sheet Year Ending October 2018 Liabilities & Equity Liabilities Current Liabilities Accounts payable Credit cards Sales tax payable FICA tax payable Fed withholding tax payable State withholding payable Fed use tax payable State use tax payable Loans payable Total Current Liabilities Current Assets Checking Money market Petty cash Total Accounts receivable Other Current Assets Undeposited funds $35,786.10 $18,527.58) $1,200.00 $18,458.52 $4,601.37 $1,347.00 9,016.90 $3,232.00 $2,211.92 $2,012.01 $820.00 $381.83 $684.45 26,275.11 $45,981.22 10 8,098.49 $6,574.25 514,672.74 37,732.63 12 13 14 15 16 Total Total Current Assets Fixed Assets Brewing equipment Bar furniture and equipment Computer equipment $88,019.74 $212,628.76 $1,824.22 $184,561.64 292 928.00 $12,358.70 Long-Term Liabilities Member loans Bank loans Total Total Liabilities Equity Member equity Retained earnings Member distributions Net Income Total Equity Total Liabilities and Equity $350,000.00 $160,967.21 $510,967.21 556,948.43 19 20 ccumulated depreciation Start-up costs Accumulated amortizatiorn Total Fixed Assets - ($2,746.37), 23 24 25 26 27 28 29 30 31 $203,718.69 $46,595.22 ($123,296.61) $79,422.93 $241,451.32 Total assets 241,451.32 35 36 Balance Sheet Bull Dog is a craft brewery and pub located in Carrboro, North Carolina. In a span of three years, the owners have established a successful and profitable brewery in a competitive market. However, the owners now need to decide whether they should invest in equipment and labor to bottle some of their best selling beer. This case gives students the opportunity to use skills in reflective thinking, analysis, ethical understanding, and reasoning. After completion of this case, students will be able to: Calculate net present value (NPV), Assess those strategies the company might choose to promote its growth in the brewing industry Evaluate those strategies to decide on the best fit for the company with the environment and the community . Explain how various pricing strategies would impact the company's bottom line, and Give detailed reasons for a specific choice. The Deliverable Please write a 2-3 page paper (single-spaced within paragraphs, double spaced between paragraphs 1 inch standard margins, 12 PT Times Roman font) answering each of the questions below. Submit NPV and call that LastName-AOLNPV.xlsx. Do not place your name inside of any of the documents 1. Introduction: Summarize the case in your own words. Is the brewery ready to expand? ur paper in Word and label the file LastName-AOLNPV.docx. Also submit your Excel file to calculate 2. NPV Calculation: Create an Excel spreadsheet to calculate the net present value of investing in bottling (including the purchase of the label machine and training). Do not include the calculation of NPV in your paper, but describe the NPV for this project in your paper and create a table (call this Figure 1) highlighting the key assumptions made and your answer. Be definitive. Would you or would you not invest in this project? 3. Sensitivity Analysis (interest rates): The owners are concerned that the interest rate will increase. Calculate NPV if interest rates were 5%, 8%, 10%, and 12%. Discuss how NPV would change and e impact of that change on your decision to invest? Recalculate the NPV and create a table (call 1. Introduction: Summarize the case in your own words. Is the brewery ready to expand? 2. NPV Calculation: Create an Excel spreadsheet to calculate the net present value of investing in bottling (including the purchase of the label machine and training). Do not include the calculation of NPV in your paper, but describe the NPV for this project in your paper and create a table (call this Figure 1) highlighting the key assumptions made and your answer. Be definitive. Would you or would you not invest in this project? 3. Sensitivity Analysis (interest rates): The owners are concerned that the interest rate will increase. Calculate NPV if interest rates were 5%, 8%, 10%, and 12%. Discuss how NPV would change and the impact of that change on your decision to invest? Recalculate the NPV and create a table (call this Figure 2) highlighting key assumptions made and your answers. 4. Optional: Sensitivity Analysis (price of beer): How sensitive is the investment decision to the price of beer? The owners chose to sell its beer at a lhigh price. Would the investment decision be the same if the beer sold for $1.00 less per six-pack at retail? Recalculate the NPV and be definitive. Would you or would you not invest in this project? 5. CSR: The partners discussed more engagement in other social responsibility initiatives as they continue to grow. Describe initiatives Bull Dog could engage in to help its own triple bottom line Social, Environmental, and Financial)? 6. Conclusion: After evaluating NPV, what would you suggest should be Bull Dog's next steps? In light of the financials, how should this brewery move forward with the project? 2b wrap Te L't Calibri (Body) 11 AA E Paste fi Income Statement Ending October 2018 Expenses Ordinary Inc 3,681.45 $8,580.59 4,375.20 $214.50 $5,159.58 $472,198.64 $54,432.74 $1,740.39 $50,333.30 $20,608.59 $24,349.70 550.54 624,213.90 Keg rentals Other brewery supplies Draft line cleaning Advertising and promotion Bar equipment Automobile expense Amortization expense Bank fees Computer and internet Kegs Keg deposits and refunds 500 ml bottles $87.00 $5,569.97 $823.91 Festival income Total Income 10 $389.00 $583.50 Cost of Goods Sold 654.90 $234.00 $39,925.68 $10,313.02 $260.00 $2,189.53 $23,714.00 10,022.26 6,173.64 $4,111.93 5,783.94 $40,860.86 15,803.03 33,761.76 $5,720.03 $145,951.45 Continuing education Depreciation 15 16 17 18 19 20 Donations Glassware Shirts, etc Wine Cost ofother goods sold Permits Dues and subscriptions Meals and entertainment Hotel Insurance Bar supplies Office supplies Miscellaneous Uncategorized Payroll taxes Postage and delivery Professional fees Performer fees Festival expense Festival advertising 2,533.26 $502.16 $13,197.77 $13,787.19 $1,132.45 $990.00 $10.00 13,487.69 $2,883.15 $24,283.05 $7,938.30 $10,587.07 $500.00 $74,503.68 $17,662.53 3,939.71 $12,300.00 130,912.66 $1,702.76 33,274.15 52,612.04 Malt and hops 23 25 26 27 478,262.45 Gross profit Construction costs Repaid and maintenance Guaranteed pmts to partners Payroll - employees Payroll fees Taxes, licenses, permits Cable, internet and phone Travel expense 35 36 8 $4,923.2S 17,046.04 12 $2,378 13 476,128.7 Total expense Review View Home Insert Draw Page Layout Formulas Data b Wrap Text Calibri (Body) Merge & Center v B 1 yv -v v Paste G28 Balance Sheet Year Ending October 2018 Liabilities & Equity Liabilities Current Liabilities Accounts payable Credit cards Sales tax payable FICA tax payable Fed withholding tax payable State withholding payable Fed use tax payable State use tax payable Loans payable Total Current Liabilities Current Assets Checking Money market Petty cash Total Accounts receivable Other Current Assets Undeposited funds $35,786.10 $18,527.58) $1,200.00 $18,458.52 $4,601.37 $1,347.00 9,016.90 $3,232.00 $2,211.92 $2,012.01 $820.00 $381.83 $684.45 26,275.11 $45,981.22 10 8,098.49 $6,574.25 514,672.74 37,732.63 12 13 14 15 16 Total Total Current Assets Fixed Assets Brewing equipment Bar furniture and equipment Computer equipment $88,019.74 $212,628.76 $1,824.22 $184,561.64 292 928.00 $12,358.70 Long-Term Liabilities Member loans Bank loans Total Total Liabilities Equity Member equity Retained earnings Member distributions Net Income Total Equity Total Liabilities and Equity $350,000.00 $160,967.21 $510,967.21 556,948.43 19 20 ccumulated depreciation Start-up costs Accumulated amortizatiorn Total Fixed Assets - ($2,746.37), 23 24 25 26 27 28 29 30 31 $203,718.69 $46,595.22 ($123,296.61) $79,422.93 $241,451.32 Total assets 241,451.32 35 36 Balance Sheet Bull Dog is a craft brewery and pub located in Carrboro, North Carolina. In a span of three years, the owners have established a successful and profitable brewery in a competitive market. However, the owners now need to decide whether they should invest in equipment and labor to bottle some of their best selling beer. This case gives students the opportunity to use skills in reflective thinking, analysis, ethical understanding, and reasoning. After completion of this case, students will be able to: Calculate net present value (NPV), Assess those strategies the company might choose to promote its growth in the brewing industry Evaluate those strategies to decide on the best fit for the company with the environment and the community . Explain how various pricing strategies would impact the company's bottom line, and Give detailed reasons for a specific choice. The Deliverable Please write a 2-3 page paper (single-spaced within paragraphs, double spaced between paragraphs 1 inch standard margins, 12 PT Times Roman font) answering each of the questions below. Submit NPV and call that LastName-AOLNPV.xlsx. Do not place your name inside of any of the documents 1. Introduction: Summarize the case in your own words. Is the brewery ready to expand? ur paper in Word and label the file LastName-AOLNPV.docx. Also submit your Excel file to calculate 2. NPV Calculation: Create an Excel spreadsheet to calculate the net present value of investing in bottling (including the purchase of the label machine and training). Do not include the calculation of NPV in your paper, but describe the NPV for this project in your paper and create a table (call this Figure 1) highlighting the key assumptions made and your answer. Be definitive. Would you or would you not invest in this project? 3. Sensitivity Analysis (interest rates): The owners are concerned that the interest rate will increase. Calculate NPV if interest rates were 5%, 8%, 10%, and 12%. Discuss how NPV would change and e impact of that change on your decision to invest? Recalculate the NPV and create a table (call 1. Introduction: Summarize the case in your own words. Is the brewery ready to expand? 2. NPV Calculation: Create an Excel spreadsheet to calculate the net present value of investing in bottling (including the purchase of the label machine and training). Do not include the calculation of NPV in your paper, but describe the NPV for this project in your paper and create a table (call this Figure 1) highlighting the key assumptions made and your answer. Be definitive. Would you or would you not invest in this project? 3. Sensitivity Analysis (interest rates): The owners are concerned that the interest rate will increase. Calculate NPV if interest rates were 5%, 8%, 10%, and 12%. Discuss how NPV would change and the impact of that change on your decision to invest? Recalculate the NPV and create a table (call this Figure 2) highlighting key assumptions made and your answers. 4. Optional: Sensitivity Analysis (price of beer): How sensitive is the investment decision to the price of beer? The owners chose to sell its beer at a lhigh price. Would the investment decision be the same if the beer sold for $1.00 less per six-pack at retail? Recalculate the NPV and be definitive. Would you or would you not invest in this project? 5. CSR: The partners discussed more engagement in other social responsibility initiatives as they continue to grow. Describe initiatives Bull Dog could engage in to help its own triple bottom line Social, Environmental, and Financial)? 6. Conclusion: After evaluating NPV, what would you suggest should be Bull Dog's next steps? In light of the financials, how should this brewery move forward with the project