Question

: Calculate the PERCENTAGES of each item in each category. use the P&L form to answer and show work on a separate line. The main

: Calculate the PERCENTAGES of each item in each category. use the P&L form to answer and show work on a separate line.

The main sections of this statement are as follows. Please remember that the calculations of all PERCENTAGES are part of each item in each category, and included in the points.

1. Revenues (sales) for food and beverage. Show how you get the numbers

Food = $678,910

Beverage = $126,543

2. Costs of food and beverage, show calculation and/or explain how you find, the numbers

Food = $203,673

Beverage = $22,777

3. Labor costs

Management $64000 Staff $108000 Employee Benefits $43000

4. Prime Cost (2 points)

5. Operating costs (controllable)

a. Marketing = $18,000

b. Utilities = $26,500

c. Administrative and General Expenses = $20,000

d. Repairs and Maintenance = $16,800

6. Operating costs (noncontrollable)

a. Rent = $80,000

b. Equipment rental = $5,200

7. Grand total of expenses

8. Profit or Loss

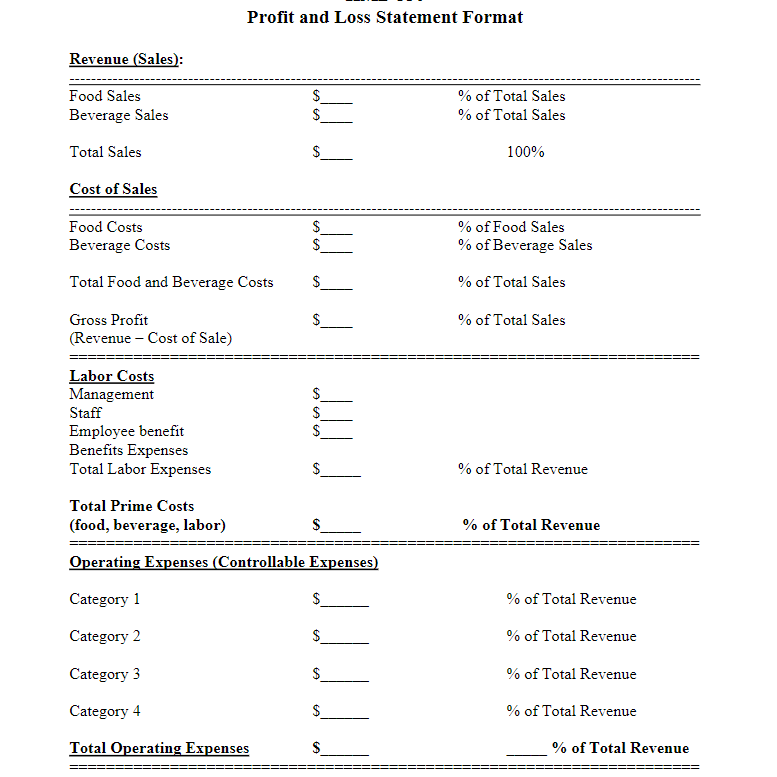

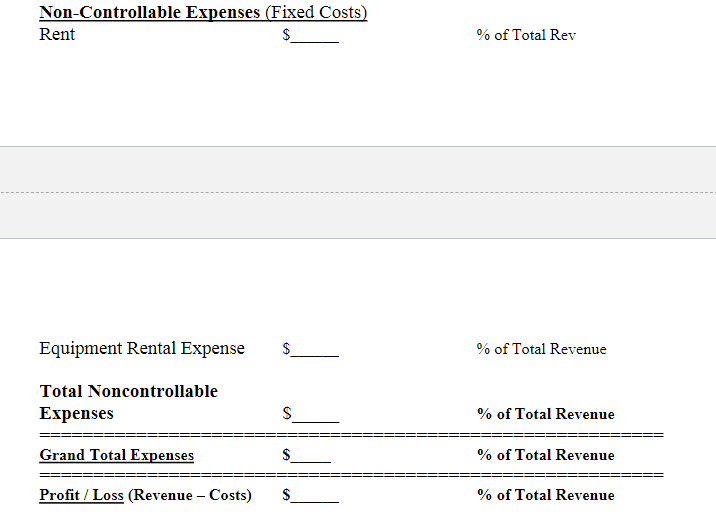

Profit and Loss Statement Format Revenue (Sales): Food Sales $ % of Total Sales Beverage Sales $ % of Total Sales Total Sales 100% Cost of Sales Food Costs Beverage Costs $ % of Food Sales % of Beverage Sales Total Food and Beverage Costs Gross Profit (Revenue - Cost of Sale) Labor Costs % of Total Sales % of Total Sales Management Staff Employee benefit SASASA $ $ Benefits Expenses Total Labor Expenses % of Total Revenue Total Prime Costs (food, beverage, labor) $ % of Total Revenue Operating Expenses (Controllable Expenses) Category 1 $ % of Total Revenue Category 2 % of Total Revenue Category 3 $ % of Total Revenue Category 4 $ % of Total Revenue Total Operating Expenses % of Total Revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started