Answered step by step

Verified Expert Solution

Question

1 Approved Answer

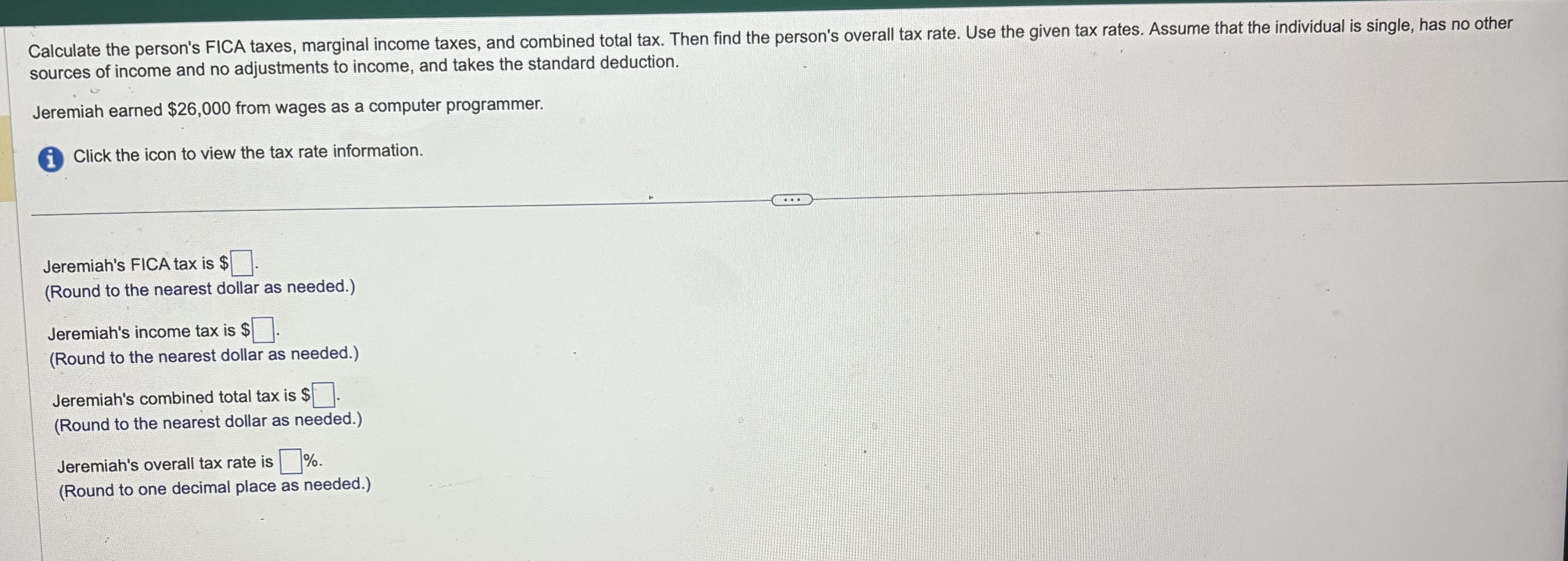

Calculate the person's FICA taxes, marginal income taxes, and combined total tax. Then find the person's overall tax rate. Use the given tax rates. Assume

Calculate the person's FICA taxes, marginal income taxes, and combined total tax. Then find the person's overall tax rate. Use the given tax rates. Assume that the individual is single, has no other

sources of income and no adjustments to income, and takes the standard deduction.

Jeremiah earned $ from wages as a computer programmer.

Click the icon to view the tax rate information.

Jeremiah's FICA tax is $

Round to the nearest dollar as needed.

Jeremiah's income tax is $

Round to the nearest dollar as needed.

Jeremiah's combined total tax is $

Round to the nearest dollar as needed.

Jeremiah's overall tax rate is

Round to one decimal place as needed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started