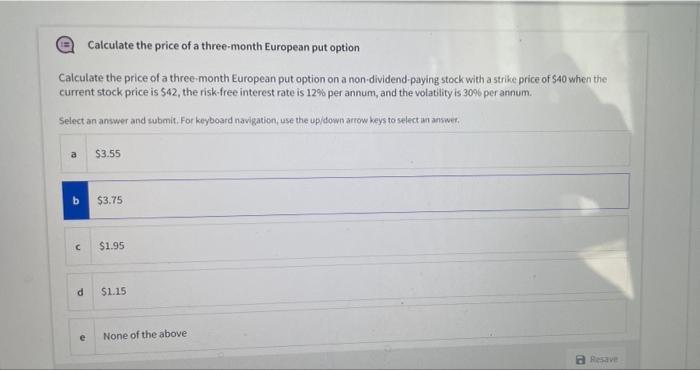

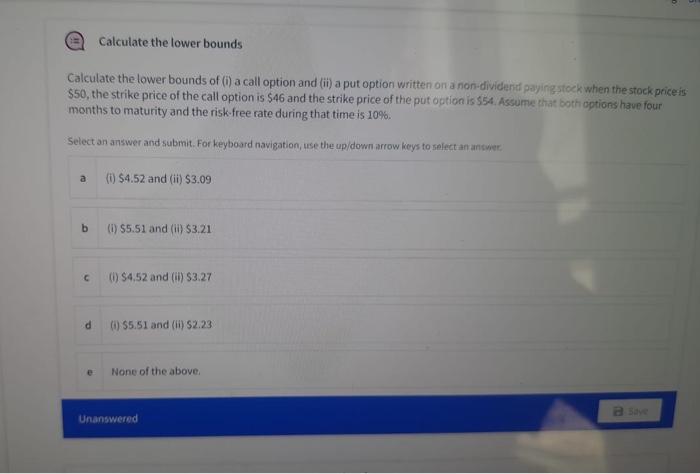

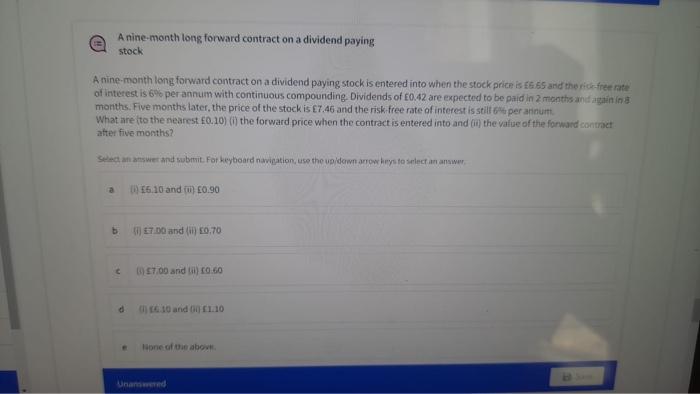

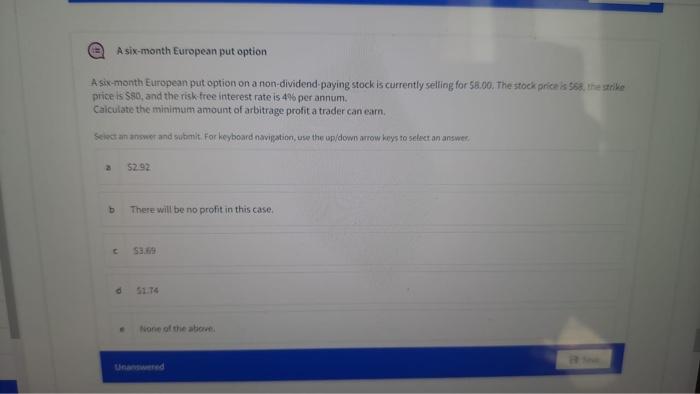

Calculate the price of a three-month European put option Calculate the price of a three-month European put option on a non-dividend-paying stock with a strike price of $40 when the current stock price is $42, the risk-free interest rate is 12% per annum, and the volatility is 30% per annum. Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a $3.55 $3.75 $1.95 $1.15 None of the above a Resave b d e Calculate the lower bounds Calculate the lower bounds of (i) a call option and (ii) a put option written on a non-dividend paying stock when the stock price is $50, the strike price of the call option is $46 and the strike price of the put option is $54. Assume that both options have four months to maturity and the risk-free rate during that time is 10%. Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a (i) $4.52 and (ii) $3.09 (i) $5.51 and (ii) $3.211 (i) $4.52 and (ii) $3.27 (i) $5.51 and (ii) $2.23 None of the above. Save b C d e Unanswered B A nine-month long forward contract on a dividend paying stock A nine-month long forward contract on a dividend paying stock is entered into when the stock price is E6.65 and the risk-free rate of interest is 6% per annum with continuous compounding. Dividends of 0.42 are expected to be paid in 2 months and again in 8 months. Five months later, the price of the stock is 7.46 and the risk-free rate of interest is still 6% per annum. What are (to the nearest 0.10) (i) the forward price when the contract is entered into and (ii) the value of the forward contract after five months? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer a (0) 6.10 and (0) 0.90 (i) 7.00 and (ii) 0.70 () 7.00 and (ii) 10.60 (6.10 and (0) 1.10 None of the above. b C d e Unanswered E A six-month European put option A six-month European put option on a non-dividend-paying stock is currently selling for $8.00. The stock price is 568, the strike price is $80, and the risk-free interest rate is 4% per annum. Calculate the minimum amount of arbitrage profit a trader can earn. Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. 2 $2.92 b There will be no profit in this case. C $3.69 51.74 None of the above d