Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the project's NPV, IRR, and payback period. 2. Perform sensitivity analyses and calculate the project's NPV, IRR, and payback period if sales volume increases

Calculate the project's NPV, IRR, and payback period.

2. Perform sensitivity analyses and calculate the project's NPV, IRR, and payback period if

sales volume increases 4.5%

unit price increases 20%

direct labor cost increases 5%

raw materials increase 5%

energy cost increases 5%

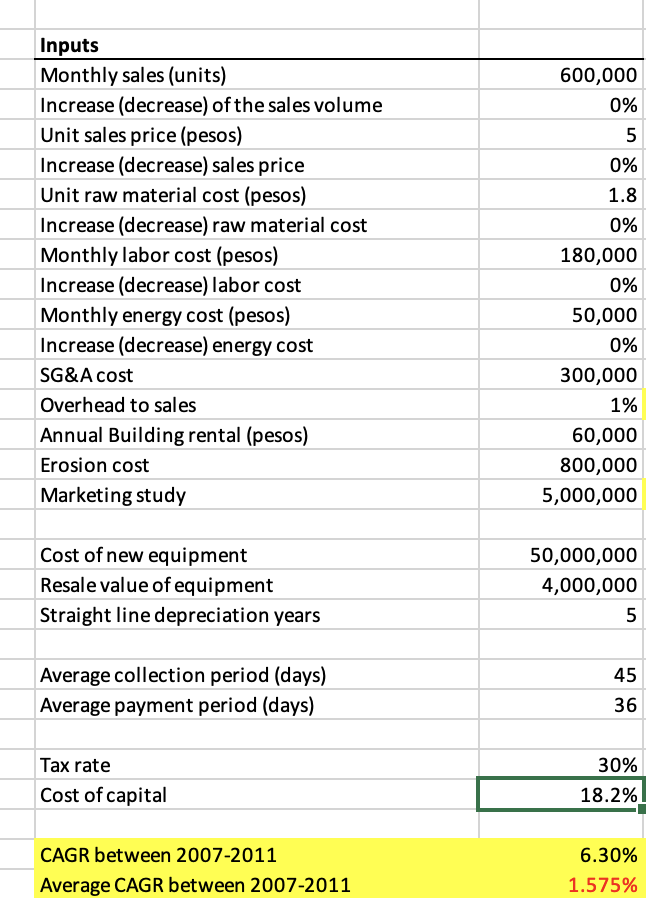

Inputs Monthly sales (units) 600,000 Increase (decrease) of the sales volume 0% Unit sales price (pesos) 5 Increase (decrease) sales price 0% Unit raw material cost (pesos) 1.8 Increase (decrease) raw material cost 0% Monthly labor cost (pesos) 180,000 Increase (decrease) labor cost 0% Monthly energy cost (pesos) 50,000 Increase (decrease) energy cost 0% SG&A cost 300,000 Overhead to sales 1% Annual Building rental (pesos) 60,000 Erosion cost 800,000 Marketing study 5,000,000 Cost of new equipment 50,000,000 Resale value of equipment 4,000,000 Straight line depreciation years 5 Average collection period (days) Average payment period (days) 45 36 Tax rate 30% Cost of capital 18.2% CAGR between 2007-2011 6.30% Average CAGR between 2007-2011 1.575%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started