Question

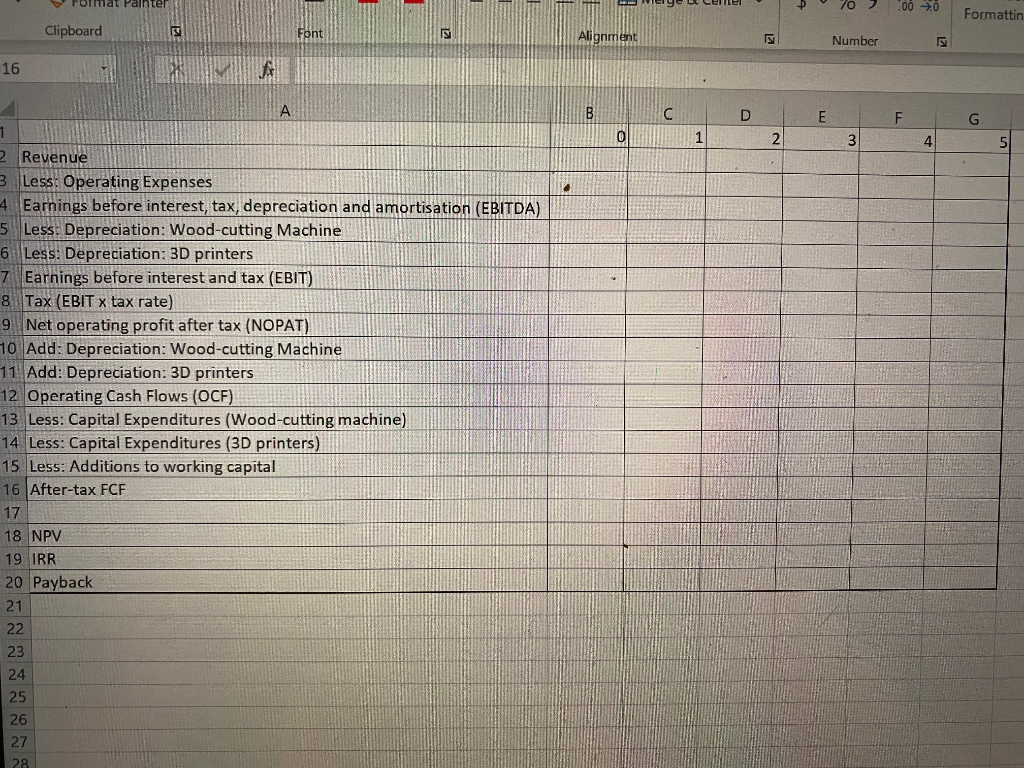

Calculate the relevant cash flows from your task for the NPV computation. For Revenue and Costs, you are to distil that section of the facts

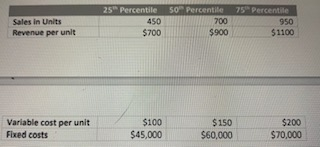

Calculate the relevant cash flows from your task for the NPV computation. For Revenue and Costs, you are to distil that section of the facts above into a single annual cash flow to enter into the NPV spreadsheet. For the Capital Expenditures (Woodcutting Machine and 3D printers), the initial outlay is given, you are to compute the annual depreciation and the final year cash flow. The calculated numbers should be filled out in the appropriate places. Market research (costing $10,000) showing that annual sales are expected to be around 700 beds at $900 each beds per year for 5 years. If the new bed is launched, its projects that net revenue from their existing SideTable line will increase by $5,000 per year. Variable costs of production are $150 per bed for the projected 700 beds sold per year. Fixed costs are $60,000 per year. Administrative costs will increase by $2,000 per year for new product line. If it launches the bed, they will increase their box order , reducing their per-unit box cost on other product lines. This is estimated to save $2,000 per year. Its rent is $6,000 per year. The new wood cutting machine will cost $420,000 ( required depreciation over 10 years to zero using the straight-line method, and at the end of 5 years, the estimated value of the wood cutting machine is $50,000.) The total cost of the required 3D printers is $750,000. ( required depreciation over 15 years to zero using the straight-line method, and at the end of 5 years, the estimated value of the 3D printers is $300,000.) The project will require working capital of $15,000 which will be recovered at the end of the 5-year life of the project. Corporate tax rate is 30%. It estimates the cost of capital for this project at 17%. Its policy is to reject projects with a payback period of more than 3 years. When it estimated the distribution of the key inputs, they estimated the 25th, 50th, and 75th percentile of the probable outcomes: That is, there is a 25% probability that sales will be below 450 units per year, a 50% probability that sales will be below 700 units per year and a 75% probability that sales will be below 950 units per year. The other table rows can be interpreted in a similar manner. These estimated probability distributions could be greatly narrowed with further market research, which would cost $2,000 per variable.:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started