Calculate the return on assets and please give a detailed explanation

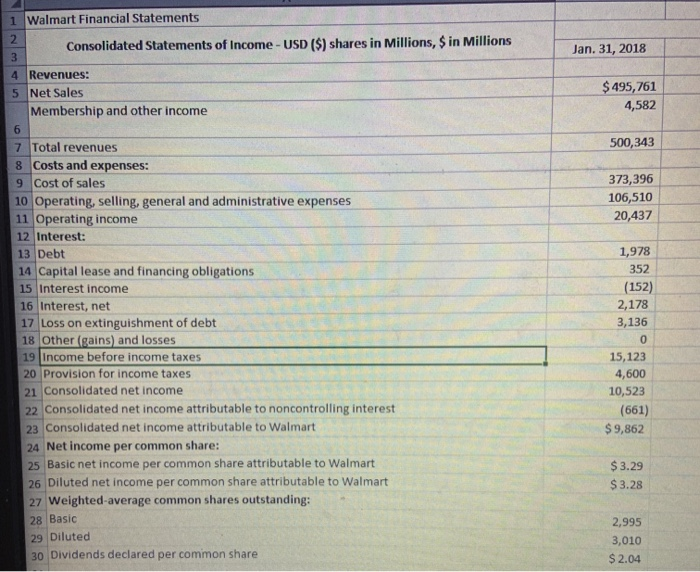

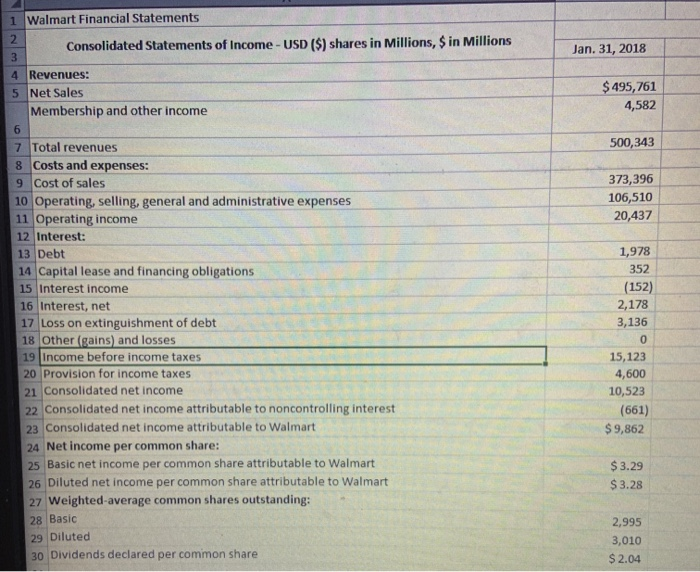

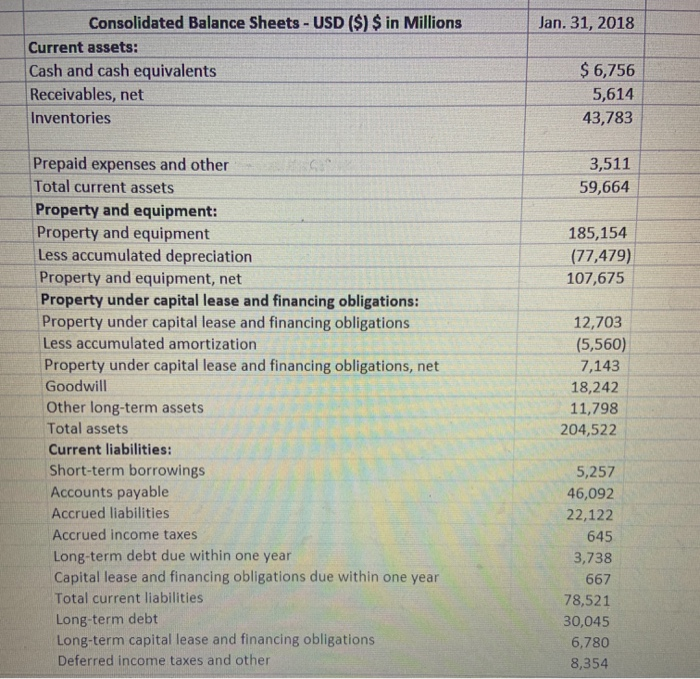

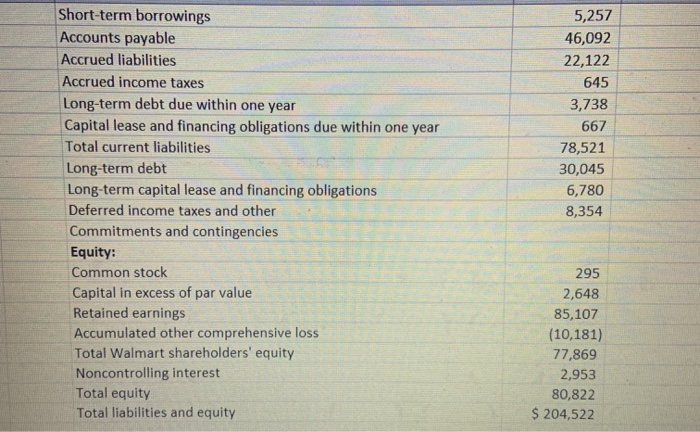

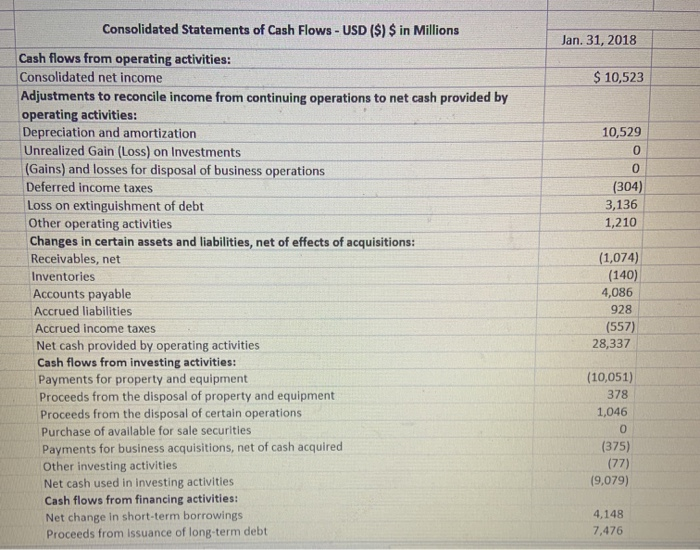

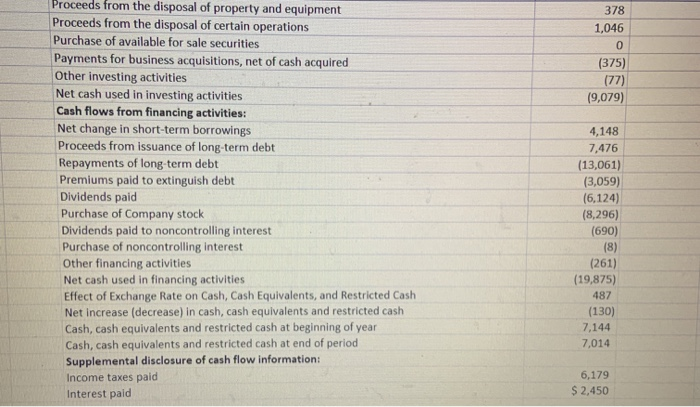

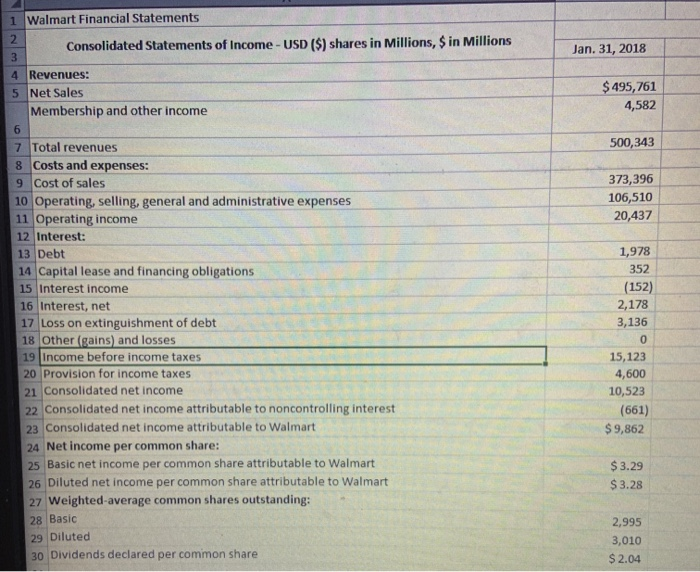

1 Walmart Financial Statements Consolidated Statements of Income - USD ($) shares in Millions, $ in Millions Jan. 31, 2018 4 Revenues: 5 Net Sales Membership and other income $ 495,761 4,582 500,343 373,396 106,510 20,437 1,978 352 (152) 2,178 3,136 7 Total revenues 8 Costs and expenses: 9 Cost of sales 10 Operating, selling, general and administrative expenses 11 Operating income 12 Interest: 13 Debt 14 Capital lease and financing obligations 15 Interest income 16 Interest, net 17 Loss on extinguishment of debt 18 Other (gains) and losses 19 Income before income taxes 20 Provision for income taxes 21 Consolidated net income 22 Consolidated net income attributable to noncontrolling interest 23 Consolidated net income attributable to Walmart 24 Net income per common share: 25 Basic net income per common share attributable to Walmart 26 Diluted net income per common share attributable to Walmart 27 Weighted average common shares outstanding: 28 Basic 29 Diluted 30 Dividends declared per common share 15,123 4,600 10,523 (661) $9,862 $3.29 $ 3.28 2,995 3,010 $2.04 Jan. 31, 2018 Consolidated Balance Sheets - USD ($) $ in Millions Current assets: Cash and cash equivalents Receivables, net Inventories $ 6,756 5,614 43,783 3,511 59,664 185,154 (77,479) 107,675 Prepaid expenses and other Total current assets Property and equipment: Property and equipment Less accumulated depreciation Property and equipment, net Property under capital lease and financing obligations: Property under capital lease and financing obligations Less accumulated amortization Property under capital lease and financing obligations, net Goodwill Other long-term assets Total assets Current liabilities: Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Capital lease and financing obligations due within one year Total current liabilities Long-term debt Long-term capital lease and financing obligations Deferred income taxes and other 12,703 (5,560) 7,143 18,242 11,798 204,522 5,257 46,092 22,122 645 3,738 667 78,521 30,045 6,780 8,354 Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Capital lease and financing obligations due within one year Total current liabilities Long-term debt Long-term capital lease and financing obligations Deferred income taxes and other Commitments and contingencies Equity: Common stock Capital in excess of par value Retained earnings Accumulated other comprehensive loss Total Walmart shareholders' equity Noncontrolling interest Total equity Total liabilities and equity 5,257 46,092 22,122 645 3,738 667 78,521 30,045 6,780 8,354 295 2,648 85,107 (10,181) 77,869 2,953 80,822 $ 204,522 Consolidated Statements of Cash Flows - USD ($) $ in Millions Jan. 31, 2018 $ 10,523 10,529 (304) 3,136 1,210 Cash flows from operating activities: Consolidated net income Adjustments to reconcile income from continuing operations to net cash provided by operating activities: Depreciation and amortization Unrealized Gain (Loss) on Investments (Gains) and losses for disposal of business operations Deferred income taxes Loss on extinguishment of debt Other operating activities Changes in certain assets and liabilities, net of effects of acquisitions: Receivables, net Inventories Accounts payable Accrued liabilities Accrued income taxes Net cash provided by operating activities Cash flows from investing activities: Payments for property and equipment Proceeds from the disposal of property and equipment Proceeds from the disposal of certain operations Purchase of available for sale securities Payments for business acquisitions, net of cash acquired Other investing activities Net cash used in investing activities Cash flows from financing activities: Net change in short-term borrowings Proceeds from Issuance of long-term debt (1,074) (140) 4,086 928 (557) 28,337 (10,051) 378 1,046 (375) (77) (9,079) 4,148 7,476 378 1,046 0 (375) (77) (9,079) Proceeds from the disposal of property and equipment Proceeds from the disposal of certain operations Purchase of available for sale securities Payments for business acquisitions, net of cash acquired Other investing activities Net cash used in investing activities Cash flows from financing activities: Net change in short-term borrowings Proceeds from issuance of long-term debt Repayments of long-term debt Premiums paid to extinguish debt Dividends paid Purchase of Company stock Dividends paid to noncontrolling interest Purchase of noncontrolling interest Other financing activities Net cash used in financing activities Effect of Exchange Rate on Cash, Cash Equivalents, and Restricted Cash Net Increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginning of year Cash, cash equivalents and restricted cash at end of period Supplemental disclosure of cash flow information: Income taxes paid Interest paid 4,148 7,476 (13,061) (3,059) (6,124) (8,296) (690) (8) (261) (19,875) 487 (130) 7,144 7,014 6,179 $ 2,450