Question

1. Calculate the ROE for Consolidated Ace, Aces shareholders, and for the non-controlling interest for 2019. Explain what the differences in ROE imply. 2. You

1. Calculate the ROE for Consolidated Ace, Ace’s shareholders, and for the non-controlling interest for 2019. Explain what the differences in ROE imply.

2. You did some more research and found the following. Ace has only one consolidated subsidiary, Beta Corporation where it acquired a 50% stake in 2017. You also note that Ace has $ 120 million of goodwill on its balance sheet related to this acquisition. You wonder whether the lower ROE has something to do with the existence of goodwill. Can you verify whether it is goodwill that is causing the discrepancy in the ROEs between Ace and its controlling interest?

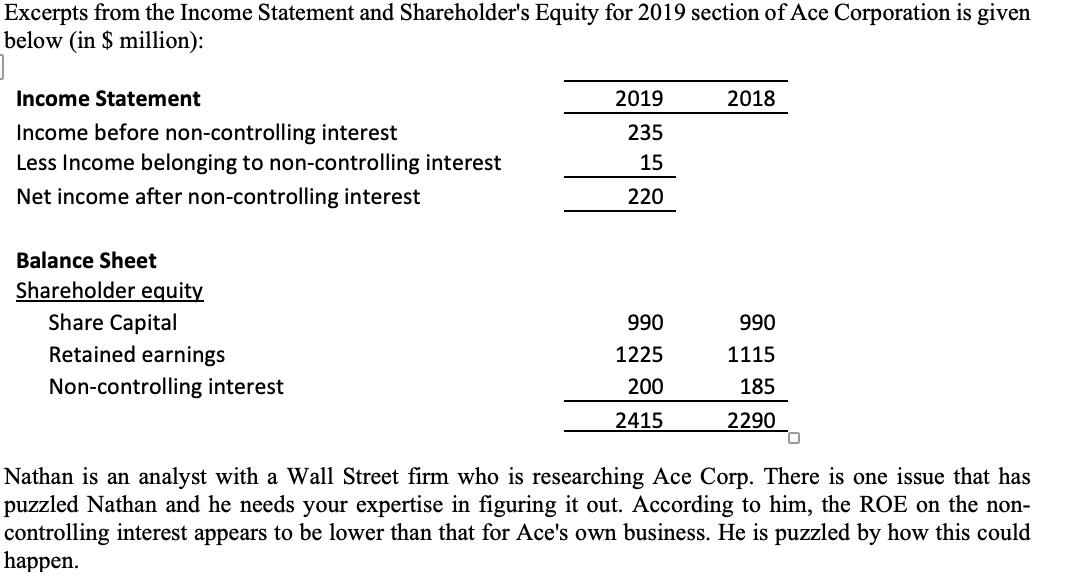

Excerpts from the Income Statement and Shareholder's Equity for 2019 section of Ace Corporation is given below (in $ million): Income Statement 2019 2018 Income before non-controlling interest Less Income belonging to non-controlling interest 235 15 Net income after non-controlling interest 220 Balance Sheet Shareholder equity Share Capital 990 990 Retained earnings 1225 1115 Non-controlling interest 200 185 2415 2290 Nathan is an analyst with a Wall Street firm who is researching Ace Corp. There is one issue that has puzzled Nathan and he needs your expertise in figuring it out. According to him, the ROE on the non- controlling interest appears to be lower than that for Ace's own business. He is puzzled by how this could happen.

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 ROE Net income Shareholders equity ROE for consolidated ace 235 2415973 ROE for Ace...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started